What Will Happen In The Mining Sector As Bitcoin Halving Approaches?

- Posted on April 9, 2024 12:12 PM

- Cryipto News

- 601 Views

For miners to sustain their operations and remain profitable, Bitcoin will need to experience significant appreciation after the halving.

Bitcoin halving is a significant milestone that occurs every 210,000 blocks or approximately every four years. This event halves the block reward earned by miners.

Consequently, besides the indirect impact on the BTC price, this event significantly affects miners' behavior as mining costs double and earning the same amount of BTC rewards costs twice as much.

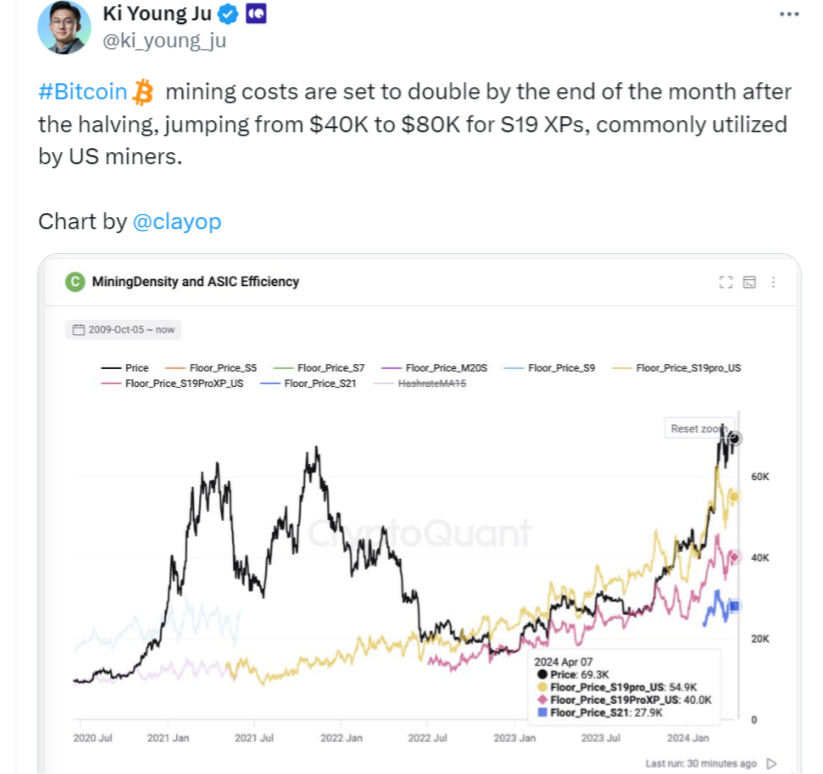

According to data from CryptoQuant CEO Ki Young Ju, the current cost of mining using Antminer S19 XPs will rise from $40,000 to $80,000. The post-halving increase in the BTC price compensates for the rise in mining costs.

After the May 2020 halving, miners needed the profitable price to be above $30,000 to sustain their operations; however, the BTC price rose to an all-time high of $69,000 in the same cycle.

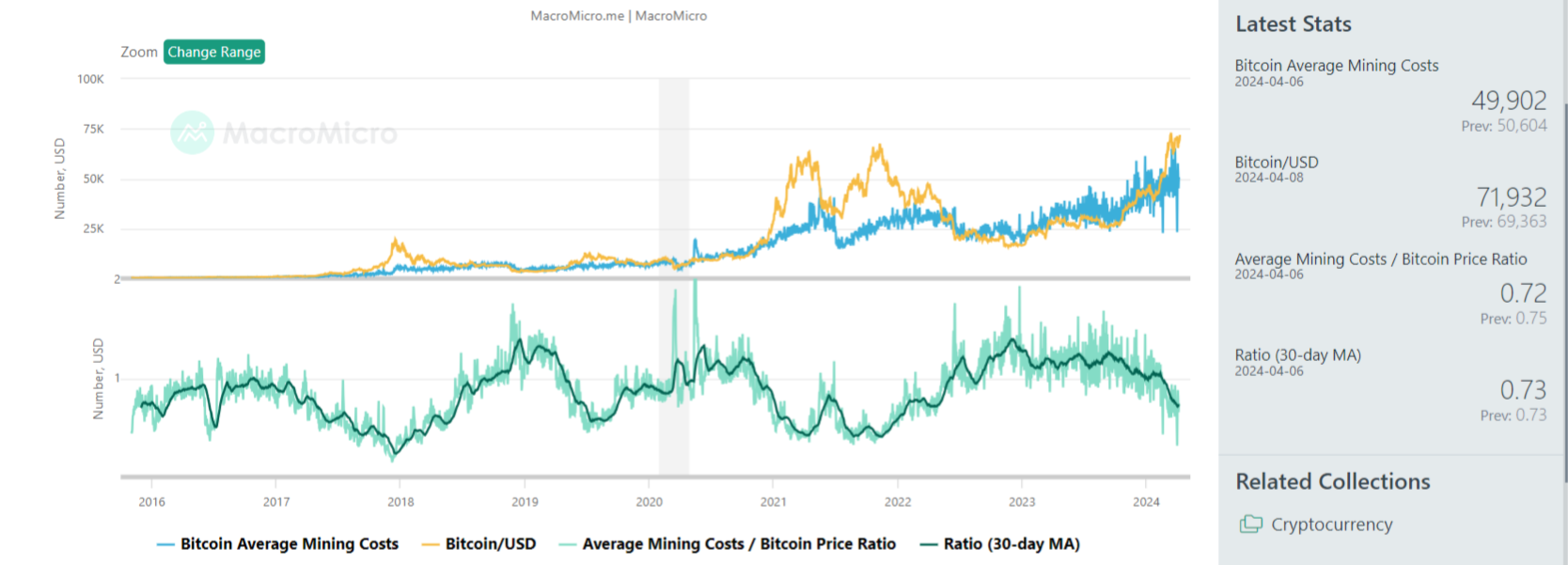

The average cost of Bitcoin mining was $49,902, and the current BTC price is above $70,000. After the halving on April 20, the average cost of Bitcoin mining will rise above $80,000. Therefore, for miners to continue their operations, the BTC price needs to trade above $80,000.

Historically, BTC prices have shown significant increases after halvings. After the 2012 halving, Bitcoin's price rose by approximately 9,000%, reaching $1,162. The 2016 halving saw Bitcoin's price increase by about 4,200%, reaching $19,800. Following the 2020 halving, Bitcoin's price nearly rose by 683%, reaching $69,000.

Despite fears of unemployment post-halving, miners have continued to remain profitable. Halving events have rendered many mining machines obsolete due to their inability to compete with the high demand for hashing power.

After every halving, there typically comes a period when the BTC price falls below the miner's profitable price. This period is shadowed by uncertainty and increased sales of mining equipment, leaving many small and independent miners often out of work.

However, as demand increases in a market with reduced supply, prices rise, often exceeding the average mining costs for miners. In such cases, miners become profitable again and can continue their operations.

Stay updated with the latest developments and news in the crypto markets with Kriptospot.com.