Goldman Sachs Plans To Launch Three New Tokenization Products This Year.

- Posted on July 13, 2024 8:19 AM

- Cryipto News

- 656 Views

The American investment bank is taking steps to meet investor demand for real-world assets (RWAs).

According to an interview published by Fortune on July 10, Goldman Sachs is preparing to launch three new tokenization products in the U.S. and Europe later this year, following a surge in customer interest in cryptocurrency assets. Mathew McDermott, the global head of digital assets at Goldman Sachs, stated that while he did not provide specific details, the company plans to create marketplaces for tokenized real-world assets (RWAs) and focus on the debt markets in the U.S. and Europe.

McDermott indicated that the investment bank intends to target financial institutions rather than individual investors with its new products and will work exclusively with approved blockchains. He also mentioned that the RWA market will stand out by accelerating adoption and expanding the types of assets that can be used as collateral.

McDermott attributed the renewed momentum in cryptocurrency to the increase in the number of exchange-traded funds (ETFs). Since U.S. regulators gave the green light to investment vehicles in January, nearly a dozen Bitcoin ETFs have been listed. Analysts are currently reviewing applications for several spot Ether ETFs expected to start trading this month.

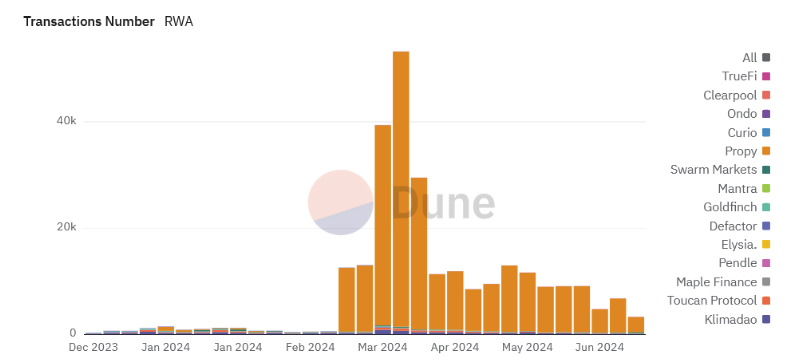

Interest in RWAs is rising in the U.S. This week, BlackRock's USD Corporate Digital Liquidity Fund (BUIDL) reached $500 million in assets under management. Franklin Templeton's OnChain U.S. Government Money Fund (FOBXX) holds approximately $400 million, placing it in second position.

According to Fortune, if the upcoming presidential elections lead to a more favorable legal stance towards the cryptocurrency sector in the U.S., the investment bank's initiatives in the crypto space could expand further in the coming months.

You can stay updated on developments and the latest news in the cryptocurrency market in real-time with Kriptospot.com.