Has The Bitcoin Halving Correction Been Completed? This Data Stands Out.

- Posted on March 27, 2024 2:33 AM

- Cryipto News

- 574 Views

As the Bitcoin halving approaches, the price of BTC surpassed the $71,000 level overnight. This raises the question of whether the correction process has come to an end.

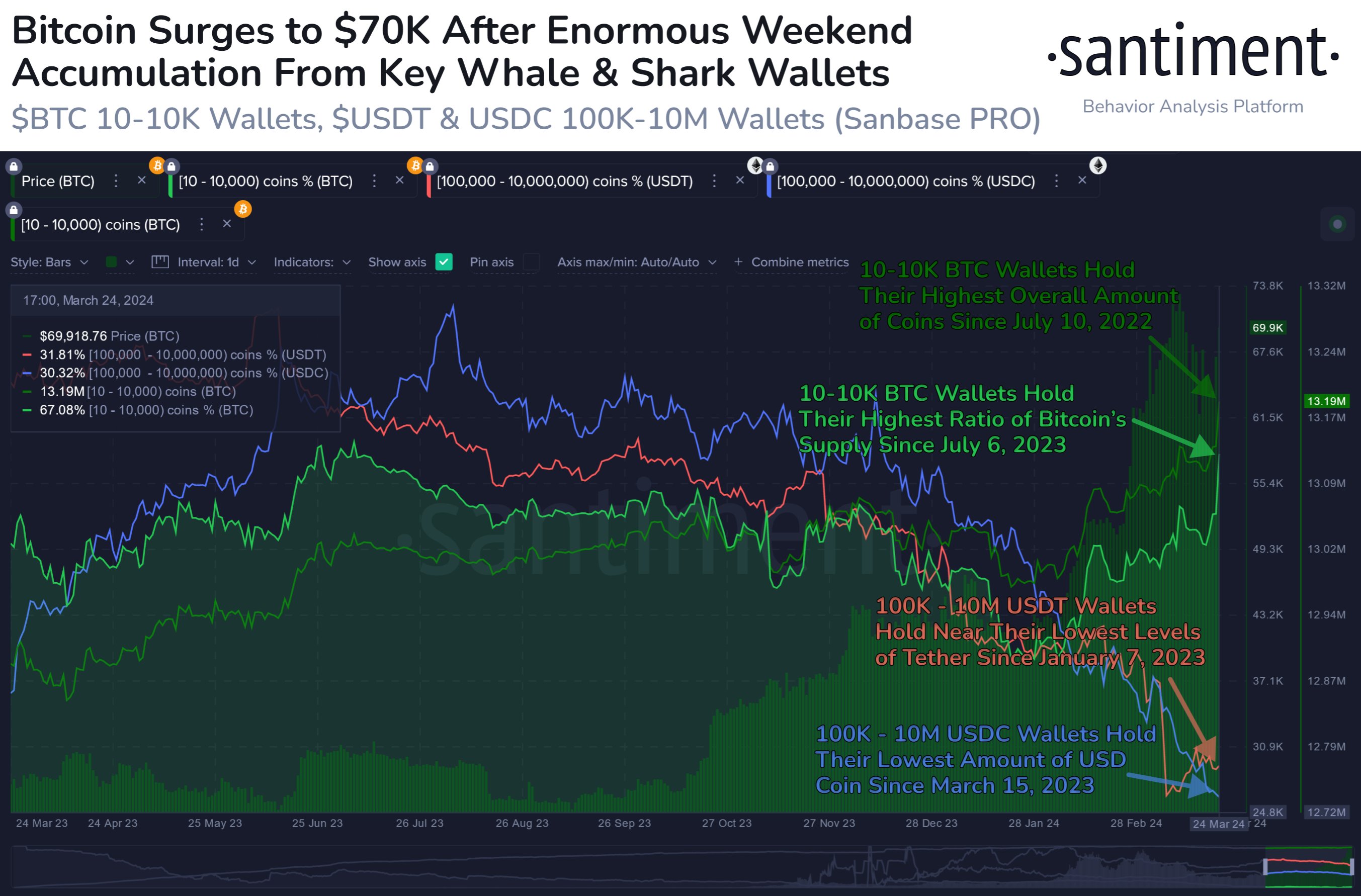

On March 25th, blockchain analysis firm Santiment noted that "key players" experienced a significant accumulation day over the weekend, indicating that Bitcoin could initiate a recovery phase.

The company reported that wallets holding between 10 and 10,000 coins, referred to as "sharks" and "whales," collected approximately 51,959 BTC on March 24th, amounting to around $3.4 billion in value. According to Santiment, this represents the collection of 0.263% of the current supply in a single day.

As the Bitcoin halving approaches, on April 19th or in about three weeks, "seeing these wallets continue to grow and potentially positively impact the overall market value of the crypto space wouldn't be surprising," it was stated.

