Turkish Lira Pairs Reached Record Levels On The Binance Exchange In September 2023.

- Posted on November 11, 2023 2:09 AM

- Cryptocurrency Exchanges News

- 675 Views

At the beginning of September, the Turkish Lira reached a record level, constituting 75% of the total fiat currency volume, influenced by new cryptocurrency investors entering the Turkish market.

According to a study conducted by the crypto exchange, the Turkish Lira (TRY) became the dominant fiat currency pair on Binance in September.

Despite being the fourth in terms of trading volume after the United States, India, and the United Kingdom, Turkey accounted for 75% of the total fiat currency volume at the beginning of September.

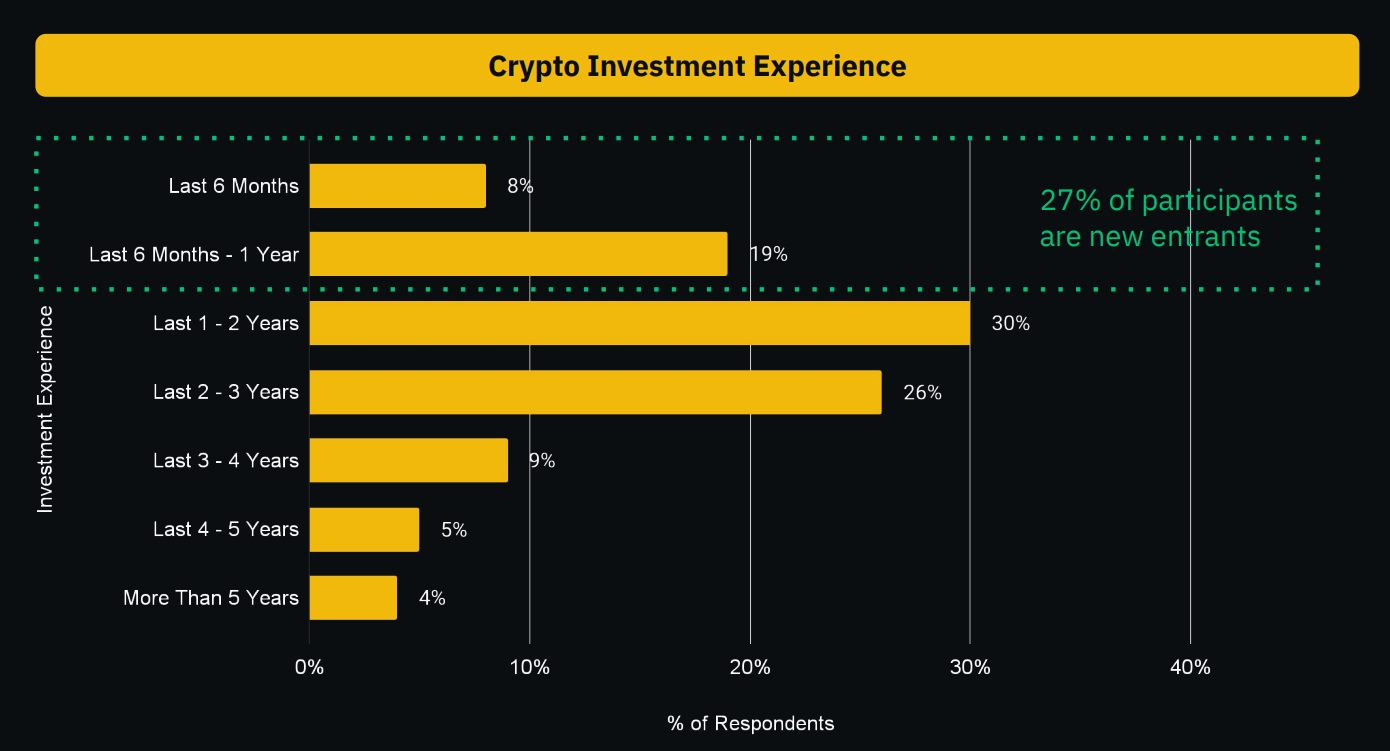

This surge in TRY pairs is attributed to the recent influx of cryptocurrency investors into the Turkish market. Among those surveyed in Binance's research, 27% reported starting their crypto journey in the past year, with 8% joining in the last six months.

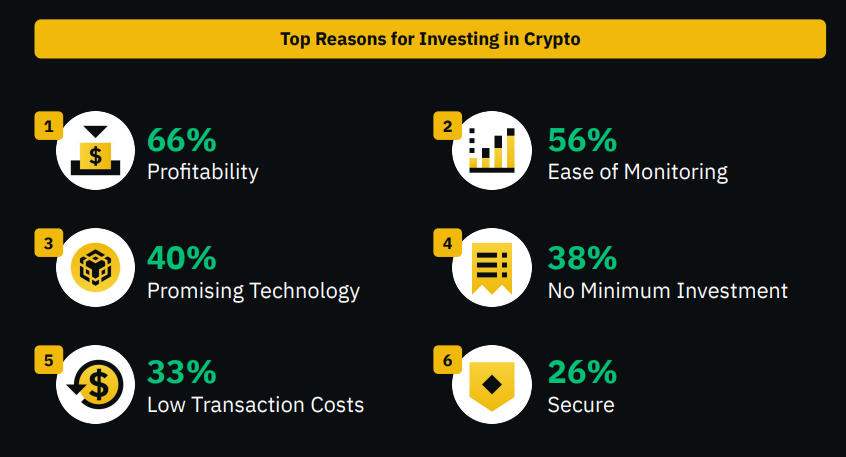

Many investors in Turkey hold approximately $175 worth of cryptocurrency (equivalent to 5,000 TL) and predominantly prefer real estate investments. The profitability factor is a significant driver of Turkey's interest in crypto. Other factors attracting investors include ease of monitoring, no minimum entry amount, and low transaction costs. However, the associated risks with crypto lead many Turkish investors to steer clear of cryptocurrency investments.

Over the past three years, with the adoption rate of cryptocurrencies rising from 16% to 40%, Turkey has climbed to the 12th position in the Chainalysis 2023 Global Crypto Adoption Index. Additionally, Turkey has been one of the countries that accepted humanitarian aid in the form of cryptocurrency during the 2023 earthquake.

As the adoption of cryptocurrencies continues at a rapid pace in the country, there are reports that Turkey is preparing new regulations on crypto assets to be removed from the Financial Action Task Force's (FATF) "grey list."

When FATF placed Turkey on the grey list in 2021, Finance Minister Mehmet Şimşek stated that Turkey complied with all but one of the 40 standards set by FATF, specifically related to cryptocurrencies.