"Chicago Mercantile Exchange (Cme) Surpasses Binance In Bitcoin Futures."

- Posted on November 11, 2023 2:50 AM

- Cryptocurrency Exchanges News

- 547 Views

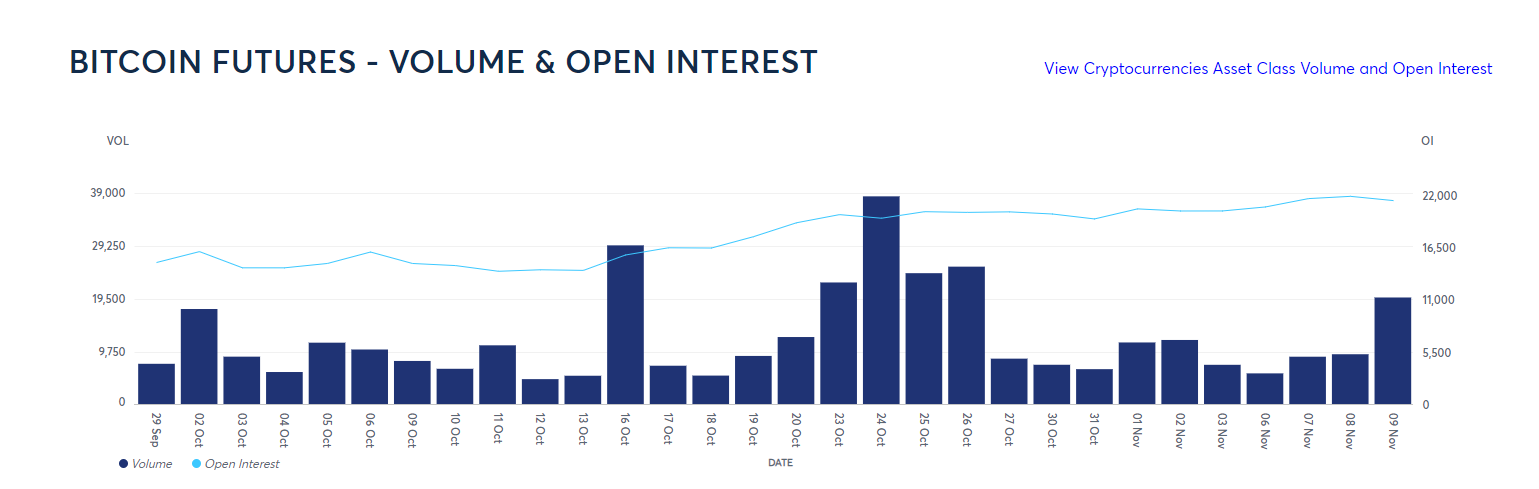

"Market analysts note an interesting 'shift' with the open Bitcoin futures positions on the Chicago Mercantile Exchange (CME) surpassing Binance."

"After Bitcoin's price surpassed the $37,000 level for the first time in over 18 months, the dominance of Bitcoin futures positions on the Chicago Mercantile Exchange (CME) in the traditional derivatives market surpassed leading crypto exchange Binance.

Various analysts highlighted the shift, noting that CME has overtaken Binance in Bitcoin futures positions, signaling the end of Binance's previous dominance."

Wow, the real flippening that no one is talking about:

— Will (@WClementeIII) November 9, 2023

CME just flipped Binance for the largest share of Bitcoin futures open interest.

Bittersweet -- there will soon be more suits than hoodies here.

(h/t @VidiellaLaura) pic.twitter.com/SIPRLMlFcy

"Open position" is a term commonly used in futures and options markets. This term represents the total number of contracts at any given time, which is the sum of all existing futures and options contracts in the market. The value of an open position indicates the difference in the number of contracts between buyers (long positions) and sellers (short positions). This difference determines the amount of open interest.

Bloomberg Intelligence ETF research analyst James Seyffart, following Will Clemente's initial post on Twitter, questioned the implications of the increasing open position volume in Bitcoin futures on the concerns of the United States Securities and Exchange Commission (SEC) regarding the depth of Bitcoin markets and the potential for market manipulation.

Okay this is interesting... Does this constitute 'market of significant size' now? haha https://t.co/eQb7QXvO3H

— James Seyffart (@JSeyff) November 9, 2023

The prolonged discussions on these topics have led the SEC to refrain from approving spot Bitcoin ETF applications for the past few years. The regulatory body had previously stated that applications were "incomplete" due to neglected declarations about the markets where companies like BlackRock and Fidelity would obtain values for Bitcoin ETFs.

In July 2023, the Chicago Board Options Exchange (CBOE) refiled its application for Bitcoin spot ETFs after feedback from the SEC. While Fidelity plans to launch its Bitcoin ETF product on CBOE, the world's largest asset manager, BlackRock, garnered attention with its proposal for a Bitcoin ETF to be listed on Nasdaq.

The amended application submitted by CBOE to the SEC emphasized additional steps to detect, investigate, and deter fraud and market manipulation in Wise Origin Bitcoin Trust shares.

CBOE intends to enter into a surveillance-sharing agreement with Coinbase, where a significant portion of spot Bitcoin trading in the US, denominated in USD, occurs. The application specifies that the agreement with Coinbase will be a "surveillance-sharing agreement," providing CBOE with additional access to Bitcoin trading data on Coinbase.

The exchange also included Kaiko Research data indicating that Coinbase constituted approximately 50% of the daily Bitcoin trading volume in USD in May 2023. This development was deemed significant in light of the SEC's concerns about the depth of Bitcoin markets supporting ETF products.

The purpose of surveillance-sharing agreements is to enable exchanges and market regulators to determine whether any market participant is manipulating the value of stocks or shares.