The Rise In Bitcoin's Value Also Benefited The Defi Sector.

- Posted on March 10, 2024 9:08 PM

- Cryptocurrency Exchanges News

- 539 Views

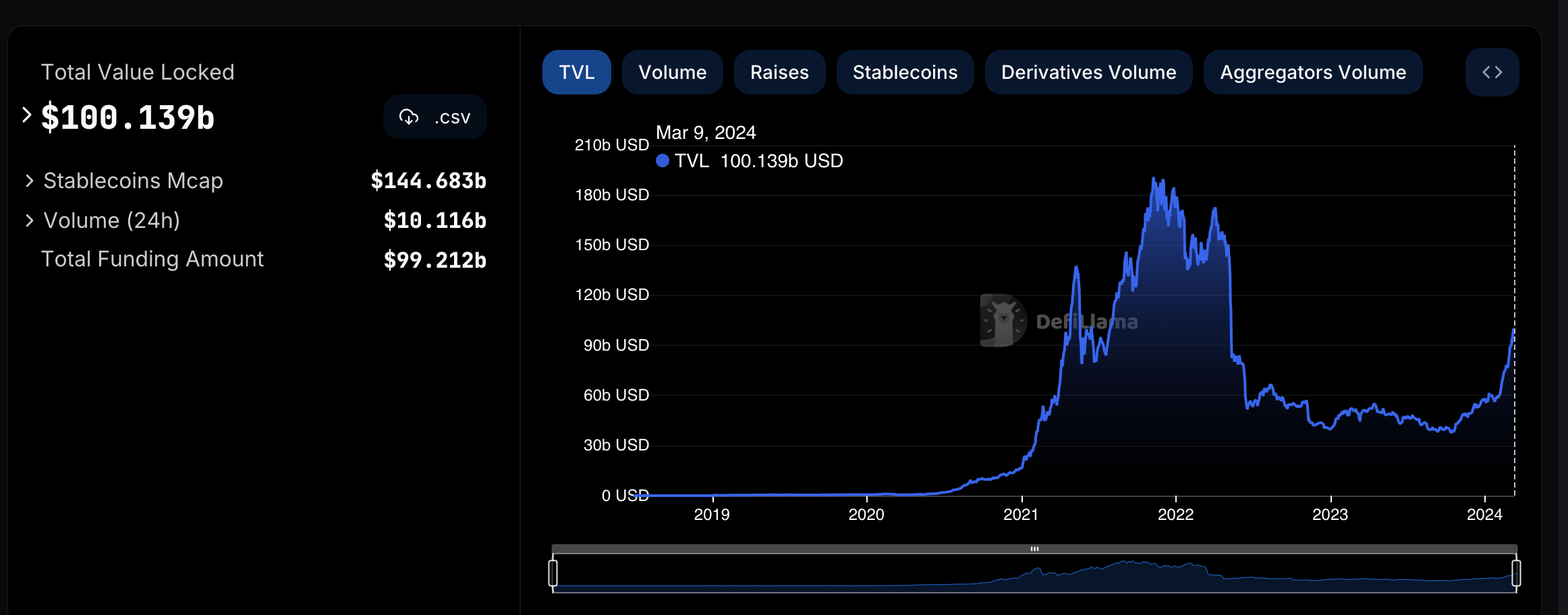

As of March 9, the total value locked in DeFi protocols reached $100.1 billion, marking a significant increase. Although this indicates the vibrancy of the DeFi sector, it still falls below the peak value of $189 billion reached in November 2021.

Demand for Bitcoin is boosting awareness in the crypto industry and pushing the capital locked on-chain over $100 billion as of March 9.

According to DefiLlama's data, the global total value locked (TVL) in decentralized finance (DeFi) protocols reached $100.1 billion, with over $10 billion in volume occurring in the last 24 hours at the time of writing. However, these figures still remain below the record $189 billion broken in November 2021.

The liquid staking protocol Lido leads the list with $38.7 billion locked on-chain, followed by the staking ecosystem EigenLayer with over $11 billion, and the Aave protocol respectively.

The total value locked (TVL) in DeFi crossed the $100 billion threshold for the first time in nearly two years. This surge is linked to a resurgence in positive sentiment towards the crypto markets following the launch of spot Bitcoin (BTC) exchange-traded funds (ETFs) in January.

The growing institutional interest in spot Bitcoin ETFs has propelled Bitcoin to its all-time high this week, surpassing $70,000 on March 8. According to BitMEX Research, the total asset value in Bitcoin ETFs reached $28 billion as of March 8. This analysis does not account for assets in the Grayscale Bitcoin Trust, which converted from an OTC product to an ETF format in January.

Rumors have circulated on the social media platform X about OTC trading desks rapidly depleting their Bitcoin stocks and turning to public exchanges to fulfill customer orders. OTC desks typically target large-volume buyers, such as institutional investors.

Major centralized crypto exchanges, including Binance, Coinbase, Kraken, and Bybit, experienced various technical issues due to the surge in trading volume following Bitcoin's rise to the $60,000 level. Crypto.com's CEO, Kris Marszalek, announced the hiring of 480 new customer service representatives to meet the increased demand.

Ivo Crnkovic-Rubsamen, the strategy manager and head of trading at the dYdX exchange, stated, "Due to the intense retail interest in the market and rapid price movements, algorithmic trading firms significantly increase the rate of orders they send and cancel to the matching engine to protect their positions."

Bitcoin's Recent Gains Benefit Memecoins In recent days, Bitcoin's gains have led to a rise in memecoin prices. According to data collected by Bitget Research, over the last seven days, Korra (KORRA) saw a 577% increase, Ribbit (RIBBIT) a 235% increase, and PUG AI (PUGAI) a 232% increase.

Popular tokens such as Shiba Inu and Pepe achieved gains of 168% and 165%, respectively. According to Bitget's data, the market value of memecoins is around $61 billion as of writing.

Amid the memecoin trend, Dogecoin (DOGE) and SHIB are currently among the top 10 tokens by market value, with $26 billion and $20 billion, respectively.

Stay updated with the latest developments and news in the crypto markets with Kriptospot.com.