Bitcoin Remained Unchanged Despite Positive Inflation Data.

- Posted on December 22, 2023 11:49 PM

- Cryipto News

- 571 Views

Bitcoin remained unresponsive despite positive inflation data ahead of the holiday season.

On December 22nd, despite positive inflation indicators for Bitcoin, anticipated reactions were not realized due to speculations about changes in interest rates in the U.S. macroeconomic data.

PCE data came in above expectations. According to data from Cointelegraph Markets Pro and TradingView, despite experiencing a $44,000 breakout earlier in the week, Bitcoin continued to stay in a strong range before the holidays.

The November data for the Personal Consumption Expenditures (PCE) Index, the inflation gauge preferred by the Fed, surpassed market expectations. While markets had a 2.8% expectation, the data came in at 2.6%. This revealed the impact of tightening monetary policy on inflation.

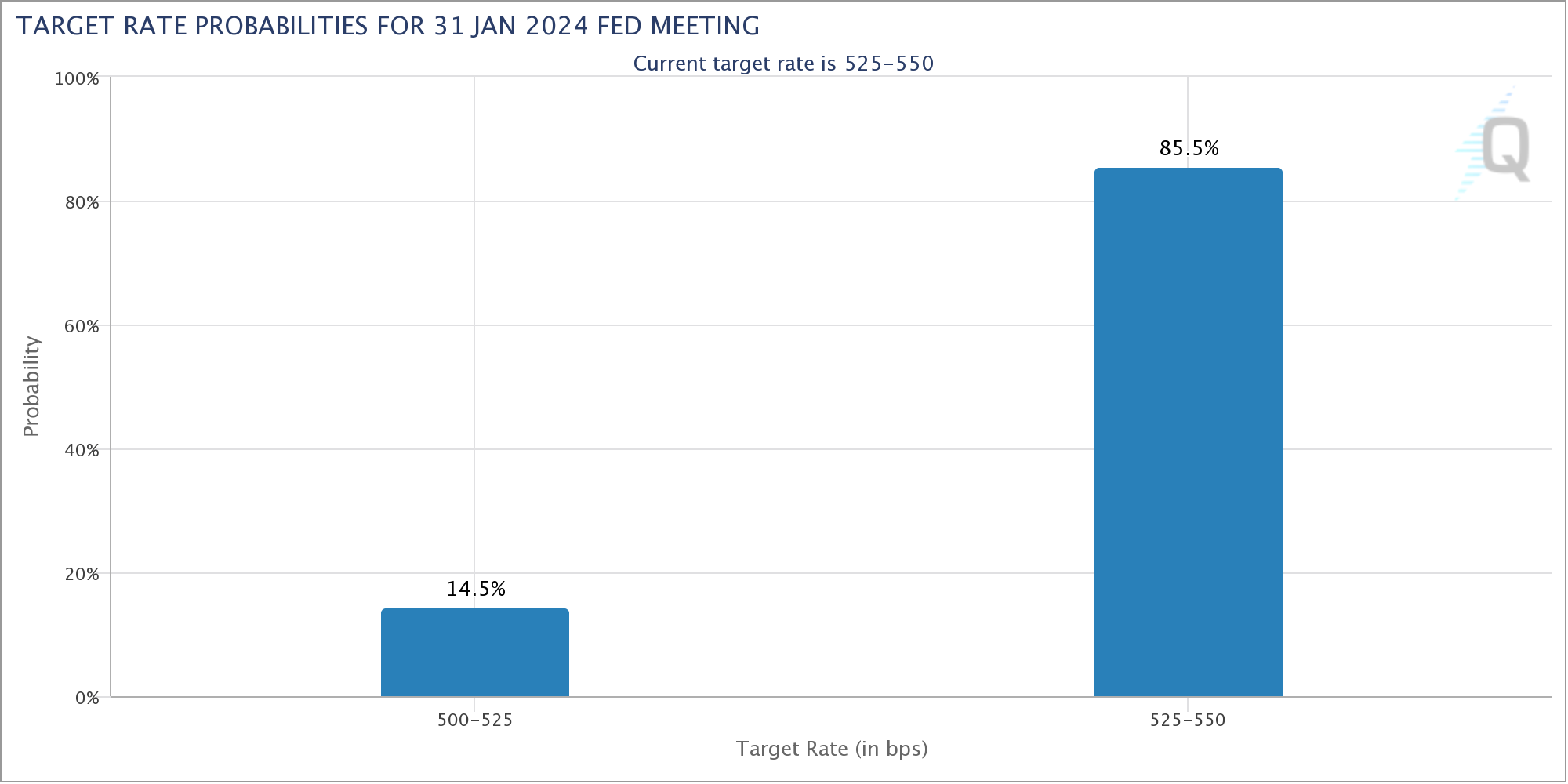

Data from CME Group's FedWatch Tool indicated a 15% increase in the probability of a decrease in interest rates.

In a post on X, The Kobeissi Letter stated, "This is the lowest PCE inflation data since May 2021. Another sign that the Fed is pleased." Kobeissi mentioned that the macro data for November aligns with decreasing inflation narratives.

"Almost all of the inflation data for November has progressed in the right direction," he added.

This situation has increased market hopes for the Fed to cut interest rates in 2024. However, the main question is how much and when the interest rate cut will begin.

The decline in the dollar is not enough for Bitcoin. Despite encouraging macro signals and the U.S. dollar falling to its lowest level since the end of July, Bitcoin's price movement did not provide much hope for the bulls.

Despite this, popular trader Skew noted that liquidity has increased on the leading crypto exchange Binance, indicating support at $41,000 and $42,000.

$BTC Binance Spot

— Skew Δ (@52kskew) December 22, 2023

Limit spot buyer nibbling here but not enough yet to force price higher

Takers will have to flip to buying spot again & then limit chasing bid

~ Key recipe for higher

Still heavy supply around $45K

Large spot bid around $42K now & other spot bids moved… pic.twitter.com/vNlaI4NWnD

$BTC / $USD - Update

— Crypto Tony (@CryptoTony__) December 22, 2023

Reclaim $44,300 and then you are in for a safer long position. Wait until then .. Trust Tony pic.twitter.com/A7NWwYWICs

Analyst Alan Tardigrade expressed that, with its current structure, Bitcoin needs to surpass its highest levels in 2023.

"Bitcoin has formed a rectangular consolidation," he said.

If it breaks the upper resistance line, he indicated that the next target could be $48,000.