Spot Bitcoin Etfs See Largest Inflow In The Last 5 Weeks

- Posted on July 19, 2024 8:59 AM

- Cryptocurrency Exchanges News

- 677 Views

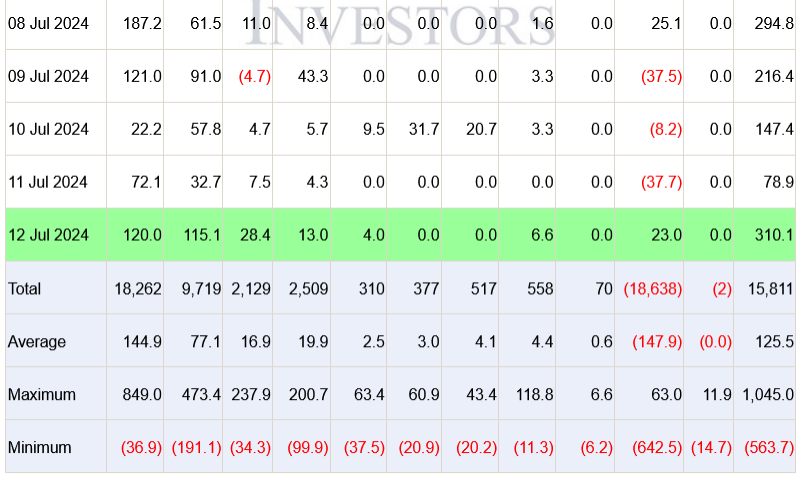

BlackRock and Fidelity's Bitcoin ETFs experienced the largest capital inflow in the past five weeks, with $310 million in new investments. During the same period, Grayscale recorded a rare inflow day with $23 million.

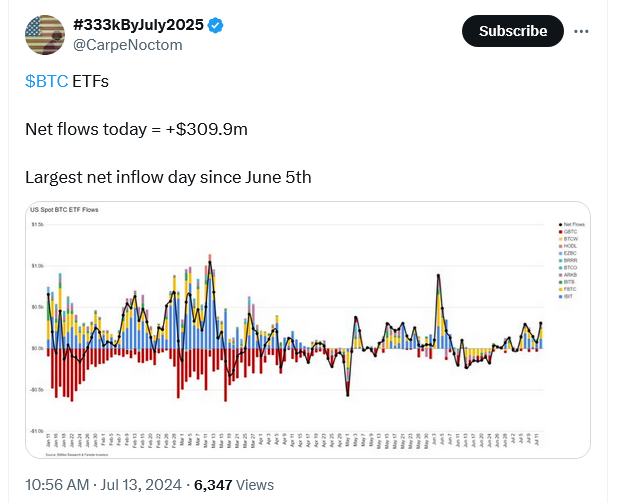

Spot Bitcoin ETFs based in the United States saw their strongest performance since June 5, with over $310 million in inflows on July 12.

According to data from Farside Investors, BlackRock's iShares Bitcoin Trust (IBIT) led with $120 million in inflows, followed by Fidelity's Wise Origin Bitcoin Fund (FBTC) with $115.1 million.

The Bitwise Bitcoin ETF secured the third spot with $28.4 million, while the Grayscale Bitcoin Trust (GBTC) saw a rare inflow day with $23 million.

The VanEck Bitcoin Trust ETF and Invesco Galaxy Bitcoin ETF added $6 million and $4 million, respectively.

However, the spot Bitcoin ETFs issued by Hashdex, Franklin Templeton Valkyrie, and WisdomTree did not record any inflows during the day.

On the day when spot Bitcoin ETF issuers experienced their largest inflow since June 5, a total of $488.1 million flowed in.

Friday's calculations show that spot Bitcoin ETF issuers have secured a total inflow of $1.04 billion for the week.

Spot Bitcoin ETFs have seen a total net inflow of $15.8 billion since their release, which has been just over six months. This figure includes more than $18.6 billion in outflows from Grayscale’s Bitcoin product, which was approved by the U.S. securities regulator in January.

Meanwhile, despite being the only spot Bitcoin ETF with net outflows, Hashdex Bitcoin ETF (DEFI) has experienced a relatively small outflow of $2 million.

According to CoinGecko, Bitcoin (BTC) has gained 1.1% in the last 24 hours and is currently trading at $57,858. However, BTC has dropped about 15% over the past month and remains over 21% below its all-time high.

According to Nate Geraci, President of The ETF Store, some Bitcoin ETF issuers are planning to launch spot Ether (ETH) ETFs as early as next week. These issuers are now waiting for the SEC to approve their amended S-1 registration statements following initial feedback received last month.

For the latest developments and news in the cryptocurrency market, you can follow Kriptospot.com.