The Memecoin Craze Disrupts Bitcoin's Halving Cycle.

- Posted on April 3, 2024 12:18 AM

- Cryipto News

- 835 Views

Experts state that liquidity flowing directly from Bitcoin to meme coins has created a "peculiar" bull market.

Crypto industry analysts suggest that the current bull market, following Bitcoin's all-time high and the significant interest in meme coins, is being noted as the "strangest" bull market of the current Bitcoin halving cycle.

On April 1st, Chainlink community liaison Zach Rynes, in a message to his followers, remarked, "this bull market was strange."

Historically, bull runs typically saw liquidity flow to Bitcoin before transitioning to Ethereum and other high-cap cryptocurrencies.

However, Rynes pointed out that the market is "skipping a few steps we've seen in previous cycles," with flows going directly from BTC to meme coins, which he noted as "a bit unusual."

The total value of the meme coin market reached $70 billion as of April 1st. Behind this surge are pumps in old meme coins like Pepe and Bonk, as well as newly launched tokens such as 'dogwifhat' (WIF) and Book of Meme (BOME) on the Solana-based platform.

Coinbase's layer-2 network, Base, has become a hub for meme coin speculation. Particularly, the recently launched DEGEN token on Base saw a remarkable 2,800% increase last month. DEGEN stands out as an unofficial meme coin distributed to the community on the decentralized social network Farcaster.

Rynes noted that fundamentals are currently playing a limited role in the market, stating, "Some individual money is entering the market, but it's nowhere near the levels we've seen before. Right now, we're in an attention economy based on specific narratives."

Ethereum educator Anthony Sassano echoed similar sentiments, calling this the weirdest bull market crypto has experienced. Sassano emphasized that the market surge is driven by crypto natives and represents isolated sector movements driven by speculative capital.

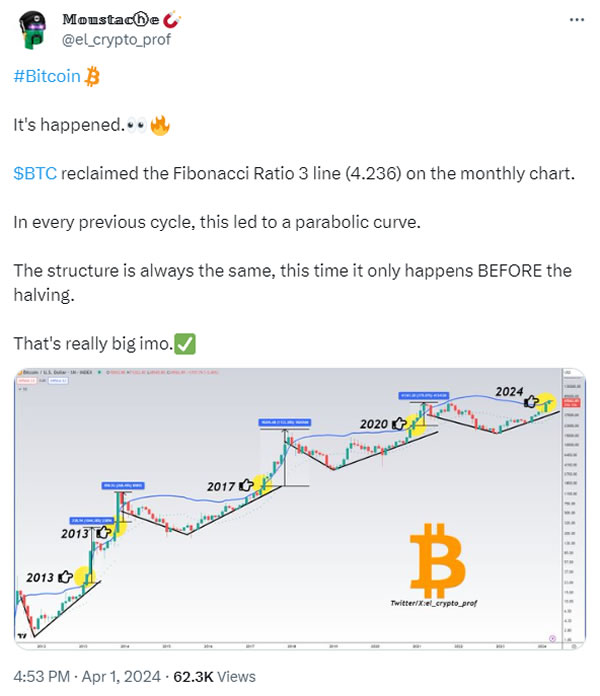

Another notable aspect of this cycle is Bitcoin reaching its all-time high before the halving. In previous cycles, Bitcoin typically peaked about a year after the halving. However, this time, Bitcoin hit $73,734 on March 14th, just 18 days before the halving on April 20th. Analysts had predicted the end of a pre-halving pullback. Technical analyst Moustache noted that BTC reclaimed a significant Fibonacci level before this halving, indicating a unique market dynamic.

You can follow the latest developments and news in the cryptocurrency markets in real-time on Kriptospot.com.