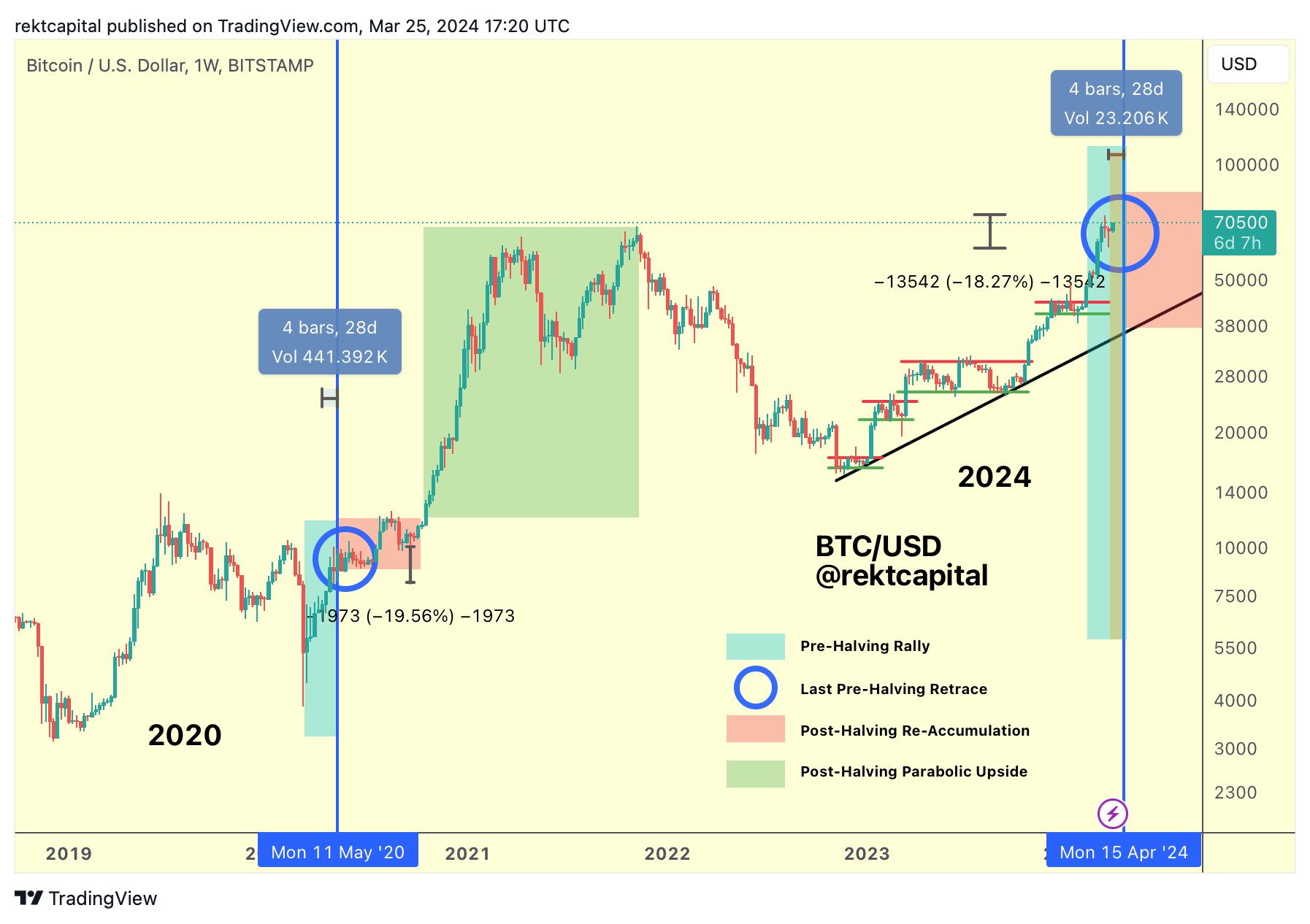

Cryptocurrency analysts were concerned about the possibility of a larger pre-halving pullback based on historical market cycles. However, according to CoinGecko, BTC only declined by around 17% from its all-time high of $73,738 on March 14th to $61,494 on March 20th.

Technical analyst Rekt Capital stated that if this pullback signifies the end of the pre-halving retracement, Bitcoin's pullback before the 2020 halving would be nearly equivalent.

Rekt Capital said, "Bitcoin retraced around 18% in this cycle, while BTC retraced slightly over 19% in 2020."

Analyst predicted that this pre-halving correction would be "less profound and potentially shorter than historical precedents."

Cryptocurrency research firm Kaiko, in a report dated March 25th, analyzed market fluctuations and declines from the previous week, noting a concentration of selling activity after the close of the U.S. markets.

The research concluded that "liquidity in the cryptocurrency market is dispersed not only across exchanges but also among trading pairs."

BTC, after reaching its intraday high of $71,000 on March 25th, is currently trading at $71,100.

You can stay updated on developments in the cryptocurrency markets and the latest news by visiting Kriptospot.com.