Sol, Avax, Inj, And Near Were The Cryptocurrencies That Pleased Investors In December.

- Posted on December 28, 2023 3:16 AM

- Cryipto News

- 793 Views

SOL, AVAX, INJ, and NEAR, pleasing their investors in December, are respectively the fourth, eleventh, twenty-second, and twenty-third largest cryptocurrencies by market capitalization.

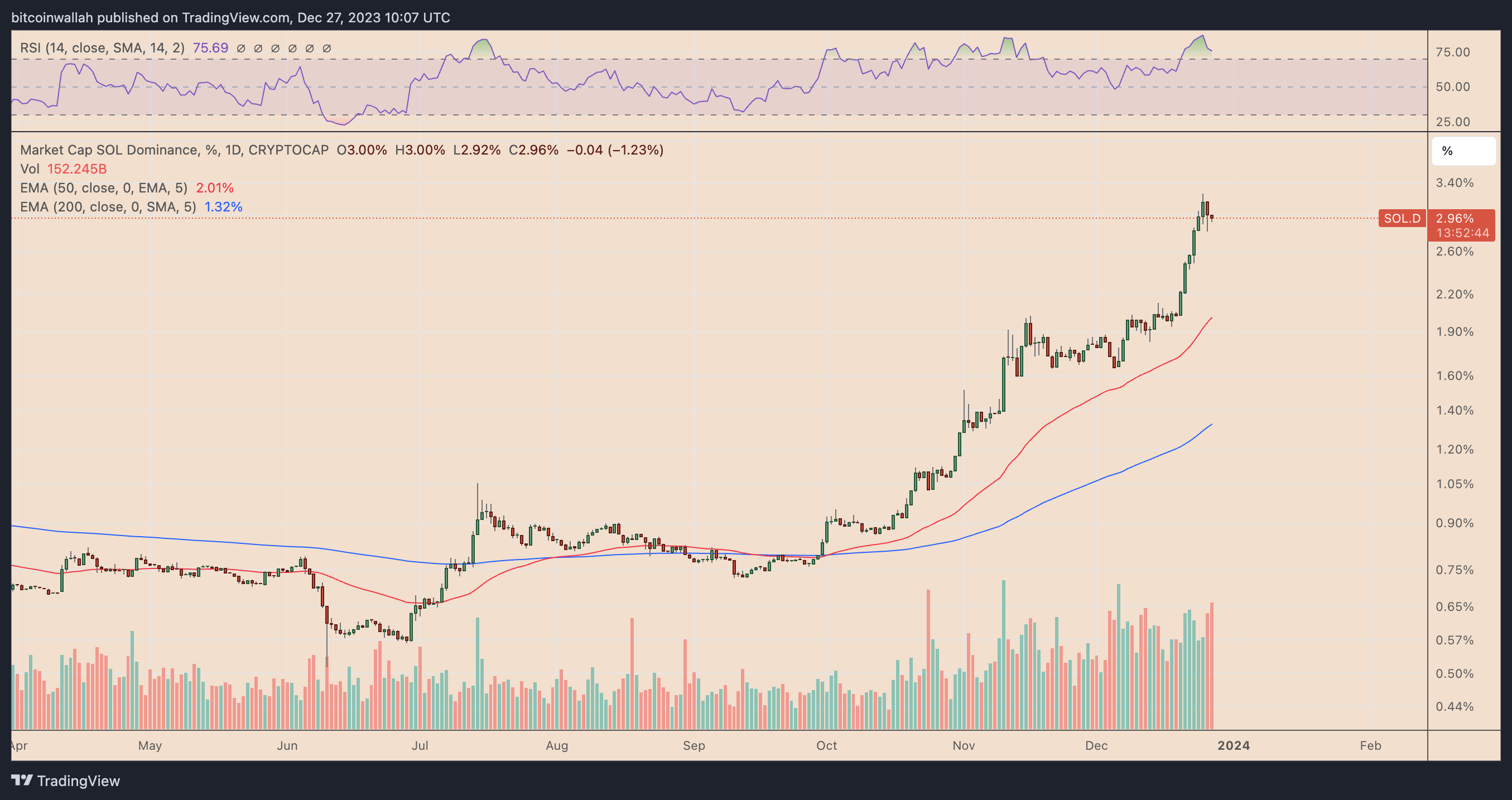

In December, SOL achieved a remarkable 95% increase, surpassing its rival Ether, which only saw a modest 9.5% rise during the same period.

