Experts Discuss: The Possibility Of Bitcoin Retracing To The $45,000 Level.

- Posted on March 16, 2024 9:40 PM

- Cryipto News

- 584 Views

During bull market periods, Bitcoin's value can experience a retracement from its highest to lowest levels by up to 40%.

Analysts suggest that Bitcoin's price could significantly drop yet still maintain its bull market momentum and historical trend.

Despite a 10% decrease in the last 24 hours, the performance of the BTC/USD pair paints a still optimistic picture, indicating that even in the face of a sharp correction, the bull market is expected to continue.

There's speculation that BTC's price could retract by up to 40%. Market participants have long agreed on Bitcoin's likelihood to continue its classic upward trajectory, reinforcing the current bull run's robustness.

Data implies that even if there's a deeper correction from the current levels around $68,000, Bitcoin's bullish market trend seems likely to persist.

A trader known as Bags, on March 15th, shared a series of comments on the X platform (formerly known as Twitter), analyzing Bitcoin's price movements during past halving periods.

Comparing price movements during previous halving cycles, Bags noted significant price drops of around 40% before each halving event, followed by price discovery phases.

Bags calculated Bitcoin's potential downward range from the peak to be around $45,500, representing a 38% decrease from the $73,500 level.

When asked about how investments through spot Bitcoin exchange-traded funds (ETFs) in the United States revitalized the market compared to previous cycles, Bags mentioned that each bull market has its unique catalysts but still couldn't prevent downturns.

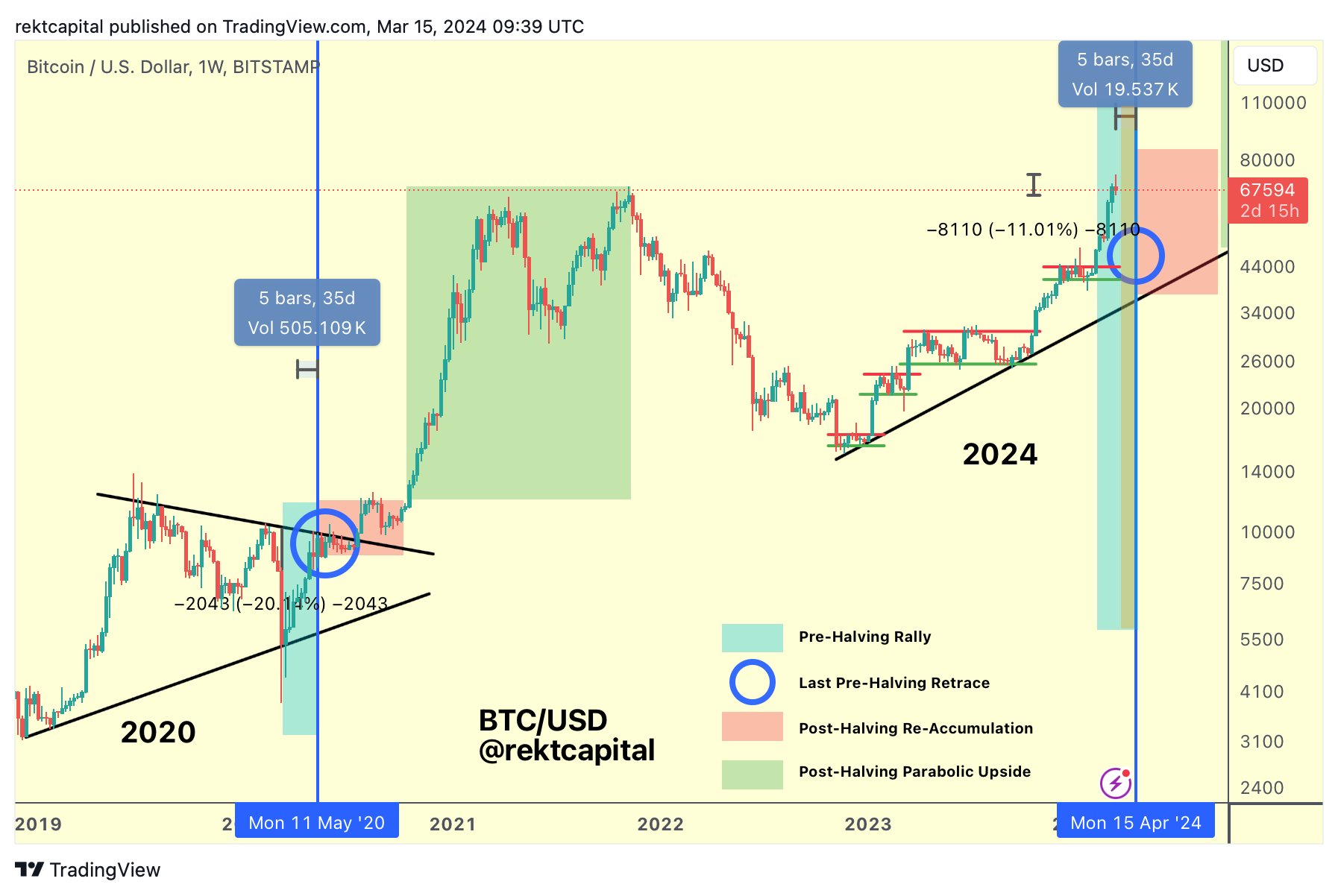

Warnings are being issued about Bitcoin nearing a "dangerous zone." Additionally, popular trader and analyst Rekt Capital is monitoring price performance related to the halving.

Despite Bitcoin reaching an all-time high before the 2024 halving, the timing is argued to represent a classic bull market scenario.

In a chart shared by Rekt Capital, this year is compared to the behaviors seen in the last halving year of 2020.

"However, Bitcoin is on the verge of transitioning from the 'Pre-Halving Rally' phase to the 'Pre-Halving Pullback' phase (indicated by orange and dark blue circles)."

In another post, Rekt warned that BTC/USD is entering the riskiest phase of the pre-halving period, which he termed as a "danger zone."

"Historically, Bitcoin has experienced pullbacks 14-28 days before the halving event," he said.

You can stay up-to-date with developments and the latest news in the cryptocurrency markets by following Kriptospot.com in real-time.