Reasons For The Decline In Bitcoin And Altcoin Prices

- Posted on August 7, 2024 2:32 AM

- Cryipto News

- 1059 Views

Uncertainty in the U.S. economy, interest rate hikes in Japan, and political tensions in the Middle East are contributing to selling pressure in the Bitcoin and altcoin markets.

Cryptocurrencies have experienced their worst daily performance since the collapse of the FTX crypto exchange in November 2022.

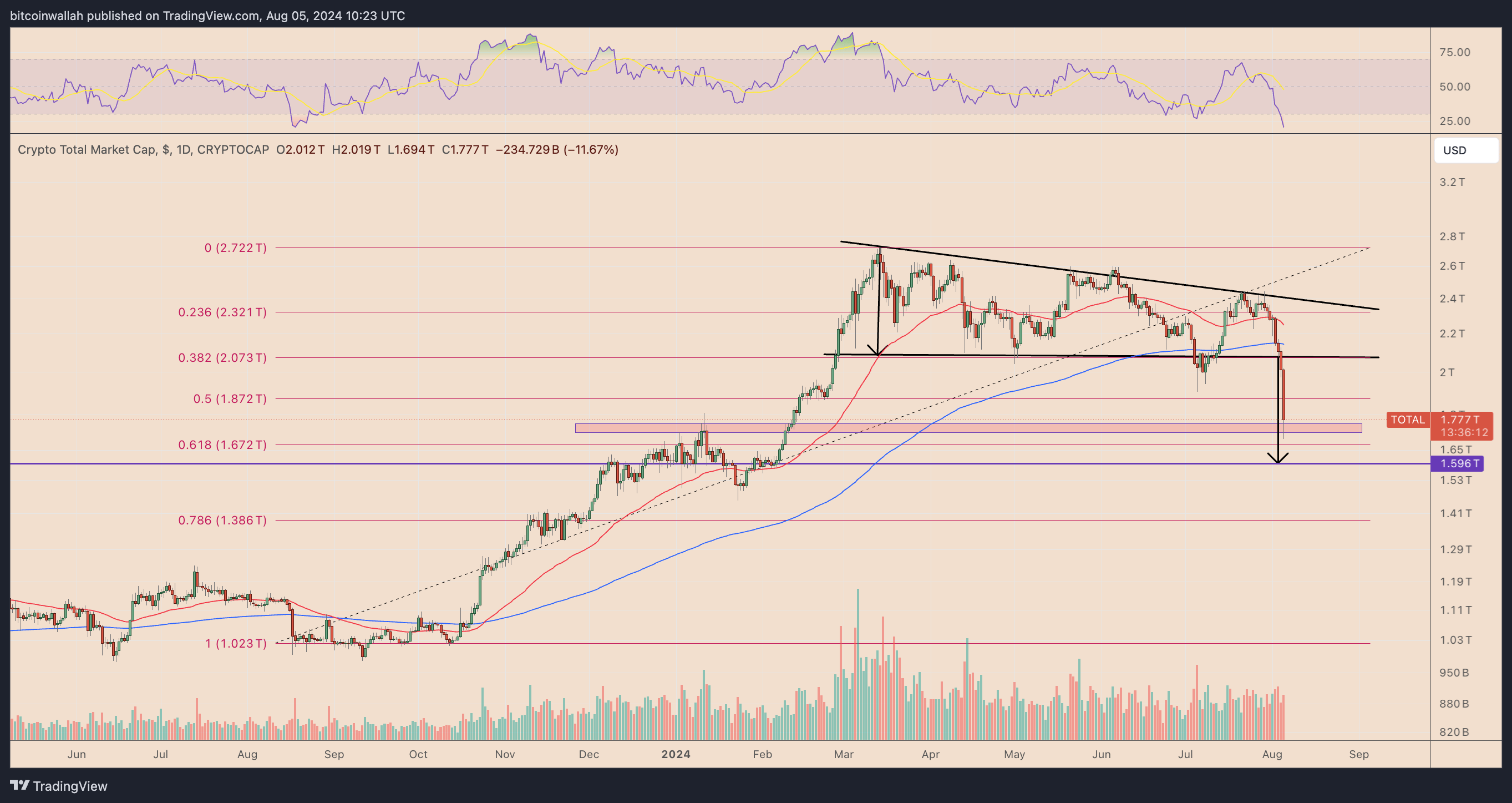

Yen-dollar carry trade operations have impacted the market. On August 5, the total market value of all cryptocurrencies dropped by 15.80%, reaching a six-month low of $1.694 trillion. This decline was largely driven by Bitcoin (BTC) and Ether (ETH), which together account for over 70% of the crypto market.

