U.s. Data Supported Bitcoin's Rise

- Posted on May 17, 2024 12:57 AM

- Cryipto News

- 730 Views

Bitcoin finds significant support with increasing expectations of the Federal Reserve (Fed) lowering interest rates.

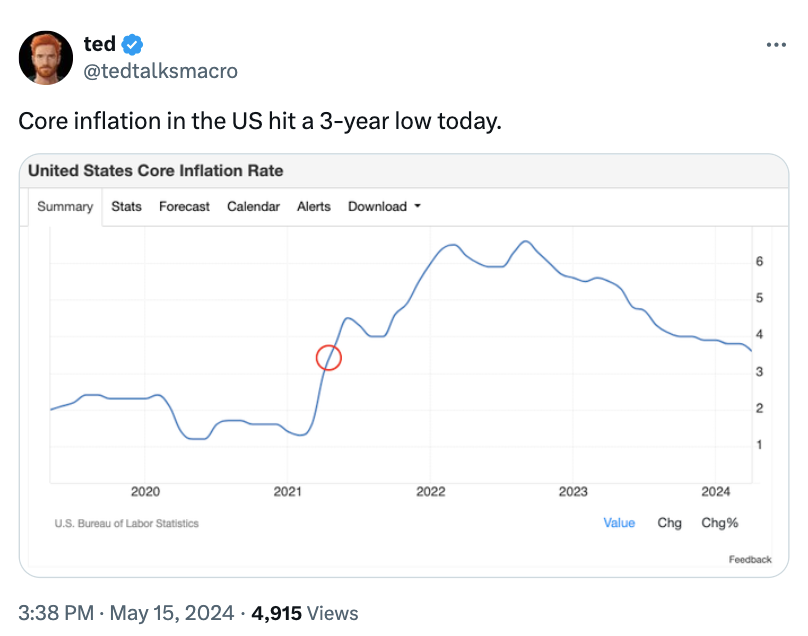

On May 15, Bitcoin (BTC) surpassed $64,000 as core inflation in the United States dropped to its lowest level in three years, contributing to the rise in Bitcoin prices.

CPI Exceeds Expectations, Boosting Bitcoin

Bitcoin prices hit a new peak on May 15, reaching $64,700.

