How Are Market Expectations Shaping Up For Ethereum Prices?

- Posted on April 12, 2024 11:22 PM

- Cryipto News

- 795 Views

Derivative traders are anticipating an increase in the price of Ethereum until the end of April.

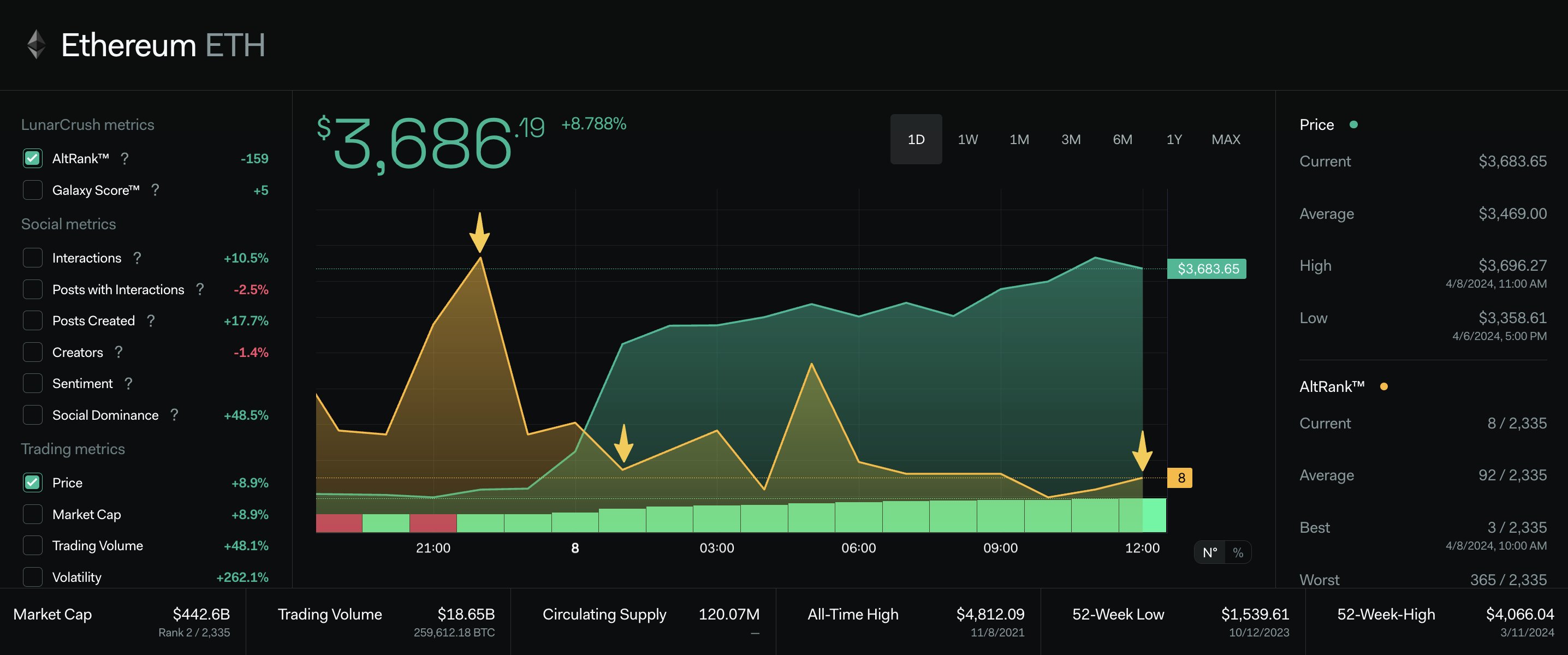

Ether surged in the spot crypto markets on Monday, fueled by increased social media interactions and optimistic expectations among derivative traders.

According to CoinGecko data, the price of Ether rose by approximately 8% in the last 24 hours, reaching as high as $3,722 on April 9th. This increase allowed Ether to outperform many of its close competitors, including Bitcoin (BTC). Ether reached its highest level in nearly three weeks, since March 16th. Currently, Ether is trading at a level approximately 9% below its peak in 2024 and 24% below its all-time high of $4,878 in 2021.