These declines are primarily due to the reduced appeal of yen-dollar carry trades.

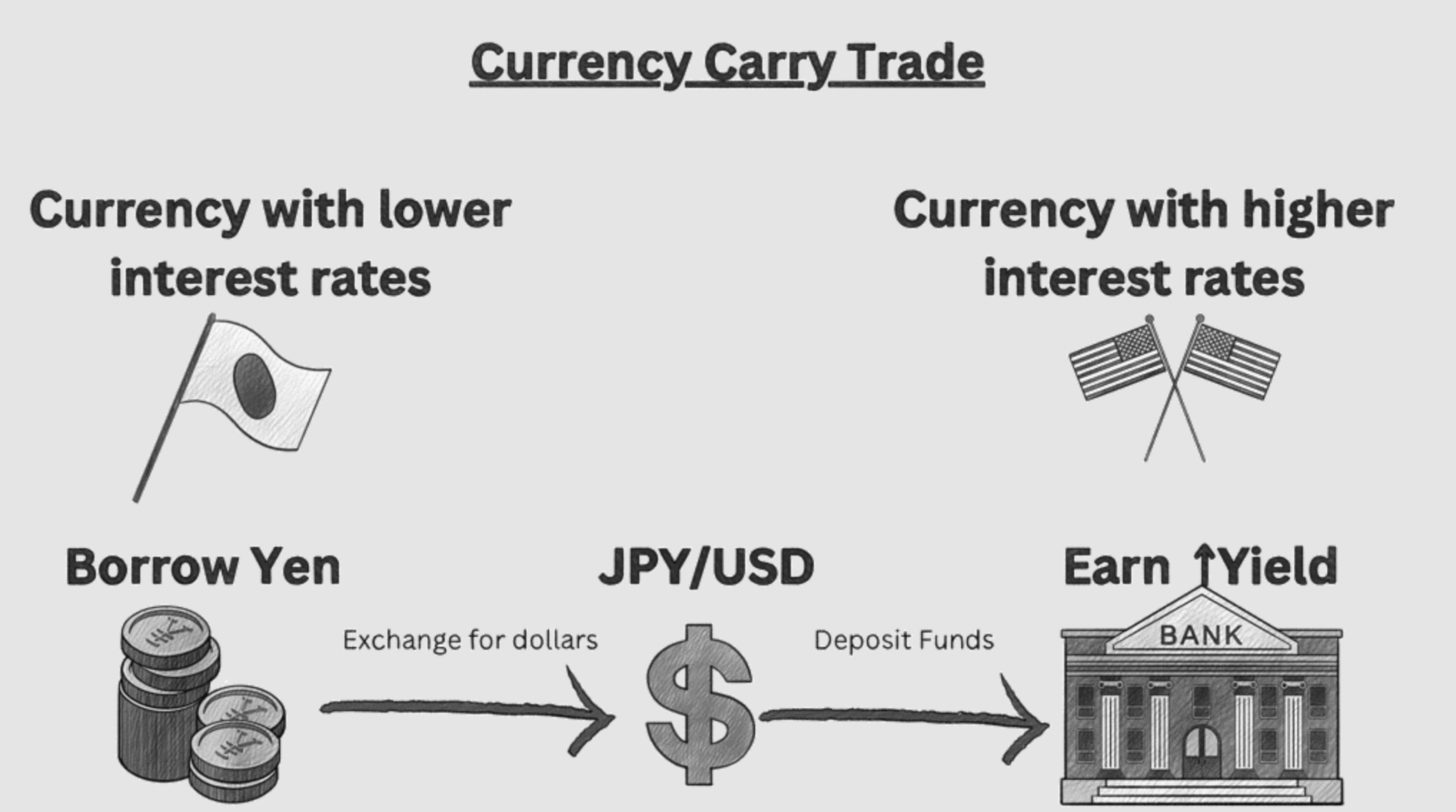

What is a carry trade?

A carry trade involves investors borrowing in a currency with low interest rates (such as yen) and converting it into a currency with higher interest rates (such as the U.S. dollar). They then use the proceeds to invest in various assets, including stocks and bonds. This strategy offers investors the opportunity to profit from the difference between interest rates.

This strategy has yielded positive results for investors due to Japan's near-zero interest rate policy compared to the higher interest rates in the U.S.