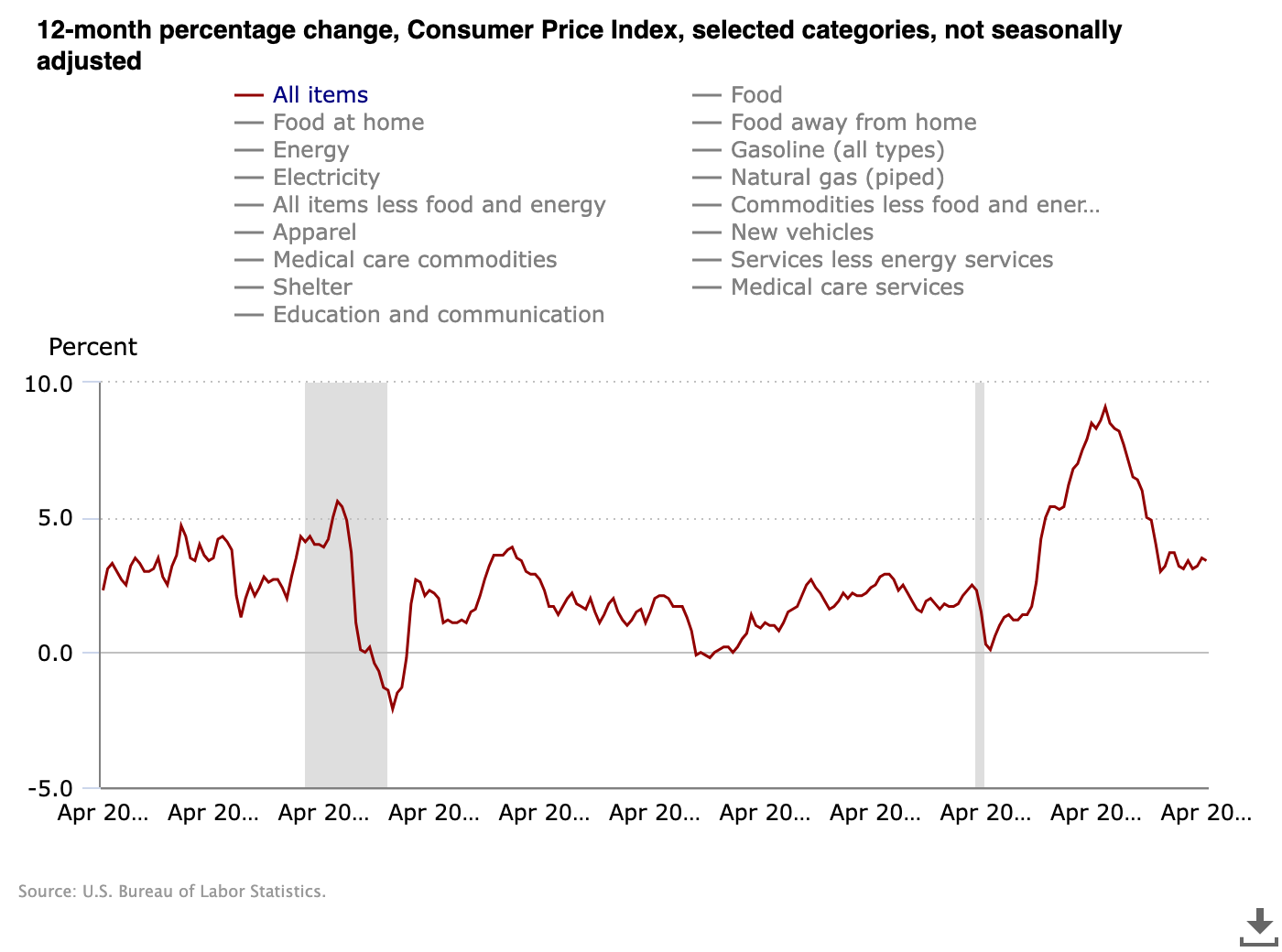

According to data from Cointelegraph Markets Pro and TradingView, the BTC/USD pair rose to $64,700 following the opening of Wall Street. This increase came after the United States Consumer Price Index (CPI) data exceeded expectations.

Gain for Risk Assets

Bitcoin bulls benefited from the gains seen in risk assets as CPI data exceeded expectations. Both the S&P 500 and the Nasdaq Composite Index reached all-time highs with this data.

Inflation Data Provides Support

The monthly CPI for April came in below expectations at 0.3%. This helped alleviate inflation concerns and created a positive atmosphere in the markets, benefiting Bitcoin's value increase.

Thus, core inflation fell to its lowest levels since 2021, increasing expectations for a cut in interest rates.

However, not everyone joined this optimistic sentiment.

The Kobeissi Letter stated, "This marks the first decline in CPI inflation in the past three months. However, yesterday's PPI inflation data showed an increase for the third time on a monthly basis."

"The Fed will remain in wait-and-see mode." Kobeissi referred to the Producer Price Index (PPI) data released the previous day. Federal Reserve Chairman Jerome Powell, maintaining a cautious tone, responded to Reuters when asked about the PPI data, saying, "I wouldn't say hot, I would say mixed."

