Did Spot Bitcoin Etfs Succeed After Their Launch?

- Posted on January 20, 2024 10:07 PM

- Cryipto News

- 633 Views

Although Grayscale's spot Bitcoin ETF experienced significant sales, the interest in ETF products remains high.

The launch of Spot Bitcoin ETFs may have triggered cryptocurrency sales, but according to analysts, the first week of ETFs has been highly successful. According to CoinGecko's data, Bitcoin has experienced a decrease of approximately 6.6% since the ETF launch on January 11, dropping from $49,000 to $42,876. This sharp decline mostly occurred in the first two trading days, reaching a low of $41,753.

According to analysts, spot Bitcoin ETFs did not trigger a price increase in Bitcoin during the first week of trading, as expected by prominent investors. However, ETF products have had a successful start.

The volume of spot Bitcoin ETFs met expectations in the first days of trading. 10 funds reached a total volume of $10 billion within the first three trading days. According to Bloomberg ETF analyst Eric Balchunas, spot Bitcoin ETFs have encountered unprecedented volume since the launch day. The analyst stated that the total volume of all 500 ETFs launched in 2023 has reached $450 million so far. This represents 2,100% less volume compared to spot Bitcoin ETFs.

Balchunas shared on X, "Gaining volume is difficult. Volume needs to naturally occur in the market, and that's why it cannot be faked. This situation gives ETFs a lasting strength." Most of the transactions came from GBTC, accounting for half of the total volume in the first three days.

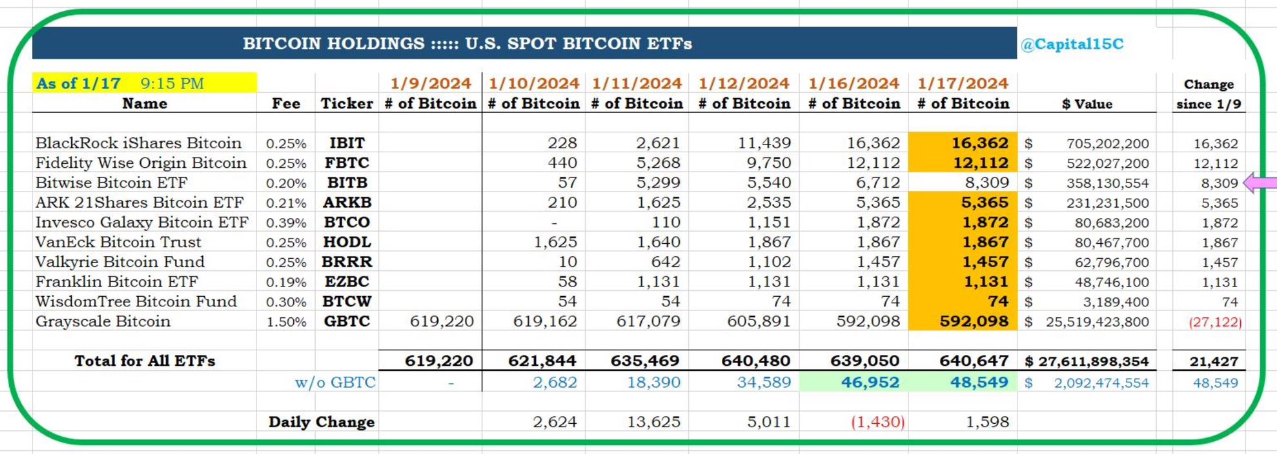

GBTC faced significant selling pressure after the ETF launch, with a total outflow of $1.2 billion in three days. While GBTC was selling BTC, other companies were buying. According to Capital15C, a Bitcoin investor on X, GBTC sold 27,122 BTC in the first four days after the launch. However, other ETF issuers, including BlackRock, Fidelity, and ARK, purchased over 40,000 BTC. BlackRock's IBIT product increased its assets from 2,621 BTC on January 11 to 25,067 BTC on January 17.

According to data, spot ETFs, which currently hold 3.32% of the 19.6 million BTC currently in circulation, have become a significant player in the cryptocurrency market.

The launch of spot Bitcoin ETFs was considered a major development by many. However, some analysts expressed expectations for more pressure from the futures market.

Matthew Sigel, Head of Digital Assets Research at VanEck, suggested that the recent correction might be due to recent sales by BTC miners.

According to Standard Chartered, spot Bitcoin ETFs have the potential to attract about $50-100 million in inflows by 2024. The company hopes that the asset's price will reach $200,000 by the end of 2025.

You can follow real-time developments and the latest news in the cryptocurrency markets on Kriptospot.com.