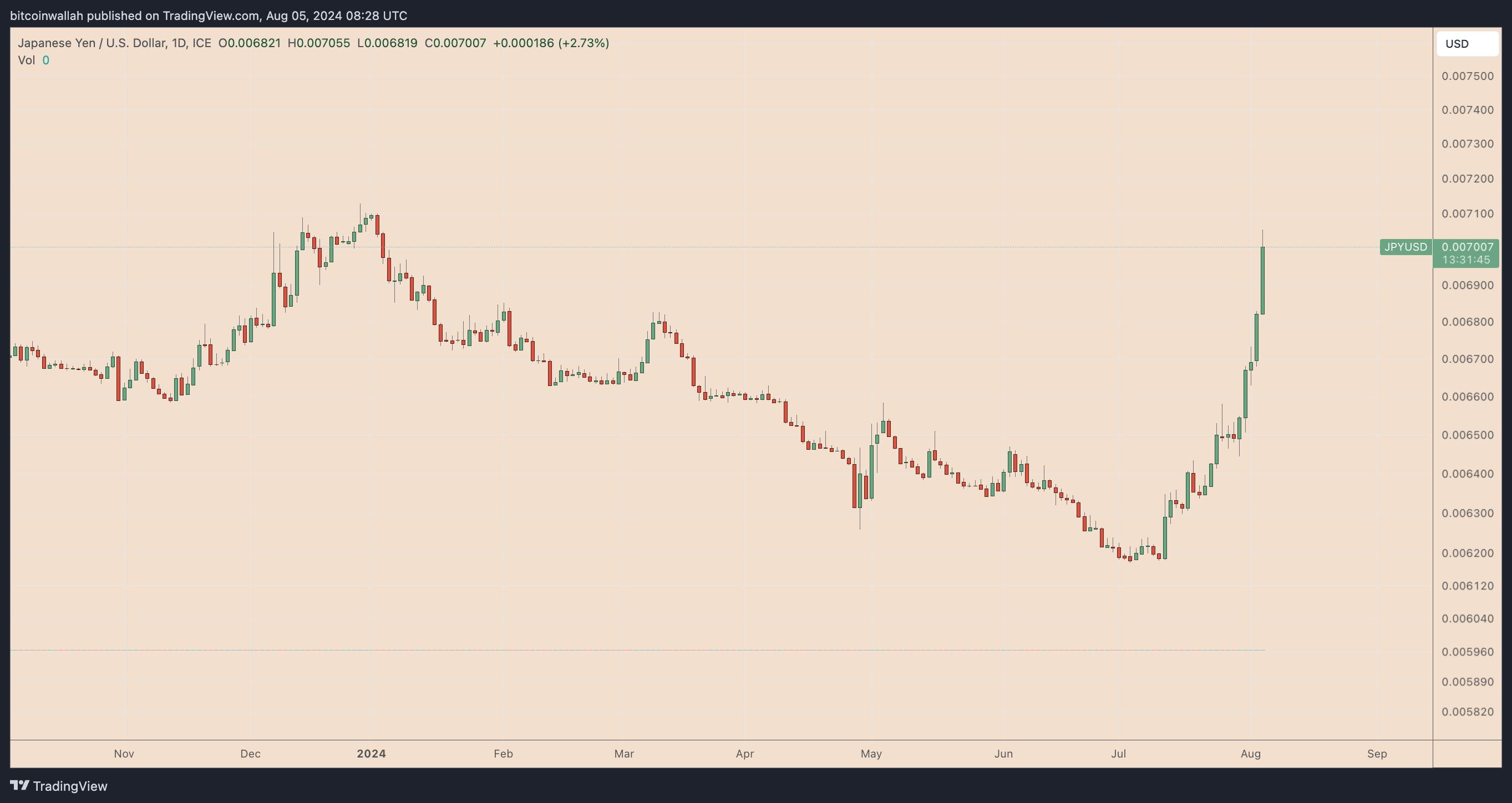

However, on July 31, the Bank of Japan (BOJ) raised its interest rate to 0.25%, leading to increased expectations of further hikes among investors. In contrast, the U.S. Federal Reserve is expected to lower interest rates in September due to rising unemployment and slowing economic growth.

As a result, the yen has reached high levels against the dollar since January 2024. This rapid appreciation has negatively impacted the profitability of yen-dollar carry trades.

Investors in riskier assets who have borrowed in yen are closing their positions to avoid increased borrowing costs and repay their debts. This has led to a collapse in the stock and crypto markets, while geopolitical tensions in the Middle East and recession risks in the U.S. have further intensified selling pressure.