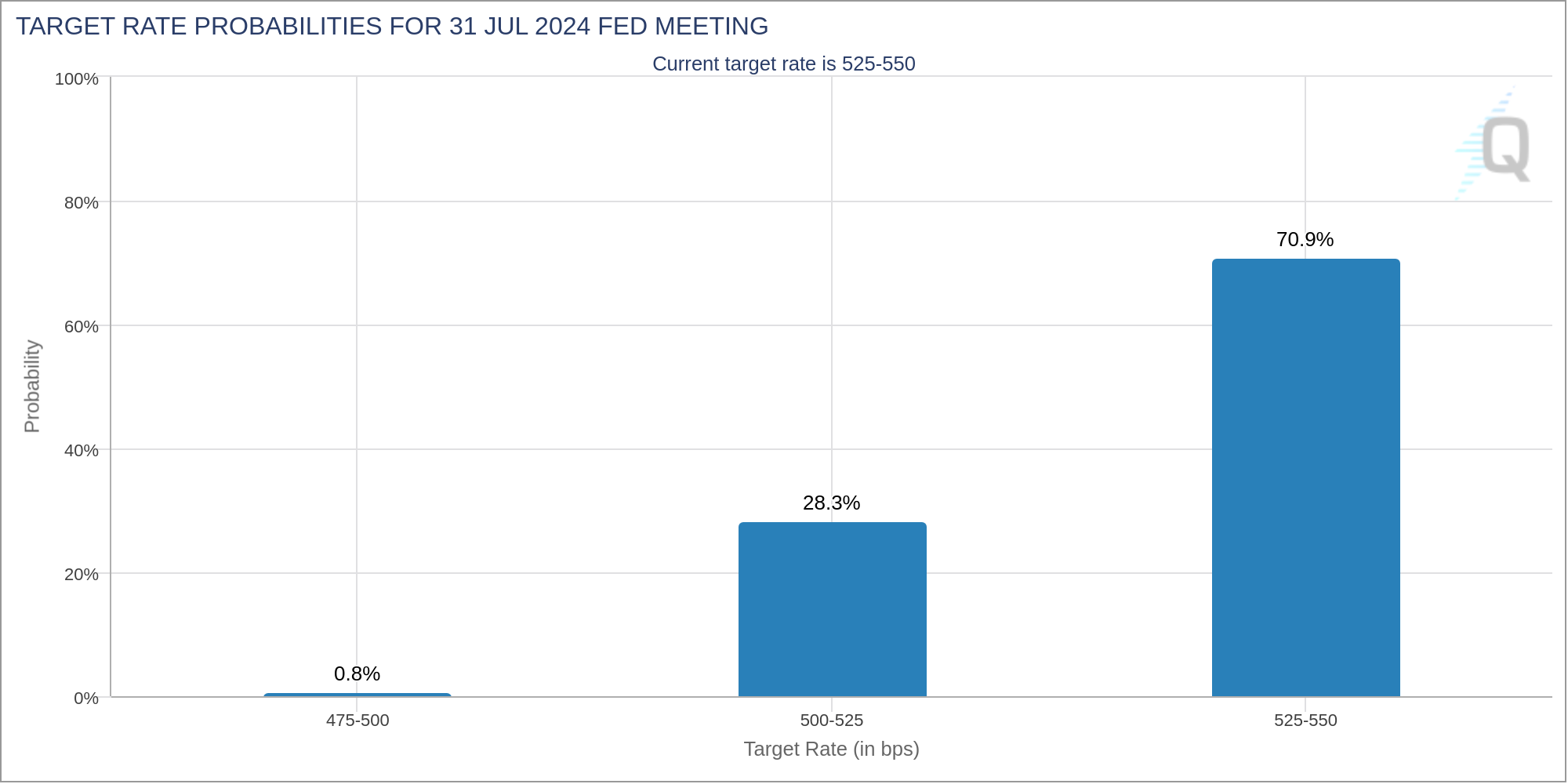

According to data from CME Group's FedWatch Tool, market expectations for near-term interest rate cuts remained largely unchanged during the day, with probabilities standing at 3.1% for June and 28.3% for July.

BTC Support Signals Recovery

Turning back to Bitcoin, the order book dynamics have significantly shifted following the reaction to the CPI data.

Data from CoinGlass, a monitoring source, indicates that liquidity has been consumed to the upside, with a new block forming around $65,000.

BTC's Current State and the Role of Spot Buyers

Popular trader Skew has emphasized the necessity for spot buyers to maintain their pressure in the market. He particularly noted the importance of reclaiming the 200-period exponential moving average (EMA), located at $63,195, as support in 4-hour time frames.

Skew continued, stating: "Ideally, BTC should strengthen from here. To boost market confidence, it still needs to surpass the $65,000 level." This analysis indicates that Bitcoin is at a critical threshold to overcome short-term resistance levels and enter a stronger upward trend.

You can follow the latest developments and news in the cryptocurrency markets instantly on Kriptospot.com.