Bitcoin-Based Spot Etfs Begin To Experience Consecutive Outflows.

- Posted on March 21, 2024 11:00 PM

- Cryipto News

- 788 Views

Spot Bitcoin ETFs listed in the US experienced an outflow of approximately $742 million in just three trading days.

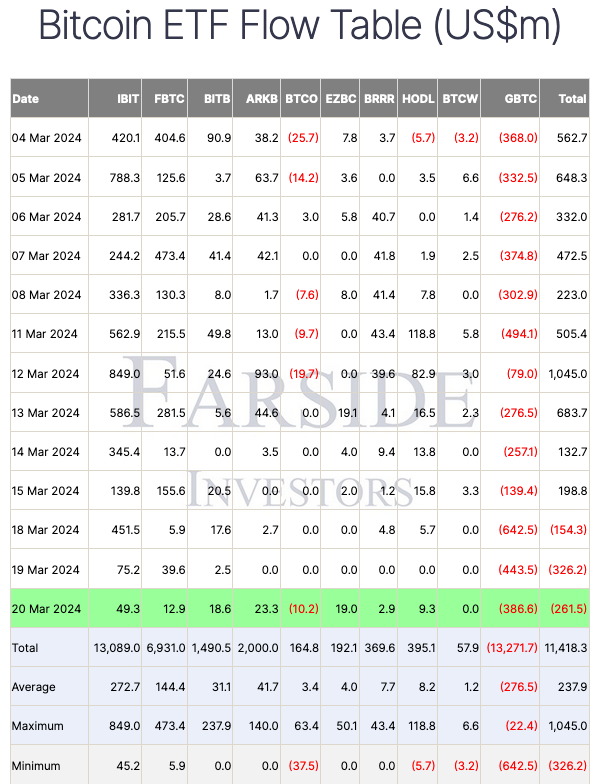

On March 20th, ten spot Bitcoin exchange-traded funds (ETFs) listed in the US experienced a withdrawal of $261.5 million. This marks the third consecutive day of outflows in spot BTC ETFs.

According to Farside Investors data, net outflows were $154.3 million on March 18th and $326.2 million on March 19th, resulting in a total outflow of $742 million by the end of the third day.

The main reasons for the outflows were a $386.6 million withdrawal from the Grayscale Bitcoin Trust (GBTC) and a $10.2 million withdrawal from the Invesco Galaxy Bitcoin ETF (BTCO). Inflows from the other eight ETFs were insufficient to offset the negative trend in GBTC and BTCO.

BlackRock's iShares Bitcoin Trust (IBIT) experienced its second lowest inflow day with $49.3 million net inflow. This was only $4 million more than the lowest daily level recorded on February 6th. Similarly, the Fidelity Wise Origin Bitcoin Fund (FBTC) saw the second lowest inflow with $12.9 million.

Recently, the second highest outflow amount recorded in Bitcoin investment funds has made history. The figure for March 20 surpassed the $326.2 million outflow recorded on March 19.

According to the data, Bitcoin gained more than 3% in value during US trading hours and was traded at $66,838 after a 7.5% increase over a 24-hour period.

As the countdown to the Bitcoin halving event, which will reduce mining rewards by 50%, enters its final month, BTC has retreated from its record level on March 14 last week.

Historically, Bitcoin has typically experienced a loss in value before a halving event, according to CoinMarketCap data. The leading cryptocurrency appears to be following a similar pattern, with 30 days left until the halving.