Is Bitcoin's Next Target $74,000?

- Posted on July 23, 2024 9:57 AM

- Cryipto News

- 689 Views

Bitcoin may be gearing up for a rally towards the $74,000 level; however, for this move to be validated, it needs to reclaim the $69,000 support level.

Bitcoin analysts identify $74,000 as the next significant price level in the current bull cycle. They discussed the reasons that could propel Bitcoin's price above $74,000.

Bitcoin Bull Flag Points to Key Target of $74,000

According to analyst Tardigrade, Bitcoin's (BTC) price may be heading towards $74,000 or its current all-time high, based on a popular technical chart pattern. The trader wrote in a post on X dated July 18:

"Bitcoin's next target: $74,000. BTC has formed a Tight Bull Flag on the daily chart. The measurement target from the flagpole is $74,000."

A bull flag is a bullish technical chart pattern characterized by two rallies separated by a brief pullback, signaling potential further upward momentum.

However, historical all-time high price levels continue to serve as key support and resistance zones. Yann Allemann, also known as Negentropic and co-founder of Glassnode, notes that before BTC/USD can confirm a potential rise to the all-time high of $74,000, it must first reclaim the $69,000 level.

In a post on X dated July 18, Allemann wrote:

"Bitcoin has risen 21% since the low on Friday, July 5. Various technical levels have broken bullishly. Now we are targeting $74,000 and looking for the $69,000 level. The uptrend continues!"