Meanwhile, Bitcoin's price surged by 3% to $71,395 within the last day. The momentum behind Ethereum's surge may be supported by various factors, including social media and market activities, as suggested by Lunar Crush. In a post shared on X platform on April 8th, Lunar Crush mentioned that "social activities continue to accelerate, accompanied by strong price movements and market volume."

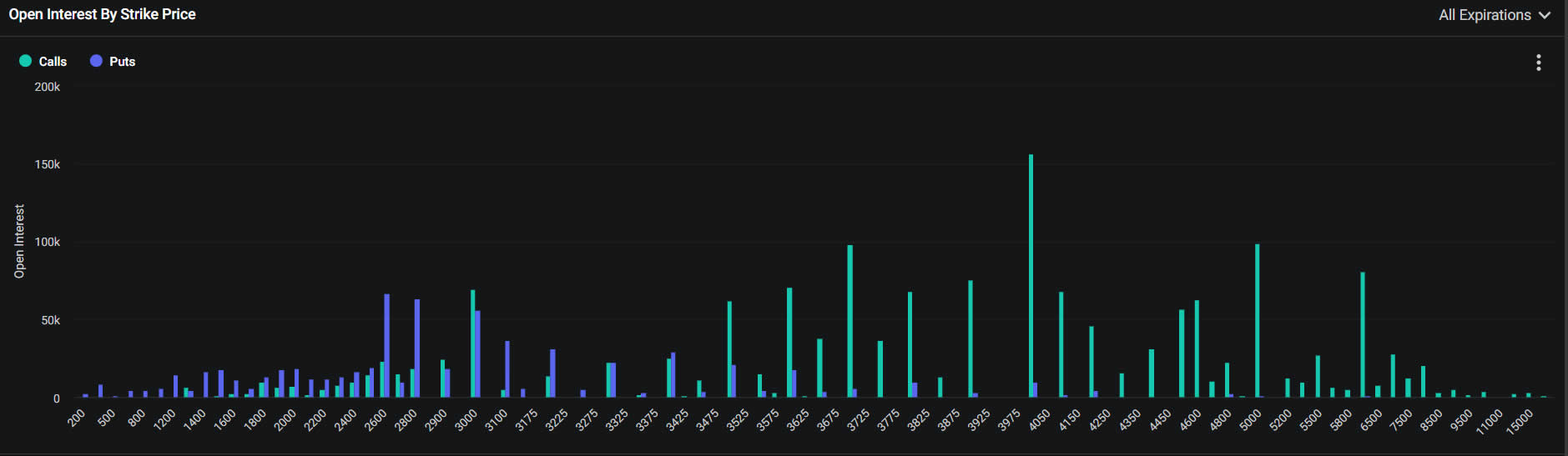

Meanwhile, the Ethereum derivatives markets are also indicating bullish expectations for the asset throughout the remainder of this month.

According to the crypto futures exchange Deribit, there is currently an open interest (OI) of approximately $600 million at the $4,000 strike price and a total of $378 million at the $3,700 and $5,000 strike prices.

This scenario indicates an upward trend and bullish expectation for the end of April options expiry, where approximately 900,000 Ethereum contracts with a nominal value of $3.8 billion are set to expire.

However, not everyone shares such optimism. Crypto writer and educator Vijay Boyapati, in a post on the X platform on April 8, stated that the approval process for Ethereum spot ETFs had fueled market activity, but cautioned that this momentum could be short-lived if these approvals were rejected.

"Given the hopes surrounding ETFs, all the capital poured into ETH could return to Bitcoin if Ethereum ETFs fail to materialize..." he remarked. Related: Ethereum (ETH) could see these levels this year.

According to on-chain analysis firm Santiment, as of April 9, ERC-20 assets, "buoyed by Ethereum's positive start to the week," were "averaging significantly ahead" of the market, with the sector recording an 8.1% growth last week.

Meanwhile, Toncoin (TON) surged to an all-time high of $6.50 on April 9 with a daily increase of 18.5%, surpassing Cardano (ADA) and settling in the tenth position in terms of market capitalization.

You can stay updated with the latest developments and news in the cryptocurrency markets by following Kriptospot.com.