Following Sam Bankman-Fried's Conviction, Ftx Compensation Claims Have Increased By 57 Percent.

- Posted on November 4, 2023 5:30 AM

- Cryptocurrency Exchanges News

- 560 Views

The increase in compensation claims against FTX is attributed to the company's recent early investments in artificial intelligence firms with rising valuations.

Claims Market verilerine göre, FTX talebi yüzde 57'ye ulaştı. Bu artışın nedeni, FTX'in daha önce yatırım yaptığı iflas etmiş yapay zeka (AI) şirketlerinin değerlenmesine atfediliyor.

Alacaklılar, bir işletme finansal zorluklar yaşadığında veya iflas ettiğinde yatırımlarının bir kısmını telafi etmek amacıyla talepte bulunurlar. Yatırımcılar, tahmini geri kazanım değerine dayalı olarak bu talepleri alıp satarlar. Bir talebin fiyatlandırması yükseldiğinde tahmini geri kazanım değeri de artar.

FTX's increased compensation claims are also associated with the appreciation of the investments it made in artificial intelligence companies. A compensation claim is the legally requested sum of money.

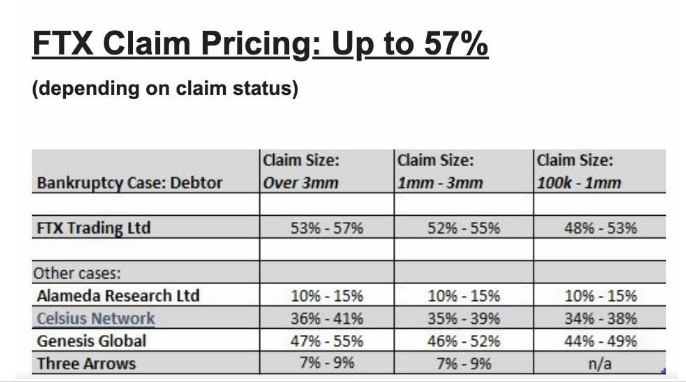

The percentage value of these claims represents the expected recovery amount from the platform. Compared to other insolvent cryptocurrency firms such as Celsius (approximately 35-40%), Genesis (approximately 50%), Alameda (10%), and Three Arrows Capital (3AC) (only 7-9%), FTX's compensation claims have reached the highest percentage value.

The surge in FTX compensation claims occurred during the public trial that ended on November 2, where former FTX CEO Sam Bankman-Fried was found guilty of all seven charges by the jury. The presiding judge in the case will announce the decision in March 2024.

FTX's compensation claims had been a significant topic of discussion within the crypto community throughout the bankruptcy process. The judge in the case allowed FTX to sell approximately $3.4 billion worth of crypto assets to pay off its debts. With the rise in cryptocurrency prices and the increased value of the companies FTX invested in, creditors have come closer to recovering a significant portion of their lost funds from FTX.