Bitcoin Surpasses $70,000 With Etf Purchases

- Posted on May 22, 2024 2:46 AM

- Cryipto News

- 659 Views

Analysts believe that Bitcoin has completed its latest correction phase and is now progressing toward new highs.

Bitcoin has risen to $70,000 amid noticeable increases in spot and ETF purchases. The cryptocurrency community is debating whether this surge marks the start of a new bull market or if it's nearing its peak.

Has the Bitcoin Trend Reversed?

TLDR analyst "ELI5" noted that despite head formations, most on-chain indicators suggest the beginning of a new bull market. Farside Investors reported an influx of approximately $950 million last week, the highest since March. This has sparked increased interest following the breach of the recent $60,000 support level.

If this trend continues, Bitcoin is thought to potentially exceed expectations. Currently, BTC is trading at $71,100. The 20-day exponential moving average (EMA) is at $64,371, and a positive RSI indicates that an upward breakout is more likely. After the $68,000 resistance, the next critical level is $73,777.

Conversely, a breakdown below the moving averages could indicate a bearish trend, potentially leading to price drops to $59,600 and $56,552.

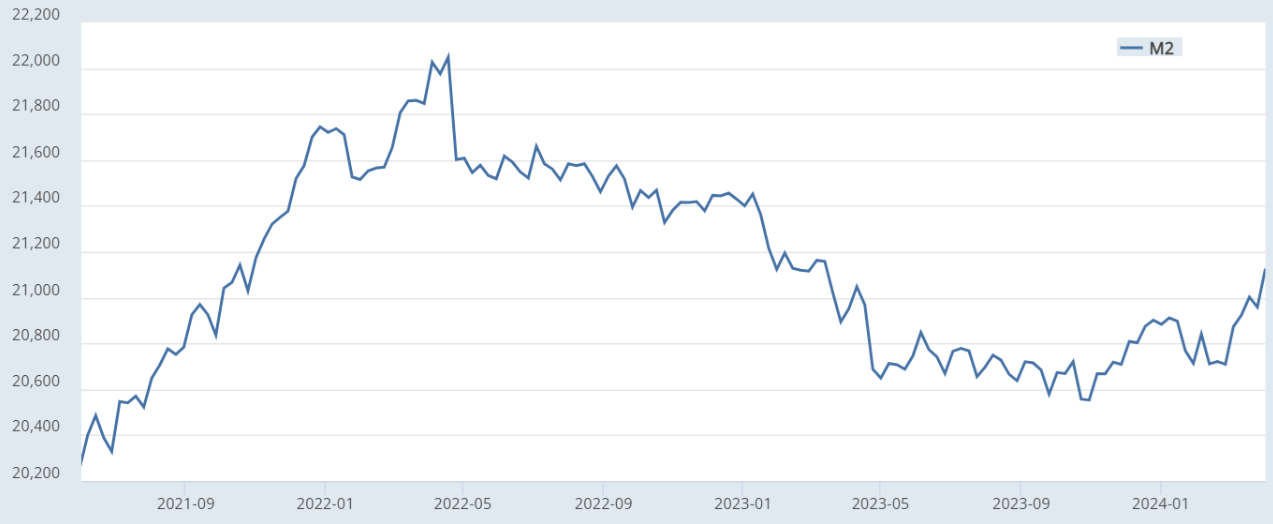

Changes in US monetary policy are boosting Bitcoin prices

In a broader economic context, Bitcoin’s rise of 51% to date reflects investors’ expectations of US monetary expansion, with the M2 money supply projected to exceed $21.0 trillion by April 2024.

This increase in the circulating money supply points to rising inflationary pressures despite periods of spending hesitation among companies and individuals. The Federal Reserve's strategies for managing inflation and preventing recession could influence liquidity, thus affecting the appeal of scarce assets like Bitcoin.

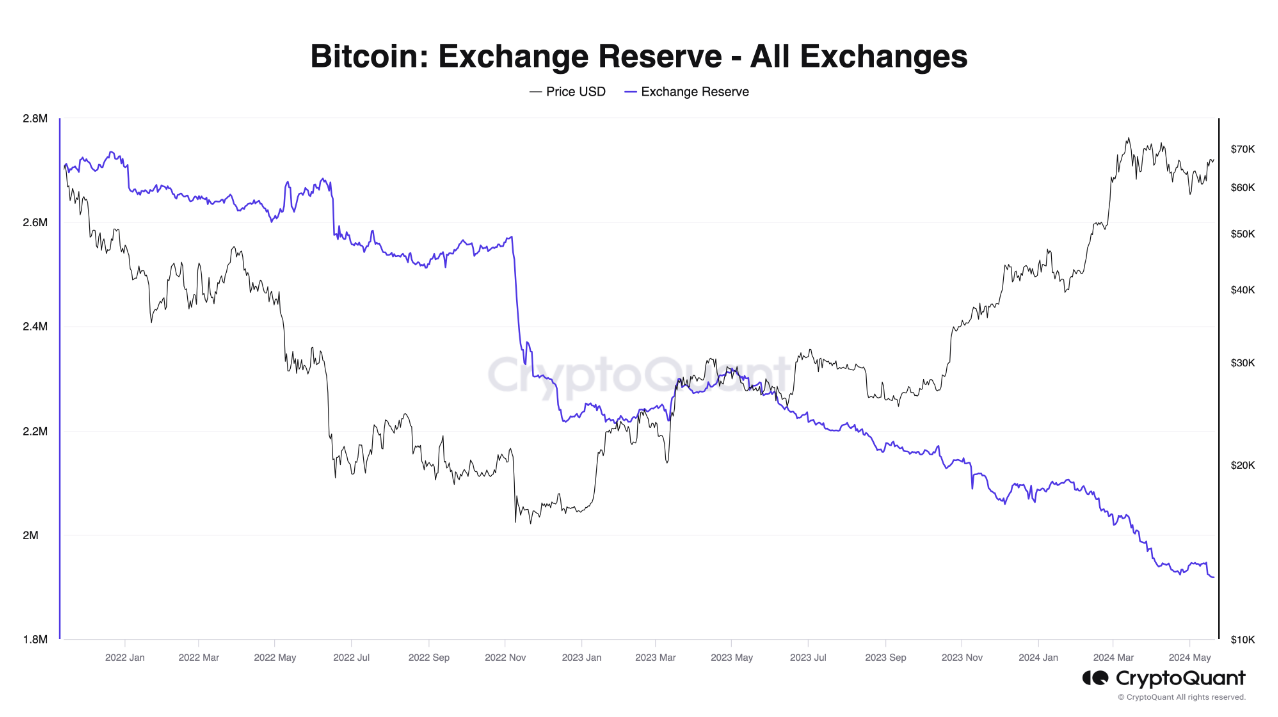

Exchange Reserves at a Seven-Year Low

In addition to the bullish expectations, Bitcoin reserves on exchanges have fallen to their lowest level in seven years. According to CryptoQuant data, as of May 19, there were only 1,918,417 BTC available on major exchanges, marking a significant drop from the previous year.

This scarcity, coupled with the recent halving event that cut the potential new supply of miners by half, makes it increasingly difficult to justify bearish expectations for Bitcoin.

This article is not intended as investment advice or a recommendation. All investment and trading moves involve risks, and it is important for readers to conduct their own research before making a decision.

Stay updated on developments in the cryptocurrency markets and the latest news with Kriptospot.com.