This Defi Altcoin Dropped Over 40%! What's The Reason?

- Posted on November 20, 2023 1:11 AM

- Cryipto News

- 546 Views

Yearn.Finance's YFI token experienced a significant rise in November, but following this increase, it plummeted by over 43% in just five hours.

Yearn.Finance's governance token, YFI, experienced a significant surge of around 170% in early November, but on November 18, it saw a drop of over 43% within just five hours. This sudden decline led to speculations about a potential exit scam.

According to CoinMarketCap data, during this drop, the asset lost $300 million in market value. The asset is currently trading at $9,149, significantly lower than its recent price of $14,185. The token's performance data for the last 30 days still indicates an overall increase of 83%.

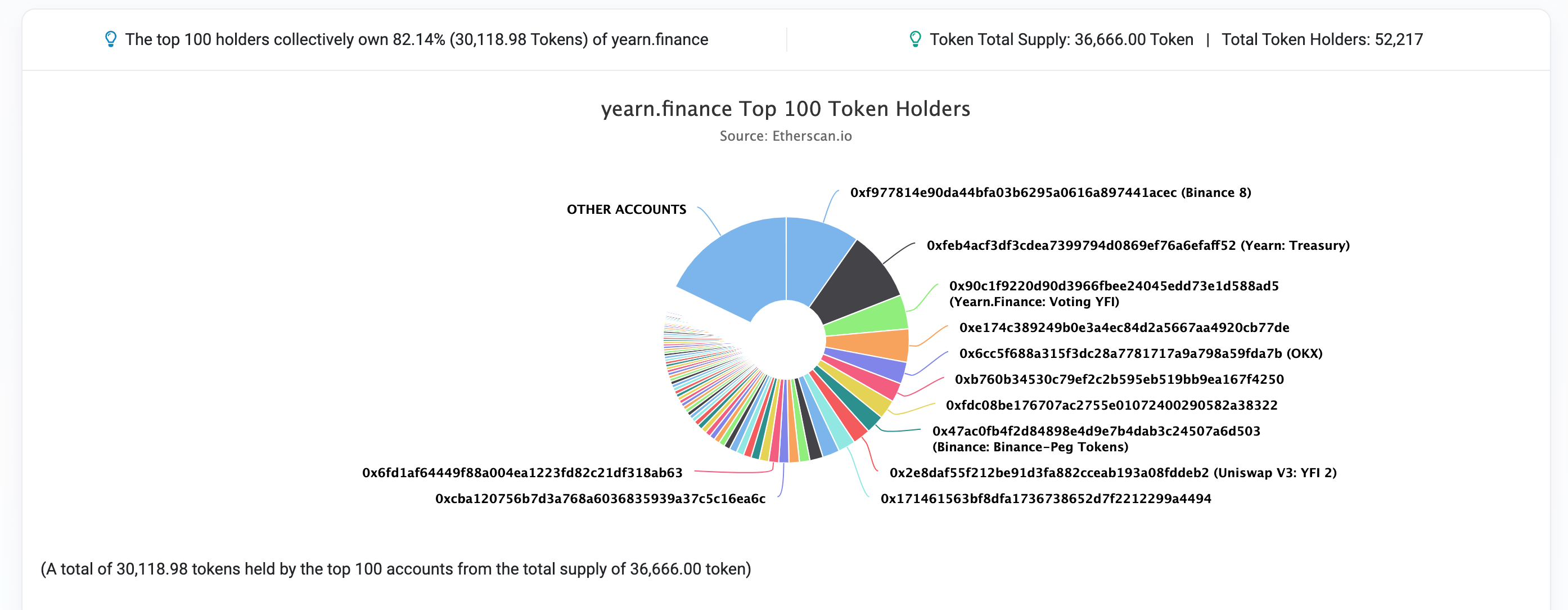

These sales created an atmosphere of fear, uncertainty, and doubt (FUD) within the community. Some users claimed that 50% of the token's supply is held in 10 wallets controlled by developers. Etherscan data suggested that some of these wallet owners might be crypto exchanges.