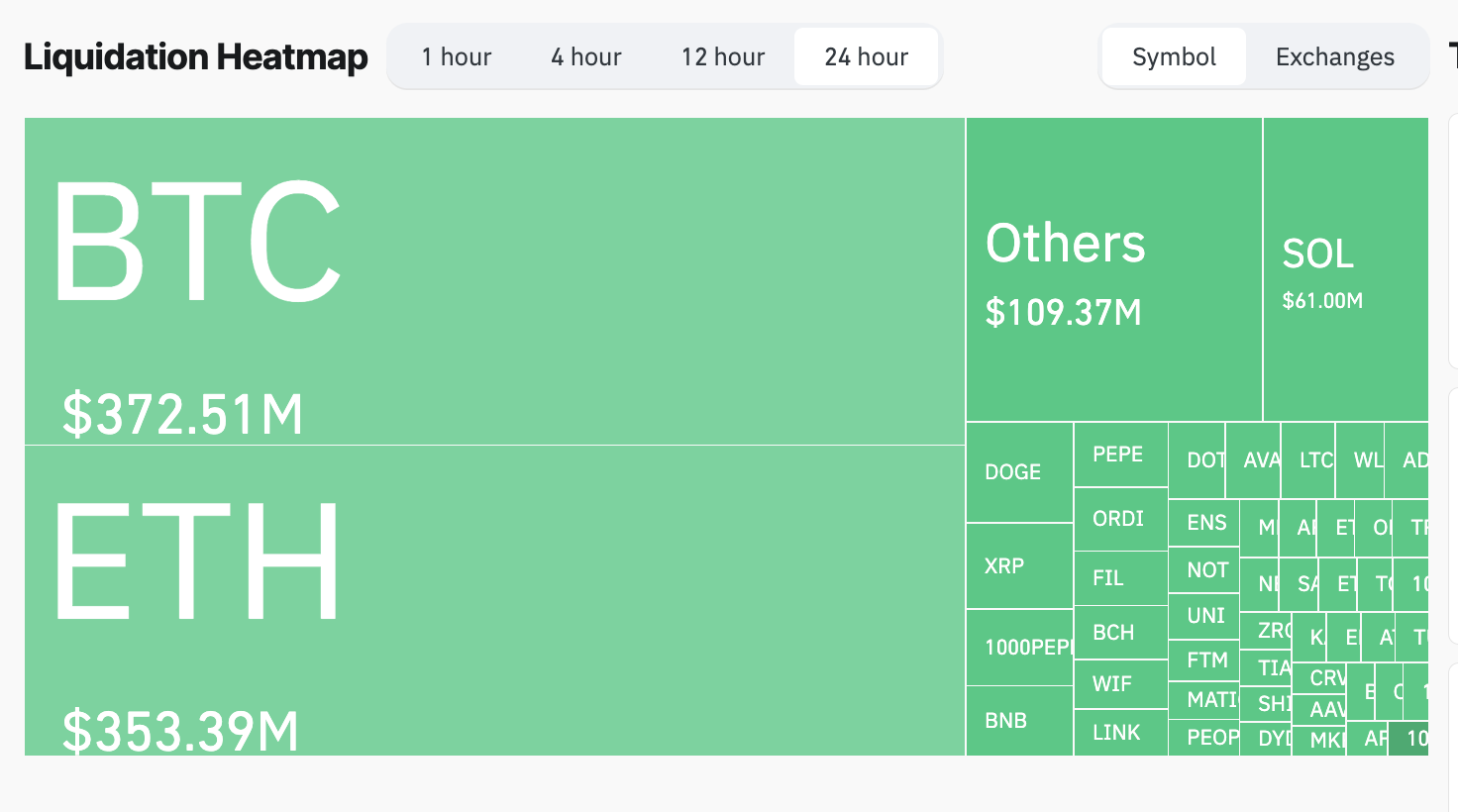

$1 Billion Liquidated in Futures Crypto Trades

The decline in the crypto market has accelerated, with $1.08 billion in liquidations over the past 24 hours, of which $919.54 million came from long-term positions. During this period, the open interest (OI) in the crypto futures market also fell by approximately 15%.

The significant liquidation of long positions indicates that many investors have entered the market with overly optimistic expectations and are using high leverage.

When the market moves against these positions, a series of liquidations can amplify downward price movements. This scenario often leads to a rapid decline due to increased stop-loss and margin call triggers.

