Bitcoin Price Could Rise With Two Significant Developments.

- Posted on June 24, 2024 4:39 AM

- Cryipto News

- 708 Views

Analysts indicate that Bitcoin price could only rise after BTC miners capitulate and the network's hash rate recovers.

Bitcoin (BTC) has been in a downtrend over the past two weeks and is currently trading approximately 13.8% below its all-time high of $73,835, which it reached on March 14, equivalent to around 2,085,417 Turkish Lira.

Analysts argue that for Bitcoin to end its downtrend, it needs to recover its hash rate and shake off "weak hands."

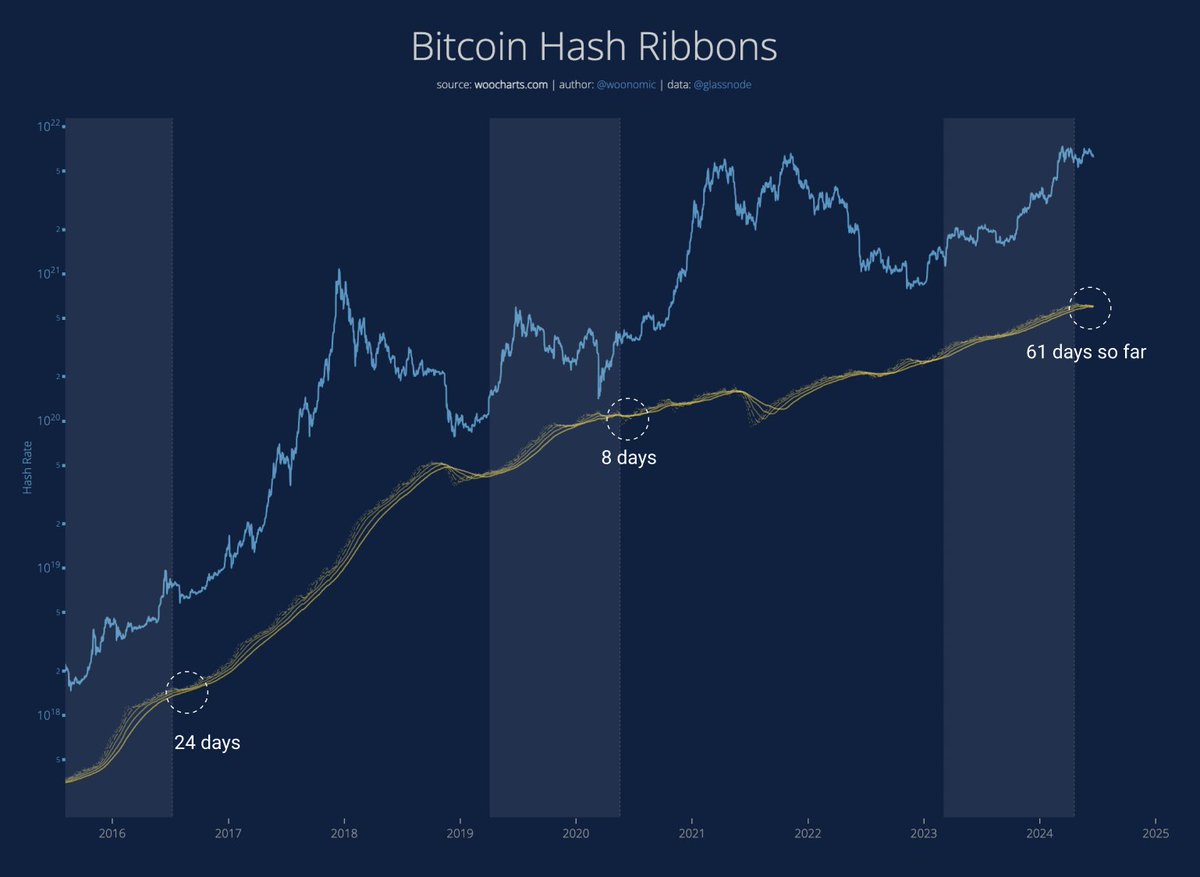

Crypto analyst Willy Woo mentioned that Bitcoin's price can only recover when "weak miners capitulate" and the hash rate improves. He stated in a post on social media platform X on June 21, "In this cycle, miners capitulating after halving took so long that it will go down in history."

The theory of miner capitulation suggests that when Bitcoin falls below a certain price level and mining becomes unprofitable, miners shut down their equipment and sell their Bitcoins.

When Bitcoin falls into the hands of "weak hands," it means inefficient miners operating with old and high-cost equipment may go bankrupt. Others may have to switch to more efficient equipment due to a significant drop in revenue. In both scenarios, miners are compelled to sell their Bitcoins to offset losses or upgrade their equipment.

Woo added that capitulation in the current cycle may last longer, likely due to increased profitability concerns.