SOL has outperformed Ether this month for various reasons. As the year comes to a close, SOL is not the only Layer-1 token with impressive returns. Let's take a closer look at three major tokens that have outperformed SOL with their performance in December.

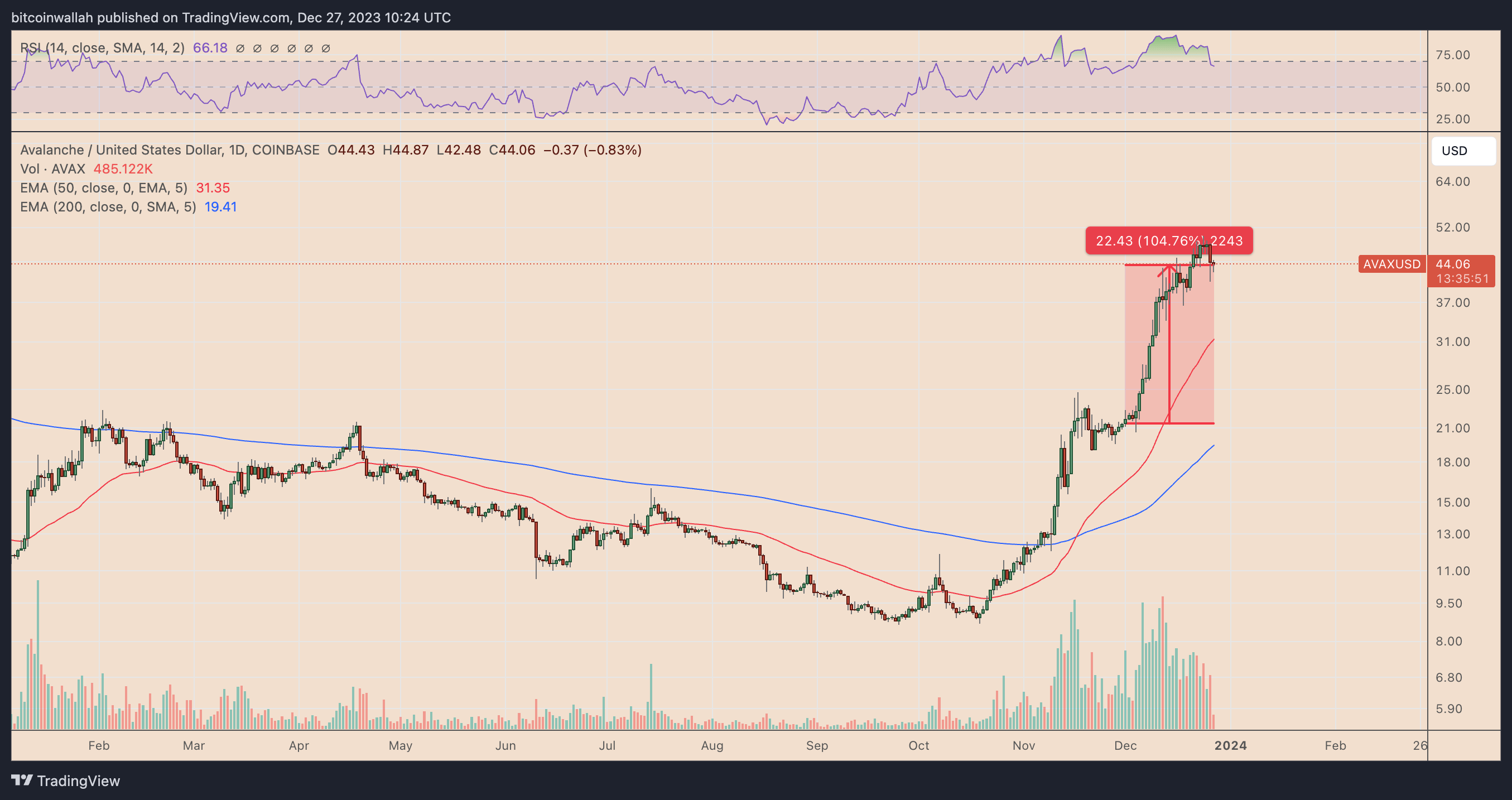

AVAX surged over 100%

AVAX, the tenth-largest cryptocurrency by market capitalization, surpassed SOL in December, reaching around $44 with a monthly (MTD) increase of over 104.75%.

