The Target For Bitcoin Is $48,000.

- Posted on January 2, 2024 8:59 PM

- Cryipto News

- 718 Views

Despite reaching its highest level since April 2022, traders with short positions were already prepared for the potential volatility after the ETF approval.

As excitement returns to the cryptocurrency market with the opening of Asian markets, Bitcoin reached its highest level in the last 21 months on January 2nd.

BTC price approaches ETF approval

The obtained data indicates that BTC is strengthening as the New Year holiday period comes to an end.

With the renewed excitement about the approval of the first spot Bitcoin exchange-traded fund (ETF) in the United States, the BTC/USD pair reached $45,922 on Bitstamp.

Previously, there were rumors circulating, along with the anticipation of a decision related to the official approval process starting on January 4.

Investors seem to agree on the source of the recent rise in BTC price. Crypto Tony shared his "expectation" regarding ETF approvals in a Twitter update.

$BTC / $USD - Update

— Crypto Tony (@CryptoTony__) January 2, 2024

Broke up from the triangle i shared yesterday, quicker than expected. My main target from a few weeks ago is back on the cards

All this is in anticipation of the ETF pic.twitter.com/pknfifzoma

Trader, analyst, and podcast host Scott Melker summarized the situation by stating, "Bitcoin is trading as if the ETF is about to be approved."

Trader Skew, who analyzed order book changes, emphasized that some selling occurred, but it remained low in terms of volume.

$BTC

— Skew Δ (@52kskew) January 2, 2024

minor for now but seeing clips of around 100BTC getting sold into price currently on binance spot

avg $45,350

vs 100BTC being bought on coinbase spot by some limit buyer https://t.co/o8HO45JXqp

In the recent X post, it was stated, "Since selling started in the spot market, the price has been consolidating, with the previous peak (44.4K $) appearing as a significant support in the decline."

It is expected that the BTC/USD pair will rise to $48,000 as the ETF approval approaches.

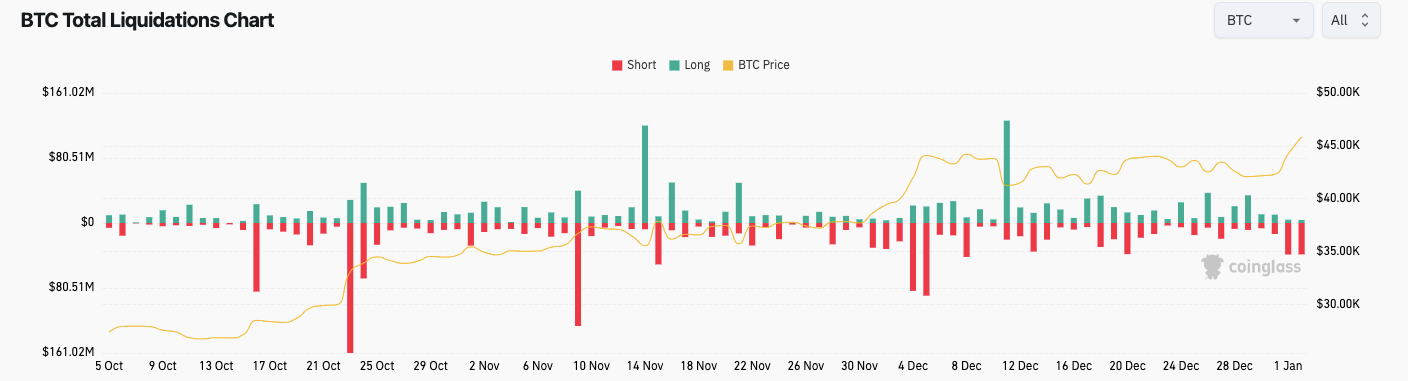

Short position holders did not suffer significant damage. Despite Bitcoin gaining up to 8% already in 2024, short positions did not incur substantial losses.

According to the latest data from the statistical source CoinGlass, at the time of writing this, only $38 million in liquidity was provided in BTC short positions.

The liquidation in cross short positions amounted to $62 million.

Skew emphasized that short positions of traders engaging in perpetual trading fell into a trap during the recent move exceeding $45,000.

"What is understood from this is that the perpetual market was not generally affected by this rally directed by the spot market. Therefore, I expect volatility, especially at the $45,000 level, in the perpetual market following the spot price," he commented.

You can follow real-time developments and the latest news in the cryptocurrency markets with Kriptospot.com.