What Happened In The Crypto Market Today?

- Posted on July 31, 2024 11:37 PM

- Cryipto News

- 759 Views

Details on Bitcoin prices, blockchain developments, DeFi, NFTs, Web3, and current trends and events affecting crypto regulations are in the rest of our news.

Analysts suggest that the growing national debt of the United States could potentially boost the mass adoption of Bitcoin. According to crypto managers, while the U.S. Securities and Exchange Commission (SEC) may have withdrawn its request for a court to classify tokens like Solana, Cardano, and Polygon as securities, Solana is still believed to be considered a security. Additionally, U.S. regulators have charged BitClout founder Nader Al-Naji with fraud.

U.S. Debt and Bitcoin's Rise

The increase in the U.S. national debt to $35 trillion could contribute to supporting Bitcoin. Analysts believe that the rising debt of the world's largest economy could accelerate Bitcoin's mass adoption. On July 30, the U.S. federal government's debt surpassed $35 trillion for the first time in history, raising concerns about the state of the economy.

Matt Bell, CEO of Turbofish, notes that the increasing U.S. debt could enhance Bitcoin's value and its status as a safe-haven asset. Bell states, "The U.S. national debt surpassing $35 trillion highlights growing concerns about the sustainability of traditional currencies and emphasizes Bitcoin's value. BTC could be a decentralized and deflationary asset that provides protection against currency devaluation."

During periods of fiat currency devaluation, investors typically turn to assets with limited supply, such as Bitcoin and gold. Historically, Bitcoin prices have risen during financial crises. The increasing U.S. debt could push Bitcoin prices to new highs.

Bitfinex analysts suggest that the rising U.S. government spending on debt servicing could make Bitcoin more attractive, potentially serving as a catalyst for the next Bitcoin bull cycle.

SEC's Decision on Solana

On July 30, the U.S. Securities and Exchange Commission (SEC) withdrew its request for a court to decide on the classification of Solana as a security within the Binance lawsuit. However, according to Jake Chervinsky, Chief Legal Officer at crypto-focused venture capital firm Variant Fund, the SEC has not definitively ruled that Solana is not a security.

Chervinsky argues that there is no reason to believe that the SEC has decided that Solana is not a security. He refers to the SEC's intent to modify its complaint regarding "Third-Party Crypto Asset Securities" and notes that the court was not asked to determine whether these tokens are securities.

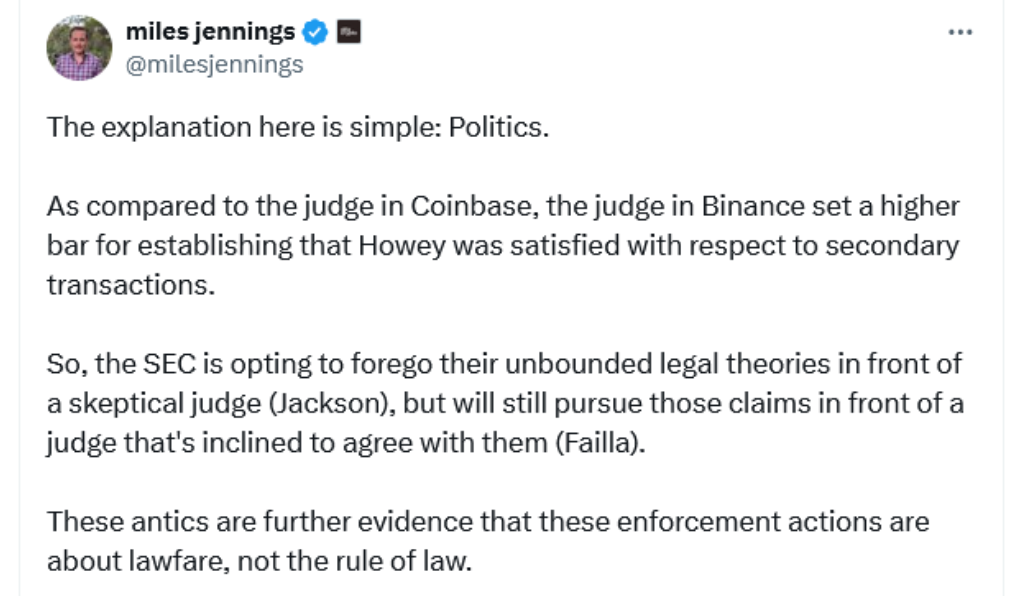

a16z Crypto and Paradigm Comments on the SEC

a16z Crypto’s General Counsel Miles Jennings and Paradigm’s Policy Director Justin Slaughter have expressed similar views regarding the SEC’s classification of tokens as securities.

