Blackrock Ceo Says Bitcoin Exchange-Traded Funds (Etfs) Are Making History.

- Posted on March 29, 2024 6:01 PM

- Cryptocurrency Exchanges News

- 603 Views

BlackRock CEO Larry Fink stated that the individual interest in the company's spot Bitcoin ETF has been a "pleasant surprise" for him.

BlackRock CEO Larry Fink expressed that he had a "pleasant surprise" regarding the performance of the company's spot Bitcoin exchange-traded fund (ETF) and stated that he is "very optimistic" about the long-term viability of Bitcoin.

During a recent interview with Fox Business, Fink mentioned, "IBIT is the fastest-growing ETF in ETF history. No other ETF has gained assets as quickly as IBIT in ETF history."

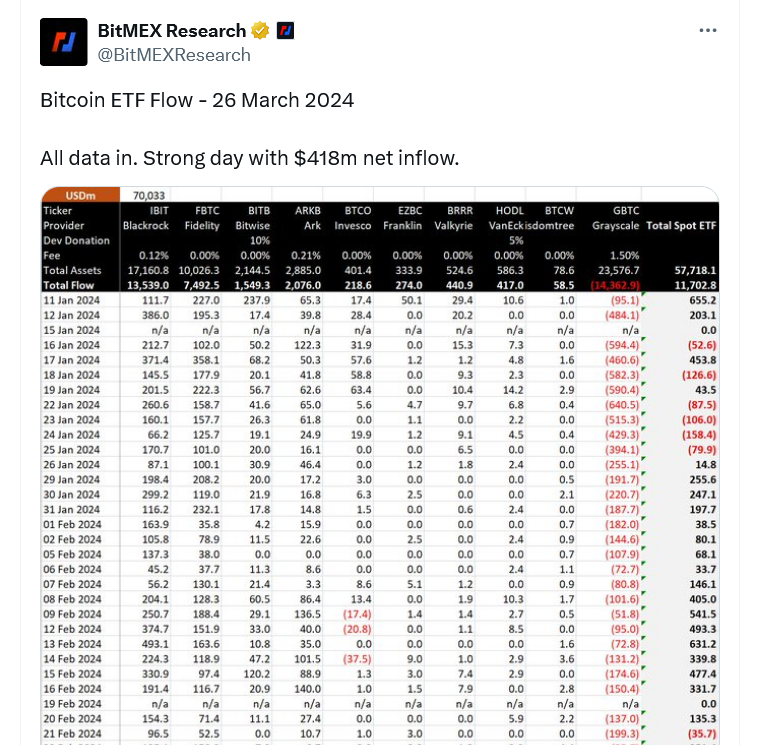

Fink also noted that the performance of iShares Bitcoin Trust (IBIT) in its first 11 trading weeks had even "surprised" him. According to Farside Investors, IBIT had a strong start with $13.5 billion in flows in its first 11 weeks and reached its highest level with a daily flow of $849 million on March 12. IBIT is averaging slightly above $260 million in flows per trading day.

The CEO of BlackRock remarked, "We are creating a market with more liquidity, more transparency, and that has surprised me. I could never have predicted this kind of retail demand before we applied."

When asked whether IBIT would "do well or be so successful," Fink responded, "Yes, absolutely."

Larry Fink added, "I am very optimistic about the long-term viability of Bitcoin."

BlackRock CEO Larry Fink says the $IBIT Spot #Bitcoin #ETF is the fastest growing ETF in history

— Simon Dixon (@SimonDixonTwitt) March 27, 2024

pic.twitter.com/NOsDlFgROi

According to BitMEX Research, IBIT currently holds $17.1 billion worth of Bitcoin, achieving this milestone in just two months, compared to the significant two-year period it took for the first gold ETF to reach $10 billion.

Among all currently approved ETFs, IBIT ranks second in terms of Bitcoin assets, only behind Grayscale Bitcoin Trust. However, Grayscale's Bitcoin assets continue to decrease from the 620,000 BTC it held before converting to a spot Bitcoin ETF.

Leading the way alongside initiatives like Fidelity Wise Origin Bitcoin Fund (FBTC) and ARK 21Shares Bitcoin ETF (ARKB), nine spot Bitcoin ETF providers, excluding Grayscale, currently possess over $34.1 billion in Bitcoin.

However, some industry experts forecast that due to unprofitability, certain spot Bitcoin ETF providers might eventually cease operations.

HANetf's co-CEO and founder, Hector McNeil, recently mentioned to Cointelegraph, "Most of the current ETFs launched will never break even since their costs can only be covered when managing assets worth billions, indicating a significant challenge ahead."

Although several ETF providers are reducing fees to stay competitive, according to Bloomberg ETF analyst Henry Jim, these smaller providers face a tough battle as "giants enter the fray."

"If they match the fees, they won't have enough revenue to survive; if they don't lower fees, they won't gather enough critical mass of assets to stay viable."

Stay updated with the latest developments and news in the crypto markets with Kriptospot.com.