The MTD rally of AVAX interestingly followed the trend of unlocking 9.54 million AVAX at the end of November. This indicated that the markets absorbed the additional token supply without causing devaluation.

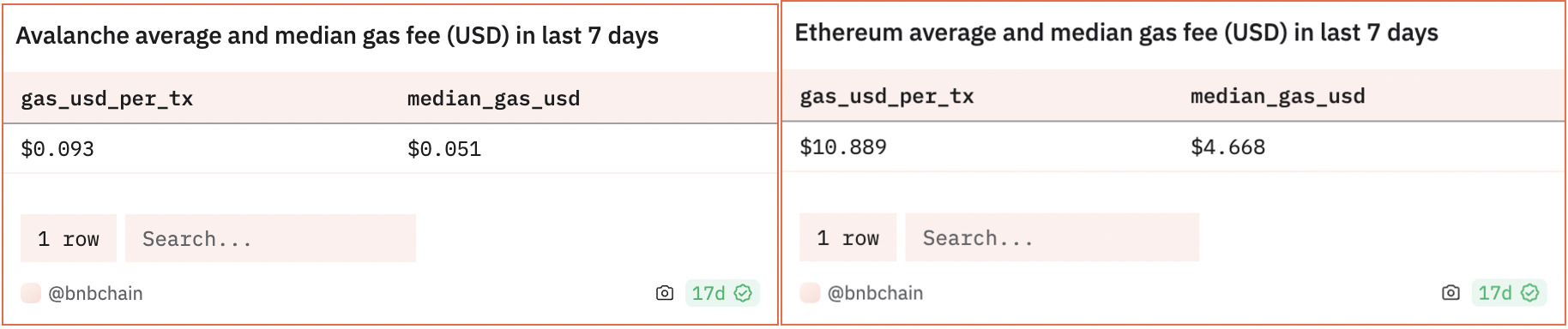

There was notably strong demand for AVAX, especially due to the increased gas fees on Ethereum in December. For comparison, Avalanche's average gas fee at the beginning of the month was $0.051, significantly lower than Ethereum's $4.66 per transaction fee.