Slaughter noted that many people are overly focused on this case and argued that it does not mean the SEC has ruled that Solana and other tokens are not securities. He also pointed out that excessive emphasis on the case could be misleading.

Jennings stated that Judge Amy Berman Jackson set a very high bar for the Howey test in the Binance case and that the time and effort the SEC has invested in proving these tokens are securities may not be worth it.

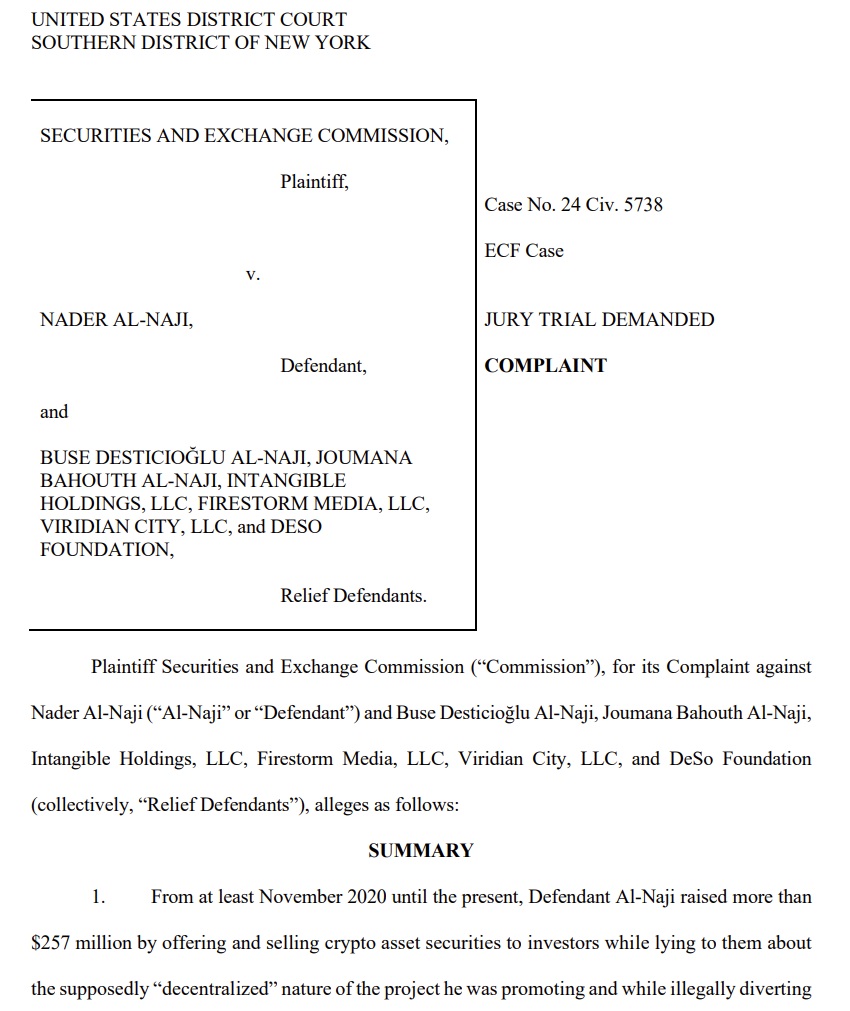

BitClout Founder Accused of Fraud

The U.S. Securities and Exchange Commission (SEC) and the U.S. Attorney’s Office for the Southern District of New York have charged BitClout founder Nader Al-Naji with fraud. According to the SEC’s allegations, Al-Naji sold $257 million worth of unregistered securities through BitClout’s native token, BTCLT, and embezzled some of these funds for personal use, defrauding investors. The complaint claims that Al-Naji spent $7 million of investor funds on luxury goods and monetary gifts for family members.

The securities regulator has also accused Nader Al-Naji of misleadingly promoting the BitClout project.

The complaint states, "Al-Naji attempted to evade federal securities laws and defraud investors by presenting a 'fake' decentralized project, which often confuses regulators and hinders their pursuit."

Stay updated on developments and the latest news in the cryptocurrency market with Kriptospot.com.