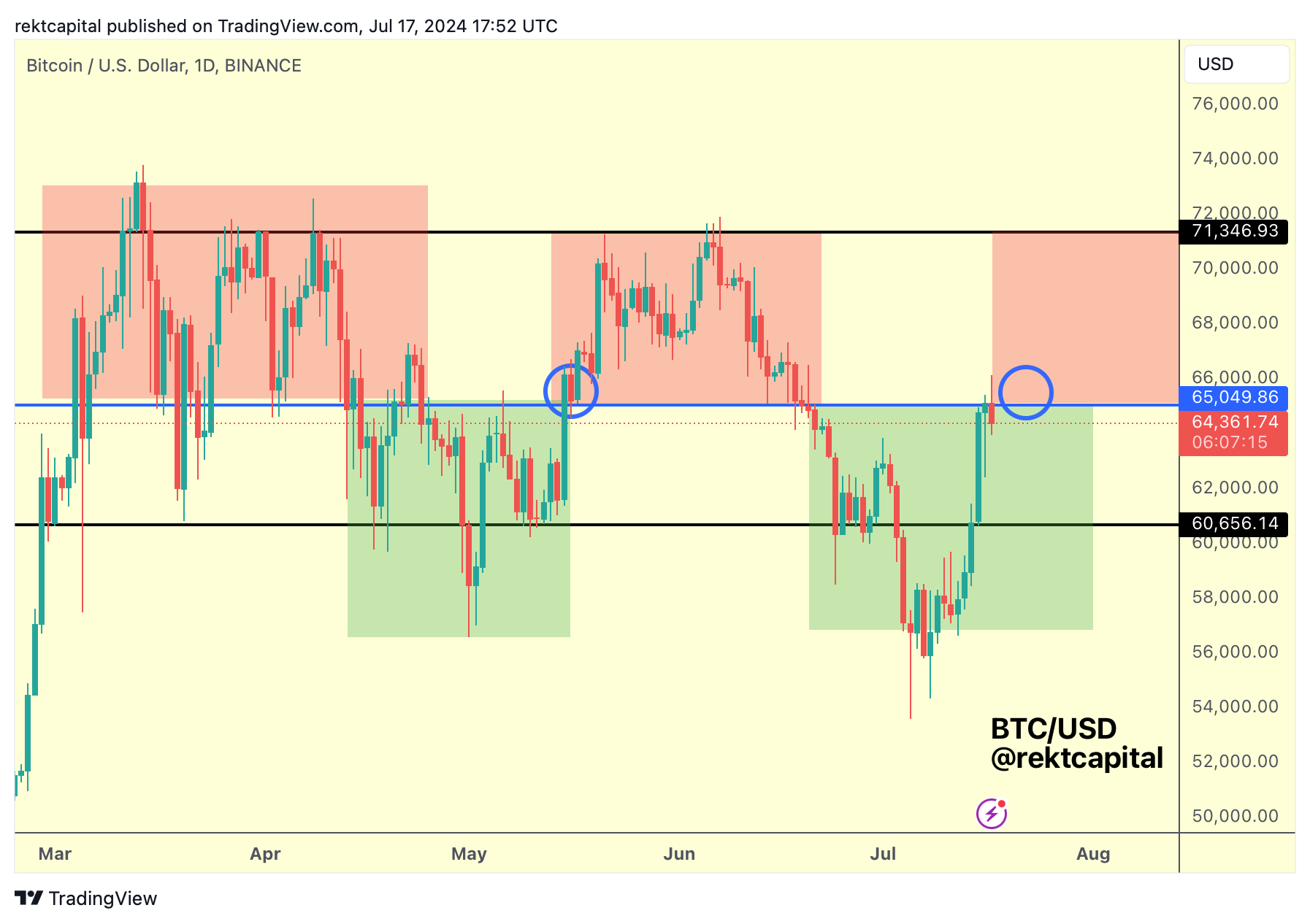

However, Bitcoin is currently facing a significant resistance level of $65,000, which has become crucial for crypto analysts.

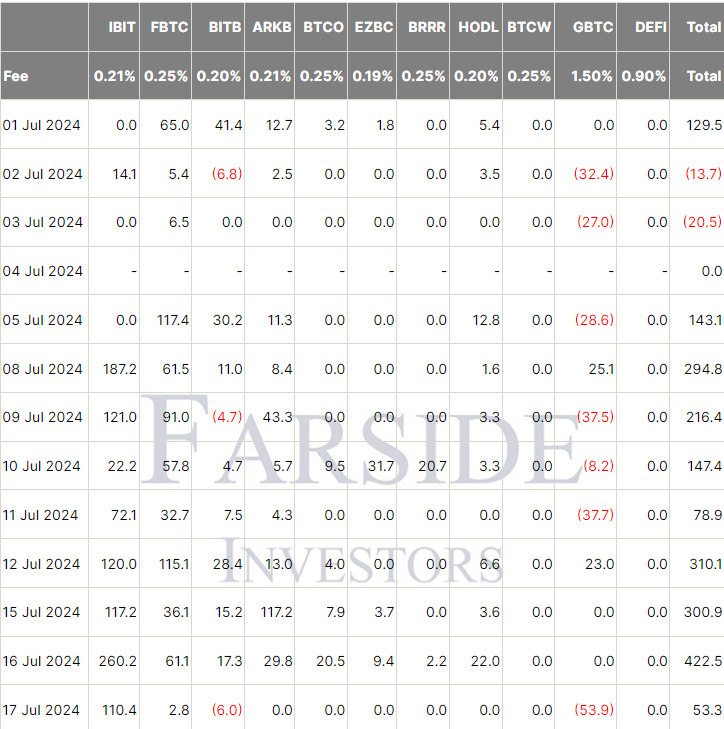

Since July 5, Bitcoin has experienced over $1.91 billion in inflows from U.S. spot exchange-traded funds (ETFs), yet the price has struggled to stay above the $65,000 mark.

Popular analyst Rekt Capital noted, "Bitcoin is not yet ready to test $65,000 as new support."

