Blackrock Is Including Bitcoin Etfs In Income And Bond Funds.

- Posted on May 30, 2024 3:41 AM

- Cryptocurrency Exchanges News

- 632 Views

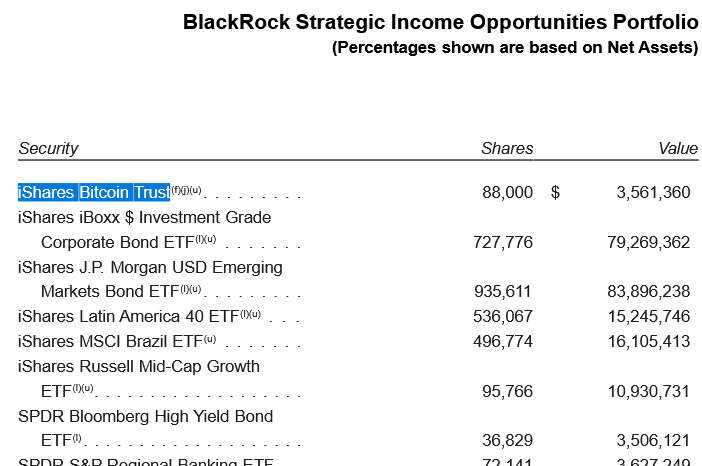

One of the funds holding a Bitcoin ETF is the Strategic Income Opportunities Fund, which has a value exceeding $37.4 billion.

According to documents submitted to public institutions, BlackRock's income and bond-focused funds purchased shares from the company's own spot Bitcoin (BTC) exchange-traded fund (ETF) in the first quarter of 2024.

BlackRock's Strategic Global Bond Fund (BSIIX) bought $3.56 million worth of iShares Bitcoin Trust (IBIT) shares, while the Strategic Global Bond Fund (MAWIX) acquired $485,000 worth, according to Securities and Exchange Commission documents dated May 28.

IBIT shares constitute a portion of the investment portfolios of BSIIX and MAWIX, which are valued at $37.4 billion and $776.4 million, respectively.

According to BlackRock's data from May 24, the iShares Bitcoin Trust (IBIT) currently holds $19.61 billion worth of Bitcoin.

Grayscale's data indicates that as of May 28, IBIT surpassed the Grayscale Bitcoin Trust (GBTC), which holds $19.76 billion worth of Bitcoin.

According to CoinGecko, spot Bitcoin ETFs worldwide hold over 1 million Bitcoin, valued at more than $68 billion. This represents approximately 5.10% of the circulating supply of over 19.7 million BTC.

Recent SEC filings reveal that more than 600 U.S. investment firms have purchased spot Bitcoin ETFs since their launch in January.

Firms such as Morgan Stanley, JPMorgan, Wells Fargo, Royal Bank of Canada, BNP Paribas, UBS, Millennium Management, and Schonfeld Strategic Advisors are among those purchasing Bitcoin ETFs.

Millennium stands as the largest spot Bitcoin ETF holder, investing $844.2 million in IBIT and $806.7 million in Fidelity Wise Origin Bitcoin Fund (FBTC), totaling $1.9 billion.

BlackRock was one of eight companies to receive approval for a spot Ether (ETH) ETF in the U.S. on May 23. However, for these products to start trading, the SEC also needs to approve the Form S-1 filings.

For the latest developments and news in the cryptocurrency markets, you can follow Kriptospot.com.