According to the information provided about hashrate recovery times, in the 2017 cycle it took 24 days for hashrate to recover, while in 2020 it only took 8 days.

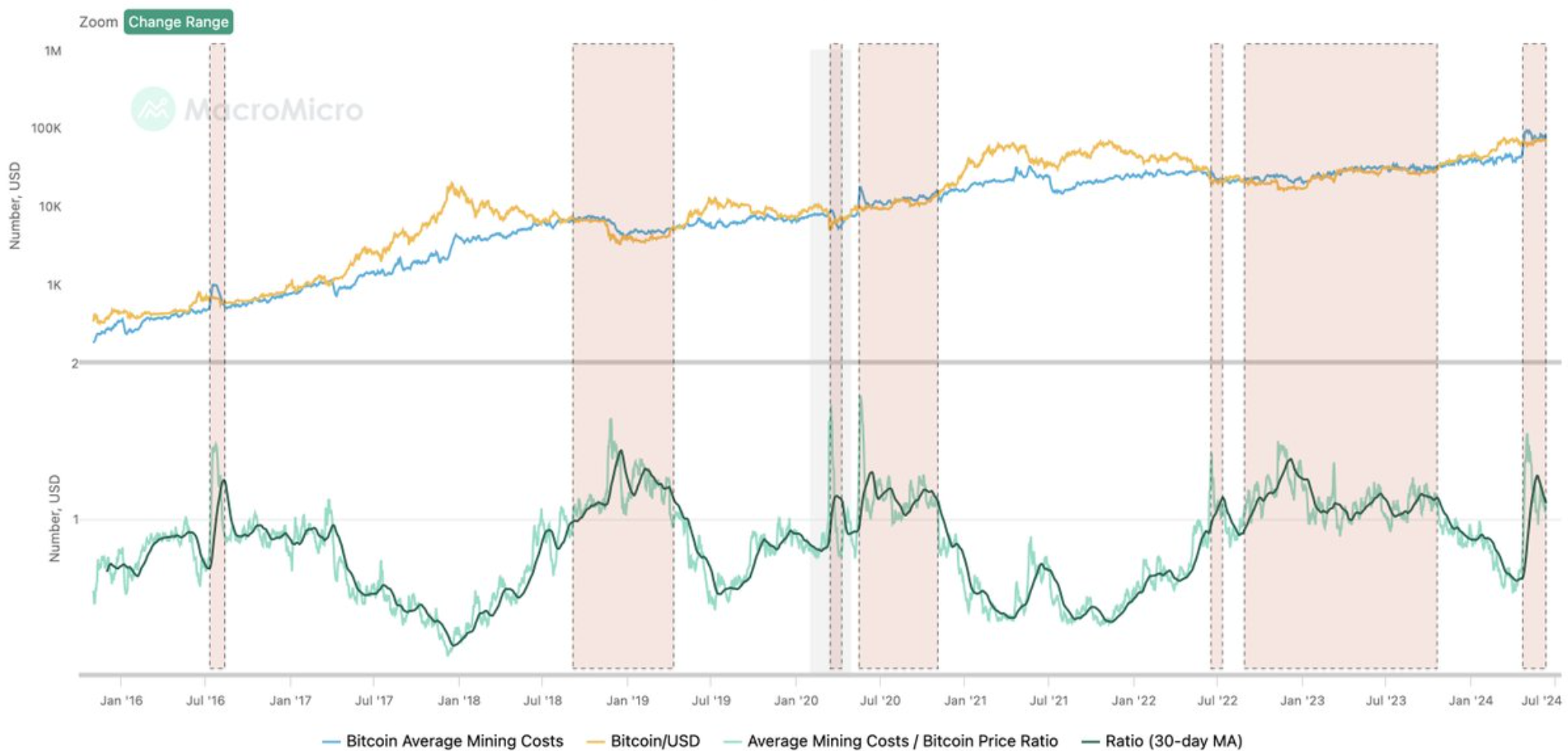

Crypto analyst Ali Martinez stated in an article published on June 15th, "Bitcoin's average mining cost is currently at $86,668."

Martinez also added, "Historically, BTC has always exceeded the average mining cost!"

Hashrate represents the number of attempts per second to solve the mathematical puzzle that verifies Bitcoin transactions. When Bitcoin hashrate increases, more computational power is used, which increases energy costs and extends transaction times.

Analyst Anderson shared his views on how the Bitcoin price downtrend could come to an end. According to him, a sharp decline in price will cause a "shakeout," prompting less committed traders to sell.

In a publication dated June 18th, Anderson explained: "The aim is to trigger panic and increase selling."

"After weak traders exit, the price typically stabilizes or recovers as strong traders buy at lower prices."

For real-time updates on developments in the cryptocurrency markets and the latest news, you can follow Kriptospot.com.