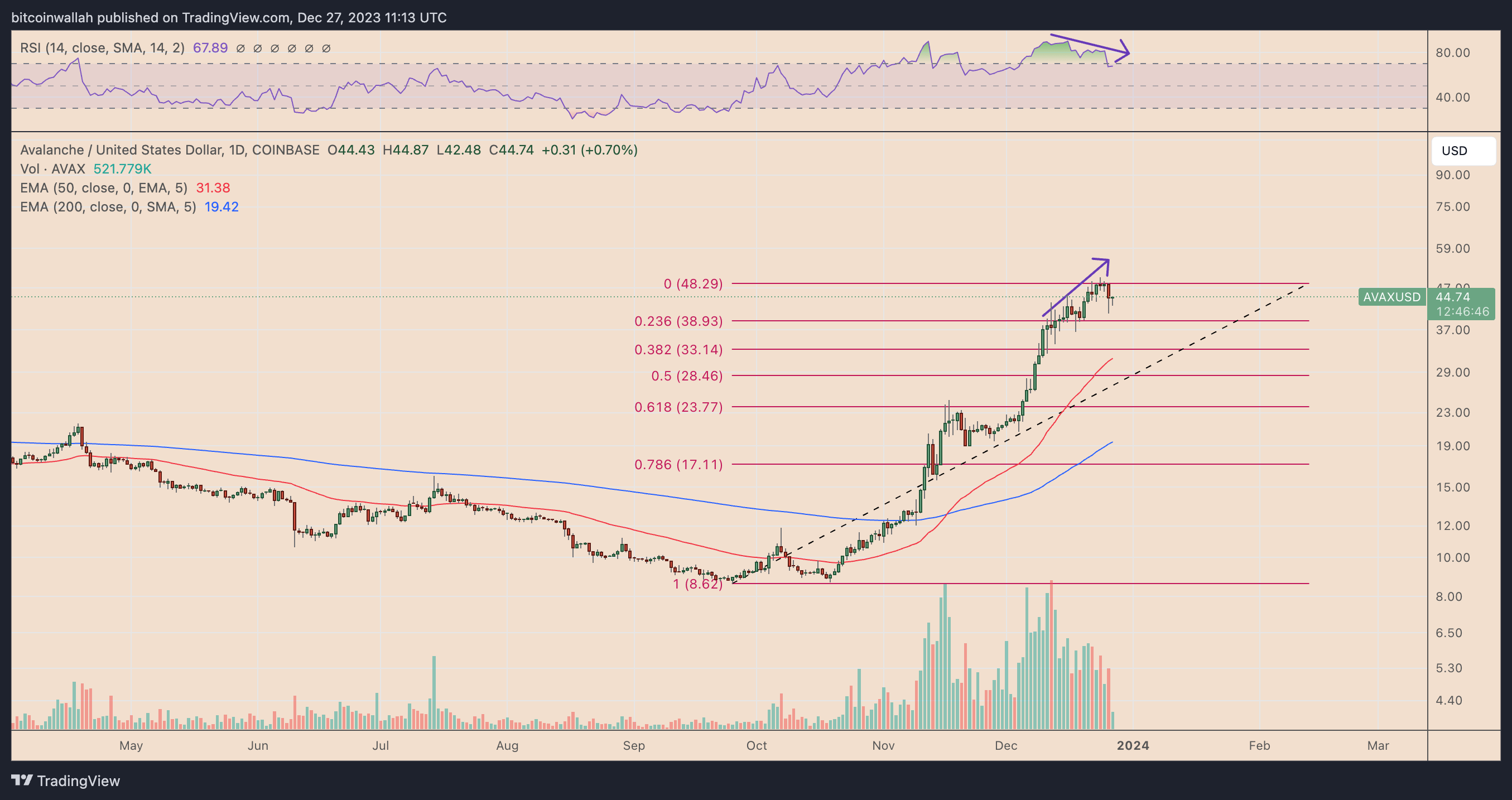

AVAX Price Analysis

From a technical standpoint, there is a noticeable discrepancy between the rising prices of AVAX and the declining momentum.

AVAX has formed higher peaks, but the daily relative strength index (RSI) has indicated a downtrend by forming lower peaks in December. In other words, the cryptocurrency's rally may be approaching exhaustion.

As a result of this situation, AVAX may experience a decline towards the support level around $33, which corresponds to the 0.383 Fib level in January, and the 50-day exponential moving average (50-day EMA) around $31.50.

