What Were The Major Developments In The Crypto Market Today?

- Posted on January 31, 2024 12:28 AM

- Cryptocurrency Exchanges News

- 878 Views

Continuing with our daily news, we'll cover the daily trends and events affecting Bitcoin price, blockchain, DeFi, NFTs, Web3, and crypto regulations.

Coinbase will start charging fees for transactions exceeding $75 million monthly starting from February 5th. Daily entries into Fidelity's spot Bitcoin ETF surpassed GBTC exits on January 29th. According to data, the asset value in BlackRock's Bitcoin exchange-traded fund (ETF) has exceeded $2 billion. Here are the details of today's developments.

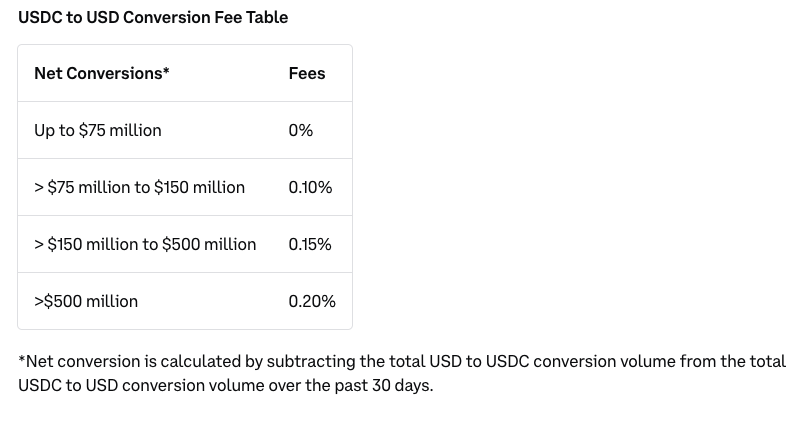

Coinbase to charge fees for transactions exceeding $75 million. The largest crypto exchange in the United States, Coinbase, will charge a commission fee for transactions converting USDC to USD that exceed $75 million. "Tier 1" and "Tier 2" members of the Coinbase Exchange Liquidity Program will continue their transactions without paying a commission fee.

The new fees were announced on January 30th on the Coinbase help page. According to Coinbase, starting from February 5th, a commission fee will be applied to transactions converting USDC to USD that exceed $75 million within a 30-day period.

Coinbase stated in its announcement that the net amount would be calculated by subtracting the amount converted from USD to USDC in the last 30 days from the amount converted from USDC to USD.

While entries into Fidelity's Bitcoin ETF are increasing, exits from GBTC are slowing down. Fidelity's spot Bitcoin exchange-traded fund (ETF) reportedly received daily entries of $208 million on January 29th, surpassing exits from Grayscale Bitcoin Trust for the first time since its launch.

Fidelity inflow of $208m today, more than offsets the GBTC outflow on its own https://t.co/aM3pnoX0OR

— BitMEX Research (@BitMEXResearch) January 30, 2024

According to temporary data from Farside Investors, there was an entry of $208 million into FBTC on Monday, while there was an exit of $192 million from GBTC. According to BitMEX Research data, this amount marked the lowest daily exit since the launch day.

The recent exits from GBTC, which were $255 million on January 26th, experienced a drop of approximately 25% on January 29th. This represents a 70% decrease compared to the $641 million exit on January 22nd. Additionally, following the $95 million exit from Grayscale's fund, it became the second lowest exit day for the spot Bitcoin exchange-traded fund (ETF) converted from ETF.

BlackRock's IBIT-coded Bitcoin exchange-traded fund (ETF) surpassed $2 billion in assets under management just a few weeks after its launch. Data shows that IBIT currently holds over 52,000 BTC, worth more than $2 billion at current prices, making it the ETF with the highest volume after Grayscale Bitcoin Trust (GBTC).

According to Bloomberg ETF analyst James Seyffart, the newly approved spot ETFs are balancing the intense sales experienced by GBTC exits since its conversion to spot ETFs.

Update for the #Bitcoin ETF Cointucky Derby after Friday (11 days). $5 billion out of $GBTC. Newborn 9 still offsetting those outflows with gross flows of $5.8 billion. Giving us net inflows of $759 million. Volume continued to slow. pic.twitter.com/QTJqqI4aoA

— James Seyffart (@JSeyff) January 29, 2024

Popular trader and social media influencer Rajat Soni suggested that BlackRock customers are purchasing more Bitcoin daily than what is being mined, hinting at a potential price increase in the near future:

"Currently, approximately 900 BTC are mined every day. Only BlackRock customers are buying 2 to 5 times the daily total BTC production."