Weak Performance Seen In Bitcoin In January.

- Posted on February 2, 2024 12:38 AM

- Cryipto News

- 560 Views

Bitcoin failed to inspire investors in February.

Bitcoin made efforts to recover its losses on February 1st after a failed monthly closing.

Bitcoin showed a modest increase during the ETF month. According to the provided data, BTC/USD pair on the Bitstamp exchange witnessed a $1000 bounce from the $41,869 low level. Bitcoin only saw a 0.6% increase in the first month of 2024.

Bitcoin, after experiencing a 20% drop from its all-time high of $49,000 over the past two years, has been struggling to recover its losses. As February began, there was a trend towards new lows.

Material Indicators addressed negative cues in its update. In one section, it stated, "Monthly charts don't necessarily mean the price will drop to a lower level this month. However, unless the new #TradingSignal is invalidated, it indicates that the price won't reach a new high this month."

"Furthermore, I would be surprised if Bitcoin does not test the support level of $38,500 by the end of the month," it continued.

New ⬇️ signals from Trend Precognition on the #BTC and #ETH Monthly charts doesn't necessarily mean price will make a lower low this month, but it does indicate that price will not make a new high this month unless the new #TradingSignals invalidate. That said, I'd be surprised… https://t.co/1II6881Bij

— Material Indicators (@MI_Algos) February 1, 2024

$38,500 represents the bottom point of Bitcoin's 20% retracement, indicating the lowest level of January.

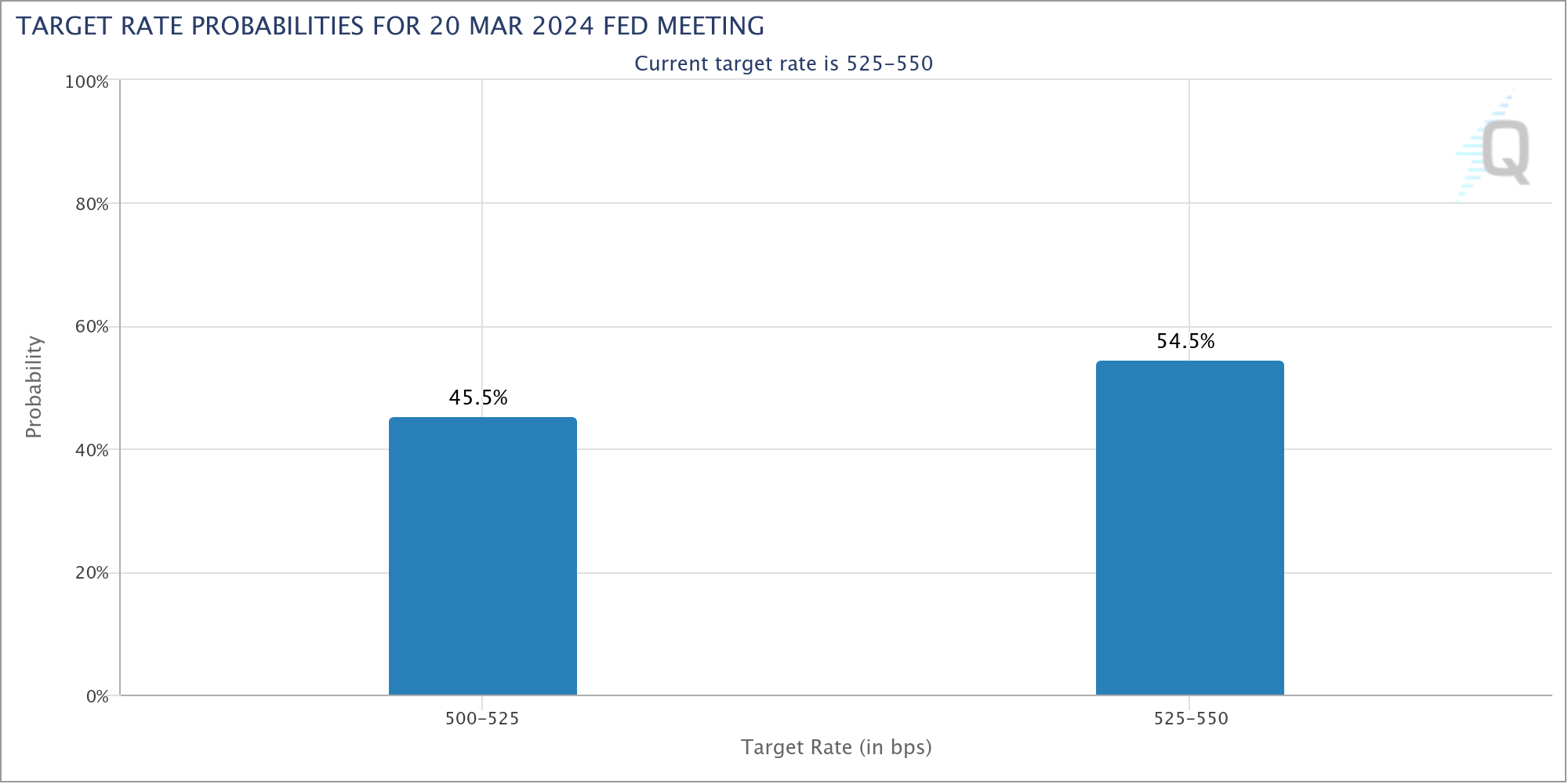

While the Federal Reserve kept interest rates steady as expected, it aimed to curb speculation about interest rate cuts in the first half of the year. This move is eagerly awaited by investors due to the potential for monetary expansion to increase liquidity conditions.

In the official press release, it was stated, "The Committee will carefully evaluate incoming data and the evolving economic outlook when considering adjustments to the target range for the federal funds rate."

"The Committee does not expect to lower interest rates until there is further confidence that inflation is sustainably moving towards 2%."

According to data obtained from CME Group's FedWatch Tool, at the time of writing, the probability of a Fed rate cut in March is shown to be 45%.

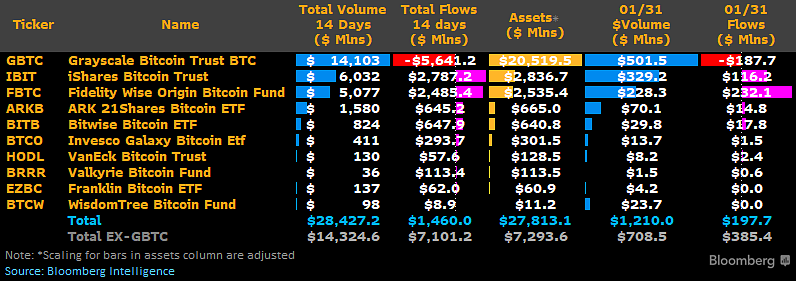

GBTC outflows were approximately around 6,000 BTC. According to data from the crypto company Arkham, there was an outflow of 6,200 BTC from GBTC on the first day of February.

While these figures align with recent trends, they are significantly below the daily 25,000 BTC seen after the approval of the ETF.

Today's #Bitcoin Sent to out by $GBTC/Grayscale comes out to be ~6.2K $BTC or ~$270M worth.

— Daan Crypto Trades (@DaanCrypto) February 1, 2024

Slightly down from yesterday. This one took a while to come in as there was no block mined for nearly an entire hour. https://t.co/zIrTRHOLqp pic.twitter.com/o7pfU02lzQ

According to data obtained from Bloomberg analyst, it was determined that the inflows into spot Bitcoin ETFs reached $200 million on January 31st. Analyst James Seyffart shared the data, also mentioning that "since the launch, the total net inflow has reached $1.46 billion."