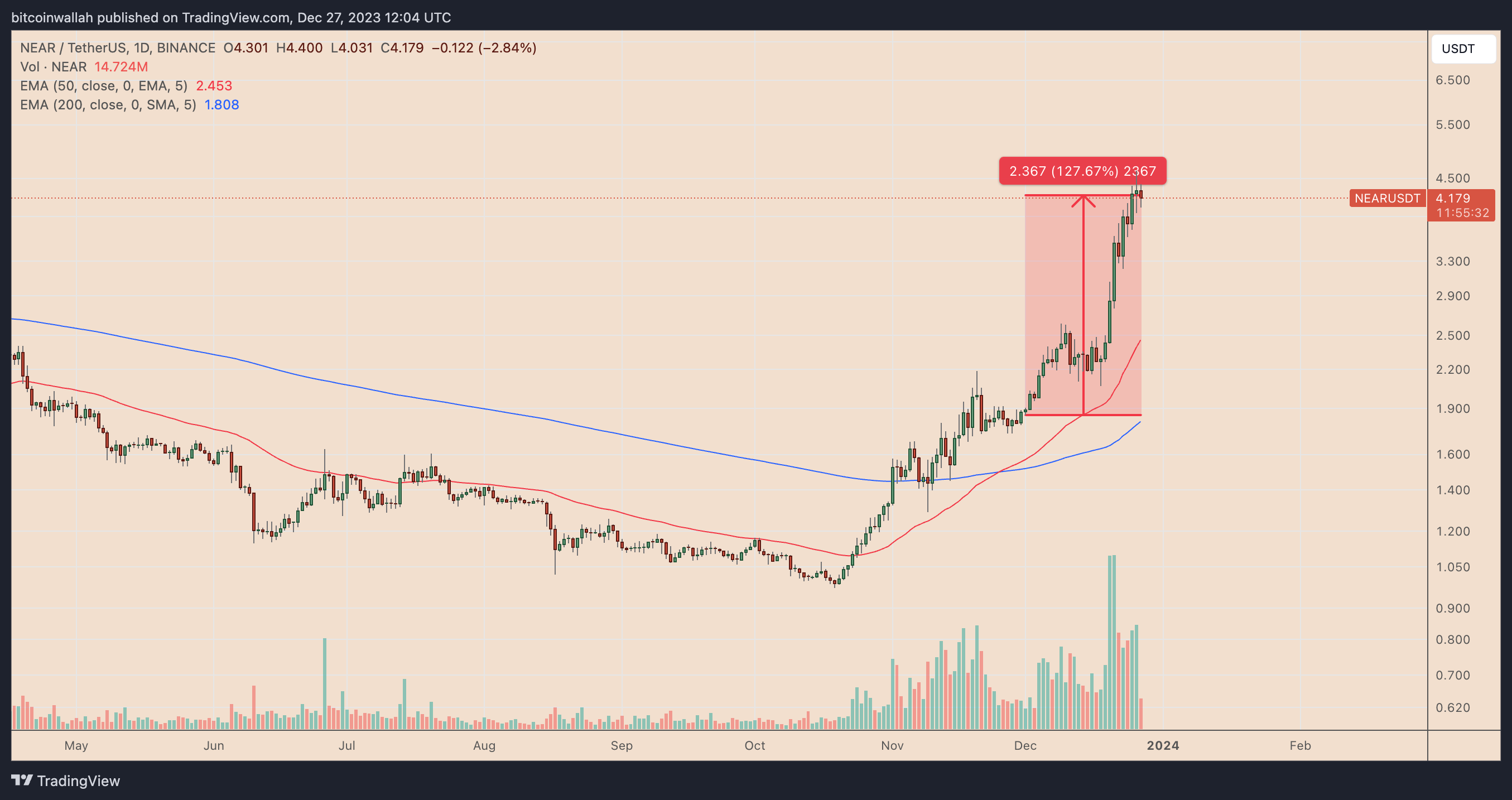

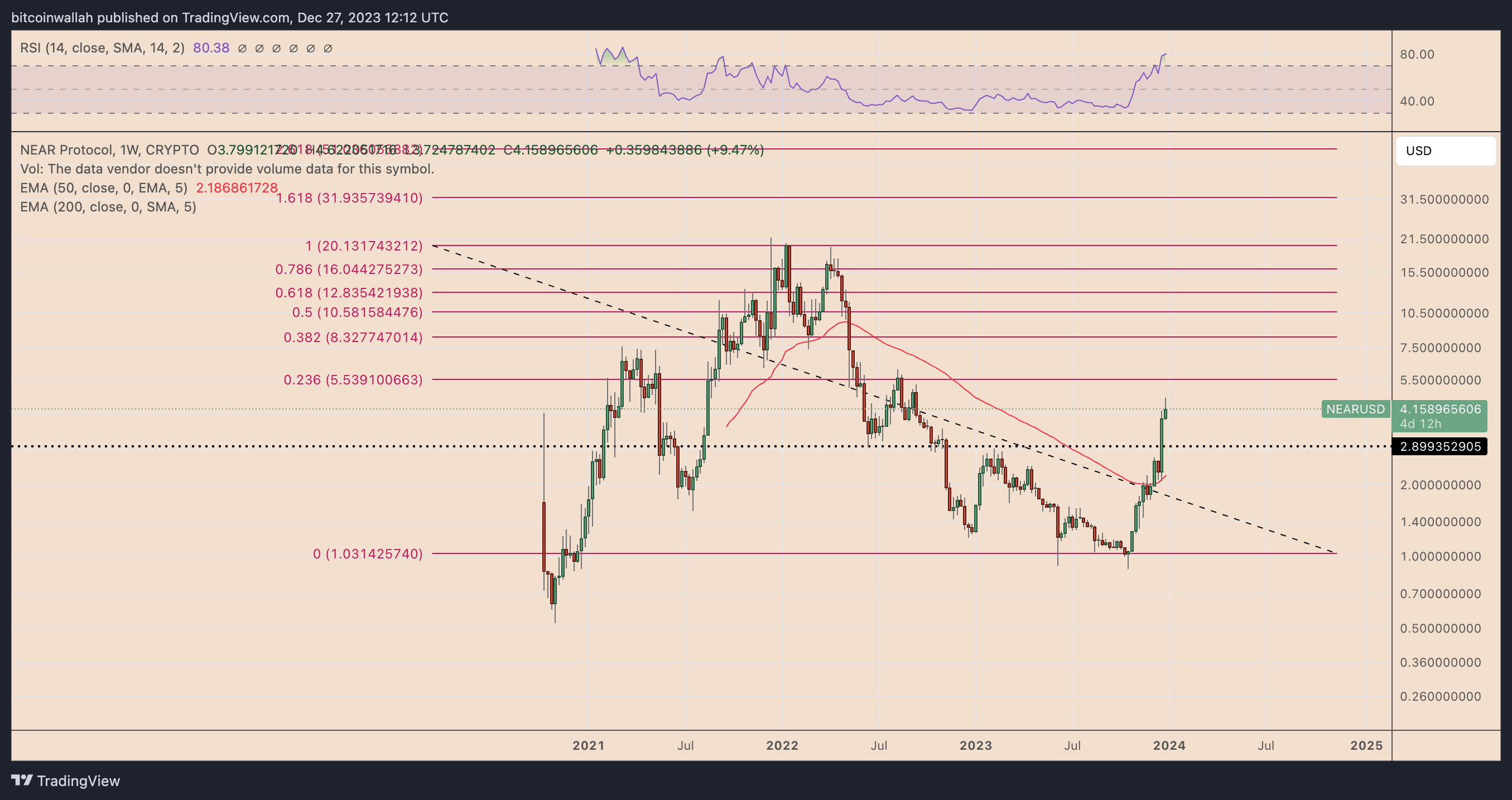

NEAR, with an increase of over 125%.

The token of the NEAR Protocol, NEAR, surged over 125% this month, reaching up to $4.20. This increase coincided with a 350% rally in NECO, a memecoin project associated with the protocol, during the month of December.

Near Protocol has strengthened its project by forming strategic partnerships with Polygon Labs and the U.S.-based IDS Inc. to enhance zkWASM.

NEAR Price Analysis

Technically, NEAR's weekly RSI is in overbought territory, indicating that the upward trend may result in consolidation or correction.

As a result, the NEAR price may experience a correction towards $2.90, which is the June-October 2022 support level, at the beginning of January 2024. A sharp close below $2.90 could lead bears to test the next downside target of $2.18, the 50-week EMA.