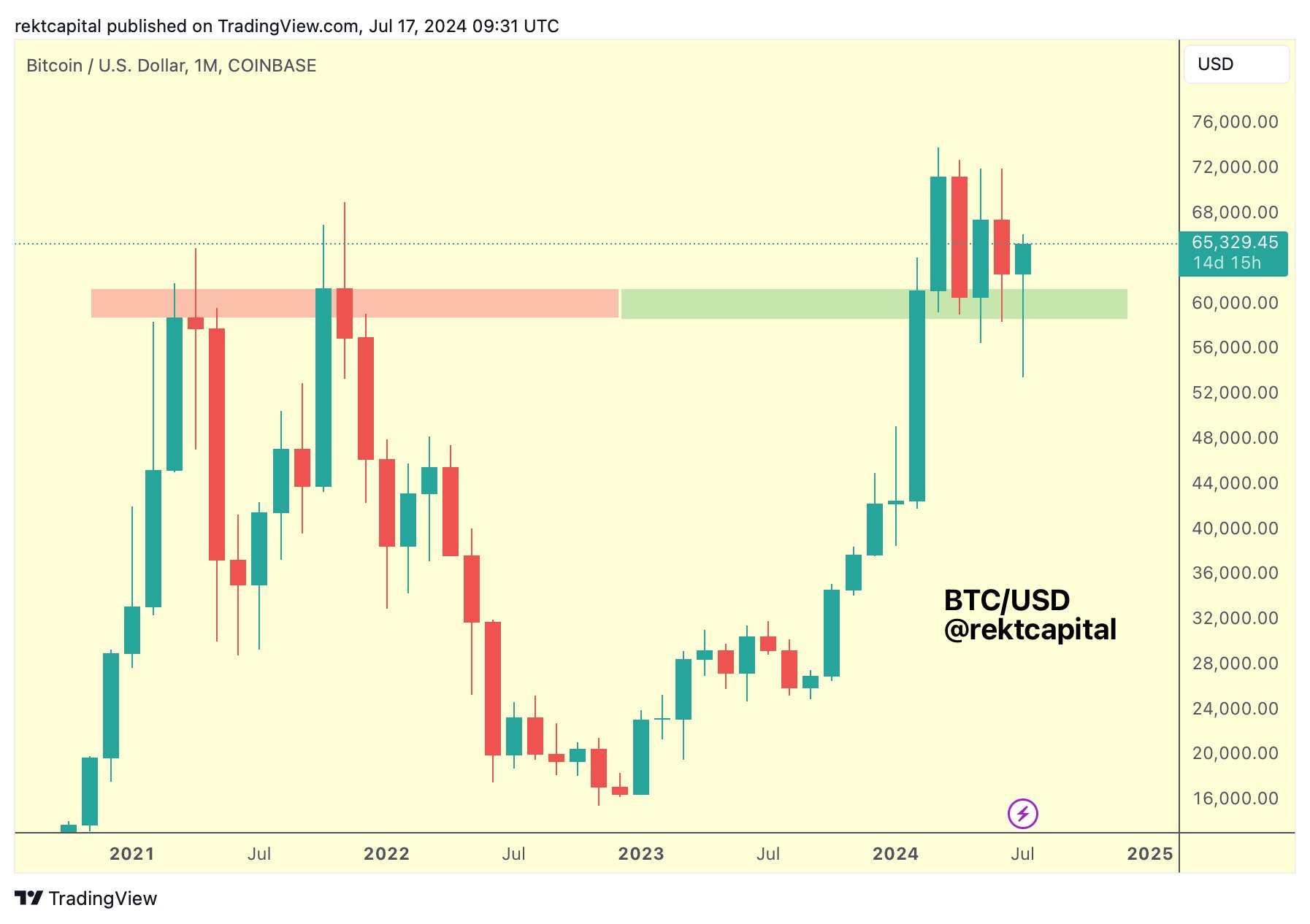

Bitcoin is staying above its monthly support level.

According to Rekt Capital, Bitcoin's price has confirmed a price recovery by remaining above a significant monthly support level.

The analyst wrote in a July 17 X post:

"Bitcoin has successfully retested the previous all-time high major resistance area (red) as new support (green) for the fifth consecutive month."

Despite this, Bitcoin's upward potential will largely depend on inflows into U.S. spot Bitcoin ETFs.

According to Farside Investors, U.S. spot Bitcoin ETFs collected a total of $422 million worth of BTC on July 16, marking the highest inflow level since early June.

ETF inflows were a key component of Bitcoin's price rally in 2024. As of February 15, Bitcoin ETFs accounted for approximately 75% of new investments in the world’s largest cryptocurrency, surpassing the $50,000 mark.

For real-time updates on developments and the latest news in the cryptocurrency market, you can follow Kriptospot.com.