Tron Network Surpasses Ethereum In Daily Revenue

- Posted on July 31, 2024 11:03 PM

- Cryipto News

- 816 Views

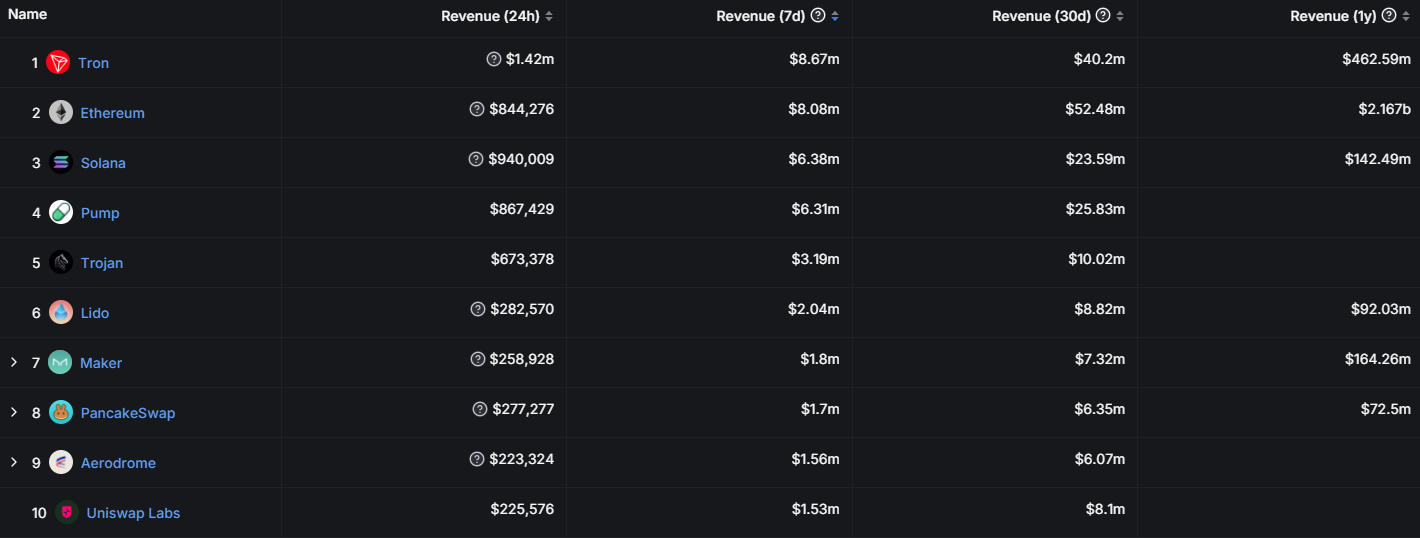

Since July 23, Tron has managed to surpass Ethereum in terms of revenue. In the last 24 hours, Tron generated $1.42 million in revenue compared to Ethereum's $844,276.

As of July 23, Tron has managed to outpace Ethereum in revenue, despite Ethereum's recent spotlight with the release of spot ETFs.

According to DefiLlama data, Tron generated $1.42 million in revenue over the last 24 hours, while Ethereum earned $844,276 during the same period.

Despite spot Ether ETFs contributing $2.2 billion in inflows, Ethereum's revenue was approximately $600,000 less than Tron's in the past seven days, as reported by CoinShares on July 30.

Revenue Comparisons

Since July 23, Tron has taken the lead in weekly revenue, with $8.67 million compared to Ethereum's $8.08 million.

In third place is Solana, which, despite surpassing Ethereum's 24-hour revenue by $940,009, produced $6.38 million over the past seven days, showing a lower performance.

Over a 30-day period, Ethereum remains in the top spot with $52.48 million in revenue, followed by Tron with $40.2 million and Solana with $25.83 million.

How Tron Surpassed Ethereum

On July 6, Tron founder Justin Sun announced that the team is developing a gas-free stablecoin solution for peer-to-peer transfers. Sun stated that the fees would be "entirely covered by the stablecoins themselves" and that they plan to integrate this solution into the Tron network in Q4 of 2024.

Sun also mentioned plans to integrate the stablecoin with Ethereum and other public chains compatible with the Ethereum Virtual Machine.

Decrease in Deposits

According to DefiLlama data, the total value locked (TVL) in the Tron network dropped to $7.5 billion on June 26, the lowest level in the past six months, indicating that investors are pulling funds from the ecosystem.

On June 27, Tron's (TRX) token performed better than Solana's (SOL) token, recording a 9.5% increase on a monthly basis. Sun transferred 173.8 million TRX worth $21.4 million to a Binance address.

During this period, 75% of Tron's total network deposits were concentrated in the decentralized application JustLend, which experienced a 15% decline in assets held over 30 days.

Stay updated with the latest developments and news in the cryptocurrency market at Kriptospot.com.