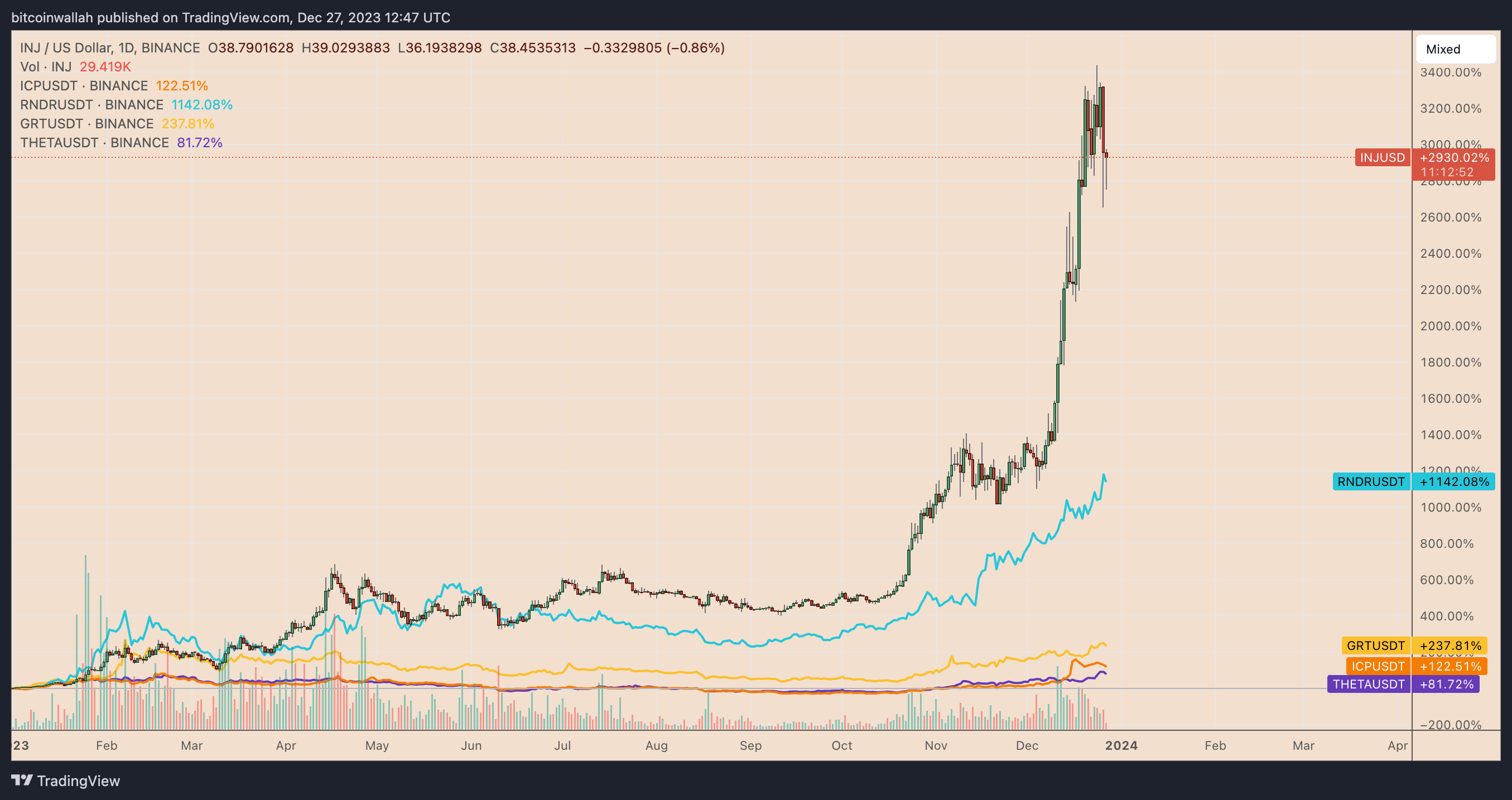

INJ Surged by 108%

INJ saw a surge of 108% with an MTD of $38.30. This happened partially due to the broader rally in artificial intelligence tokens and Injective's integration with technology DeFi as a layer-1 blockchain.

The increasing value of INJ can also be associated with the trend among airdrop farmers. These individuals actively move between different blockchains to collect new assets coming from airdrops.

An analyst named Crypto Kaduna emphasized several projects built on the Injective Protocol, stating that the airdrop plans of these projects have been confirmed.

The @Injective_ ecosystem is about to explode and many projects that are built on top have confirmed an airdrop.

— Kaduna (@CryptoKaduna) December 12, 2023

The easiest way to buy, stake $INJ and get qualified for the airdrops.

1/ 🧵

This expectation has led to an increased interest in INJ tokens.

