Did Singapore's Major Bank Invest In Ether (Eth)?

- Posted on May 31, 2024 11:07 PM

- Cryipto News

- 618 Views

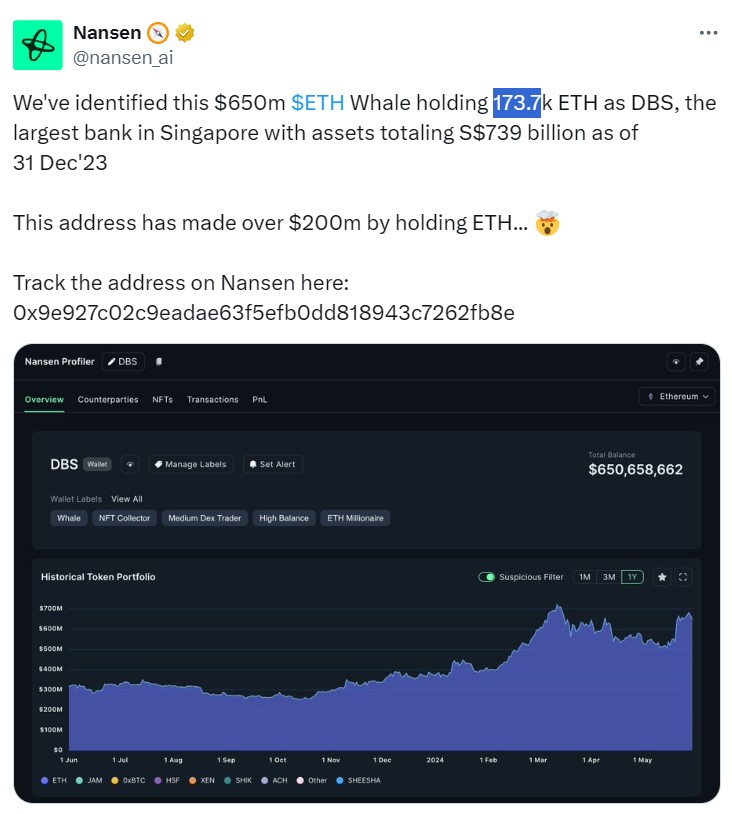

Nansen claims that its crypto wallet has earned $200 million so far from its ETH investment.

It is claimed that a crypto wallet belongs to the multinational financial services and banking company DBS Bank, containing over 170,000 Ether worth $650 million.

On May 30th, the blockchain analysis company Nansen brought attention to this alleged Ethereum "whale," associating it with DBS Bank. According to Nansen's analysis, it is estimated that this address belongs to DBS Bank and has generated approximately $200 million in profit through Ether investments.

Does the DBS wallet hold investor assets?

Although DBS Bank has not yet confirmed whether the Ether belongs to them, some suggest that this wallet could be associated with the digital exchange opened for its institutional investors. A community member pointed out that the Ether held by the wallet might not be bank assets, but rather assets held on behalf of investors.

In 2020, DBS Bank announced a platform for cryptocurrency trading, custodial services, and securities token offerings. At that time, DBS Exchange stated that it would not hold any assets itself but would provide custodial services to investors.

The bank declared that "All digital assets are held in custody with the globally recognized DBS Bank." It was also noted that DBS would support major cryptocurrencies including Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum Classic (ETC), and ETH.

Since its establishment, the DBS Bank's crypto division has achieved significant success. In 2022, the bank reported a fourfold increase in Bitcoin purchases through its digital exchange. Total transactions more than doubled from April 2022 to June 2022.

DBS Bank's transaction volume continues to grow. In 2023, DBS announced an 80% increase in Bitcoin transaction volume, attributing this growth to the downturns in the crypto market in 2022.

In July 2023, DBS Bank launched a digital yuan transaction tool and executed its first transaction for corporate customers. The DBS Bank China subsidiary launched the e-CNY merchant solution, enabling businesses to receive payments using the central bank digital currency (CBDC).

For the latest developments and news in the cryptocurrency markets, you can follow updates instantly on Kriptospot.com.