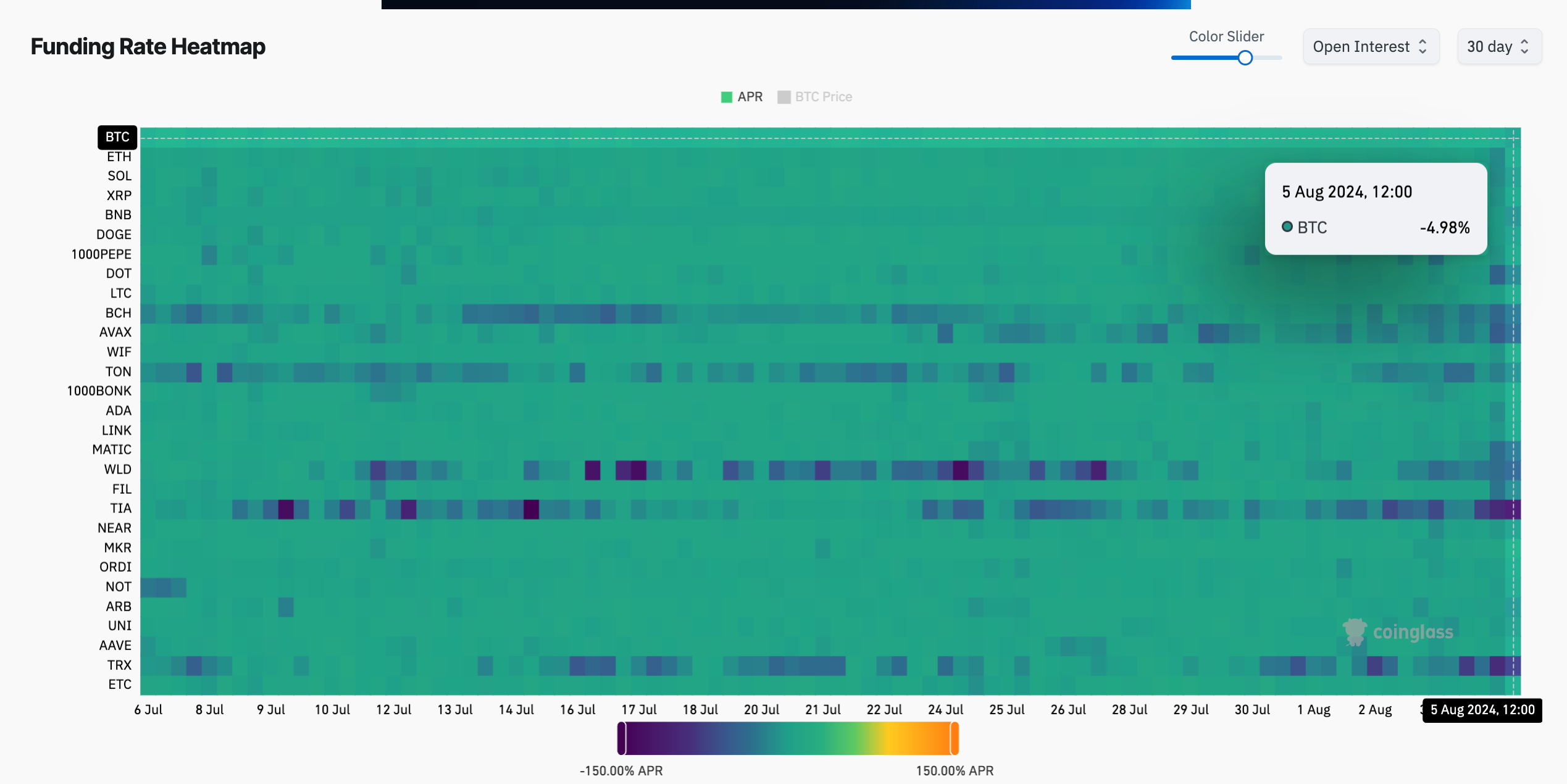

The decline in open interest signals a reduction in the number of active futures contracts. This suggests that investors are closing their positions and withdrawing from the market. Additionally, the funding rates for many top-performing cryptocurrencies, such as Bitcoin and Solana, have simultaneously fallen into negative territory.

This situation indicates a downward trend among futures traders who are willing to pay premiums to maintain their short positions. As open positions dominate the market, negative funding rates may exert further downward pressure on prices.

Descending Triangle Breakout

Today's losses in the crypto market are related to the breakdown of a descending triangle formation.

Descending triangles are typically considered bearish reversal patterns that emerge during uptrends. They are characterized by a descending trendline resistance and a horizontal trendline support. Descending triangles usually resolve when the price falls below the support trendline and declines by a distance equal to the maximum distance between the resistance and support trendlines.

As of August 5, the total value of the crypto market has dropped to $1.596 trillion. This market size had previously served as a support level from December 2023 to February 2024.

You can stay updated on developments and the latest news in the cryptocurrency market in real-time with Kriptospot.com.