In The New Week, Only This Bitcoin Etf Shows A Positive Outlook.

- Posted on April 17, 2024 11:44 PM

- Cryipto News

- 608 Views

Recently, BlackRock's spot Bitcoin ETF, IBIT, attracted significant interest from investors, pulling in $184.5 million in just two days.

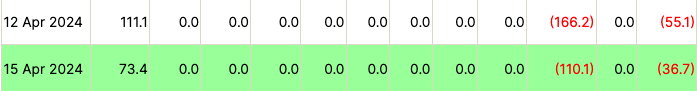

Over the past two days, while all other ETFs experienced zero inflows or lower, BlackRock's Bitcoin exchange-traded fund (ETF) stood out as the only U.S.-based spot Bitcoin fund to attract significant investments. The iShares Bitcoin Trust (IBIT) recorded a net inflow of $73.4 million on April 15, an increase from $111.1 million the previous day. According to data from Farside Investors, the other eight ETFs (excluding those from Grayscale) saw no inflows in the last two days.

However, the inflows into IBIT were not sufficient to surpass the outflows from Grayscale Bitcoin Trust (GBTC), which saw an outflow of $110.1 million on April 15, following an outflow of $166.2 million the day before.

All 10 spot Bitcoin ETFs experienced net outflows on April 14 and 15, with $55.1 million and $36.7 million outflows respectively.

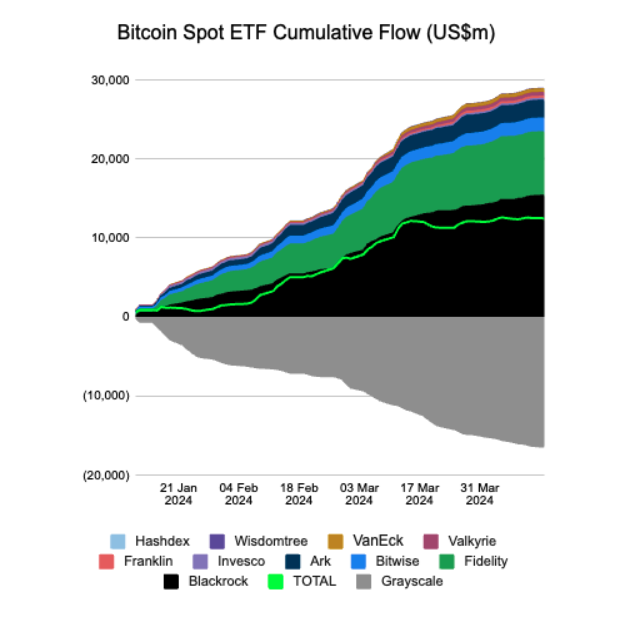

In recent weeks, Bitcoin ETFs in the United States experienced outflows as Bitcoin's price fell 11.6% to $63,410, marking a turbulent weekend for the cryptocurrency.

According to James Butterfill, Head of Research at CoinShares, global Bitcoin investment products saw $110 million in outflows for the week ending April 12. Butterfill highlighted ongoing uncertainties among investors.

He also reported that last week witnessed a total net outflow of $126 million from all crypto investment products, with weekly trading volumes rising from $17 billion to $21 billion.

On April 13, an attack by Iran on Israel triggered a steep drop in Bitcoin's price, plunging to a three-week low of $61,918.

Moreover, the upcoming Bitcoin halving event on April 20, which will cut the issuance rate of new Bitcoins in half, is causing price fluctuations as traders speculate on how it will affect Bitcoin's price movement. This event typically leads to market anticipation and speculation.

Stay updated with the latest developments and news in the cryptocurrency markets at Kriptospot.com.