There Has Been A Significant Rise In Crypto Investment Products Recently.

- Posted on June 21, 2024 2:10 AM

- Cryipto News

- 713 Views

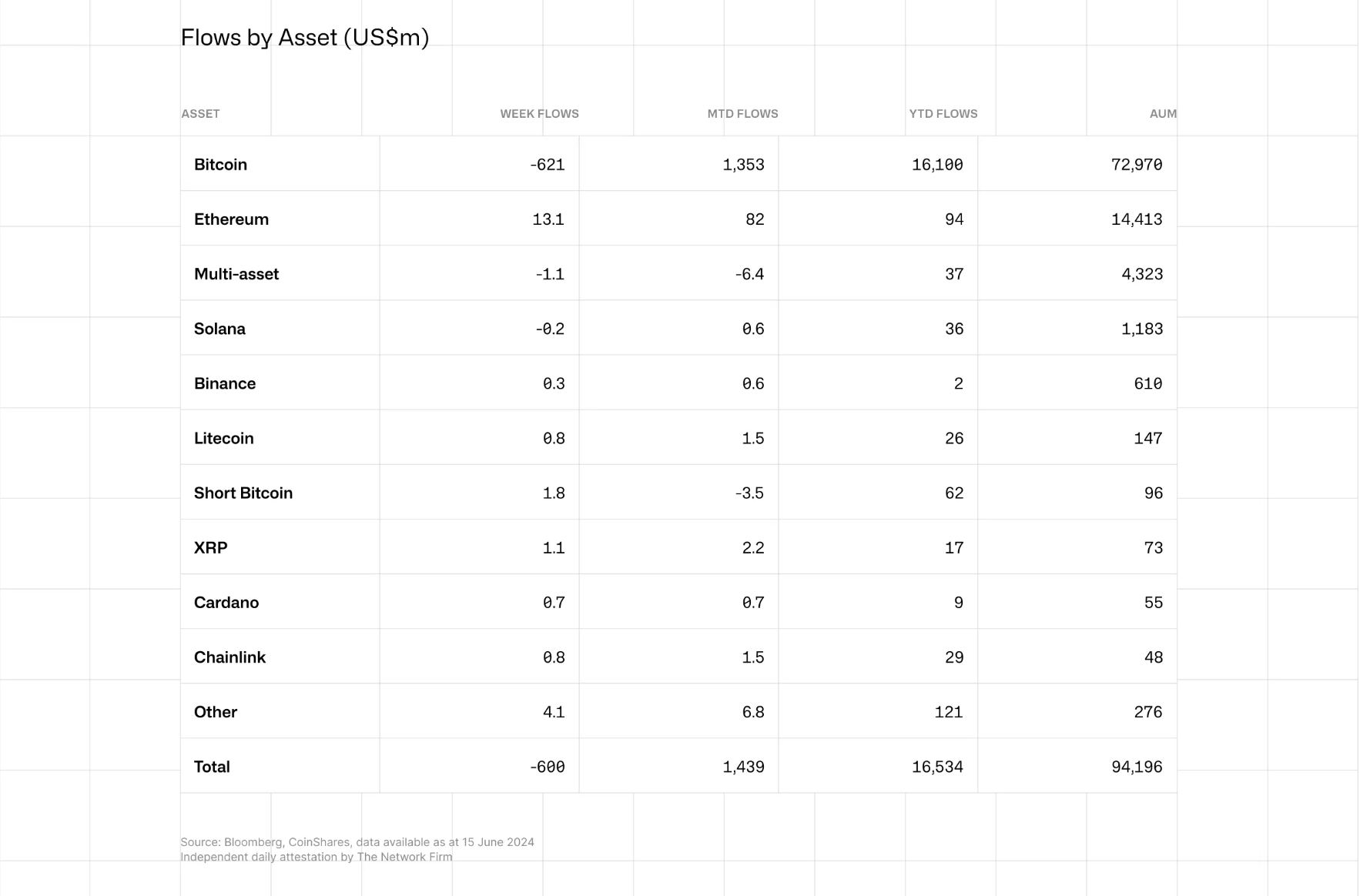

According to CoinShares data, digital asset funds experienced a $600 million outflow during the week of June 14th.

According to a report published on June 17th, digital asset products and funds experienced a $600 million outflow on the digital asset exchange last week. This marked the largest outflow since March 22nd.

CoinShares' "Weekly Digital Asset Fund Flows" report indicated that the outflows were primarily driven by a weekly $621 million outflow from Bitcoin investment vehicles. In contrast, short Bitcoin funds saw an inflow of $1.8 million for the week.

The report suggested that the likely reason for the capital flight from fixed-supply assets like Bitcoin was the Federal Reserve's more hawkish stance than expected. Despite interest rates remaining unchanged last week, Jerome Powell, speaking to the press, indicated that interest rates could remain high for longer than expected.

Meanwhile, altcoins attracted investments.

Last week, Ether (ETH) investment products saw inflows of $13.2 million, LIDO investment products received $2 million, and XRP (XRP) investment products attracted $1.1 million, showing strong overall performance.

Additionally, other investment products such as BNB (BNB), Litecoin (LTC), Cardano (ADA), and Chainlink (LINK) also saw small weekly inflows.

However, these inflows into altcoins were unable to halt the outflow and selling pressure that caused the total assets under management in the digital asset market to decline from $100 billion to $94 billion over the week.

While the launch of Bitcoin exchange-traded funds (ETFs) in the United States has increased interest, many experts believe that institutional adoption of digital assets is still in its early stages.

Marc Degen, co-founder of Trust Square, stated that institutional adoption of Bitcoin is still in the "amateur league" phase.

Referring to Bitcoin ETFs, Degen shared this view. He emphasized that ETFs have raised between $60 to $70 billion so far, with total globally managed assets reaching $100 billion in early June.

Degen compared these figures with capital inflows into digital asset funds through JPMorgan's flows, placing them in a broader perspective. The banking giant saw $489 billion in net new client inflows in 2023 alone.

One financial institution garnered more capital inflow in a year than the entire Bitcoin investment fund ecosystem through various ETFs, products, and asset trust offers.

Jenny Johnson, CEO of Franklin Templeton, recently echoed similar sentiments, stating that institutional adoption is still in its early stages, predicting a second wave of investment with strong institutional interest and capital distribution.

You can track developments and the latest news in the cryptocurrency markets in real-time on Kriptospot.com.