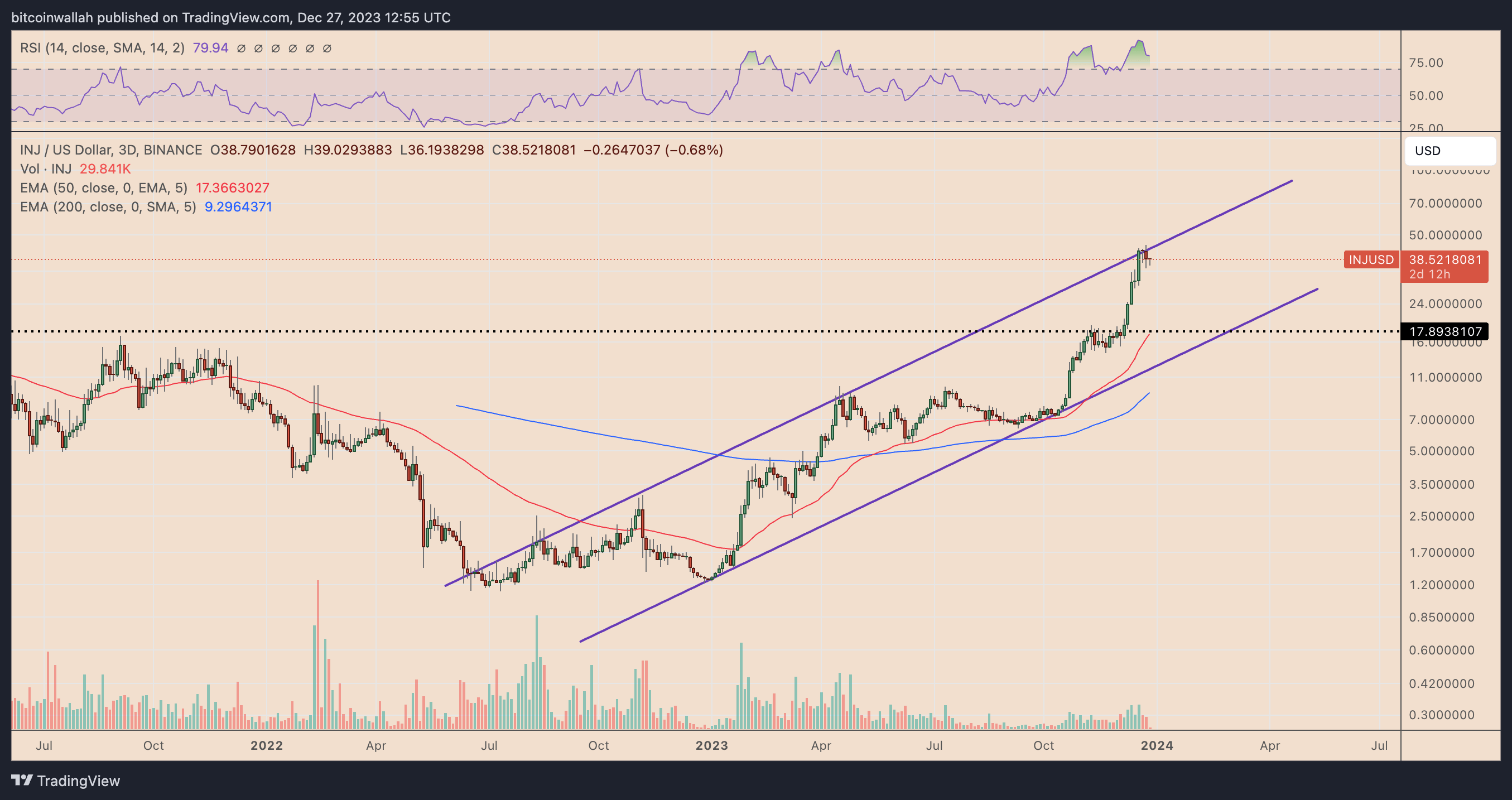

INJ Price Analysis:

Similar to NEAR, INJ carries correction risk due to the overbought condition. The three-day RSI of the asset remained above 70 throughout the month of December. At the same time, the price is near the resistance of a several-month rising trendline around $42, which could lead to the next correction or consolidation phase.

A pullback stemming from the rising trendline resistance could lead investors to witness a decline in INJ towards the trendline support around $18. This level is more than 50% lower than the current price levels and has served as resistance between November 2023 and September 2021.