What Is The Reason For The Decline In Altcoins?

- Posted on June 21, 2024 1:33 AM

- Cryipto News

- 584 Views

Crypto analysts suggest that the recent decline in altcoins could be related to the introduction of spot Bitcoin ETFs into the market.

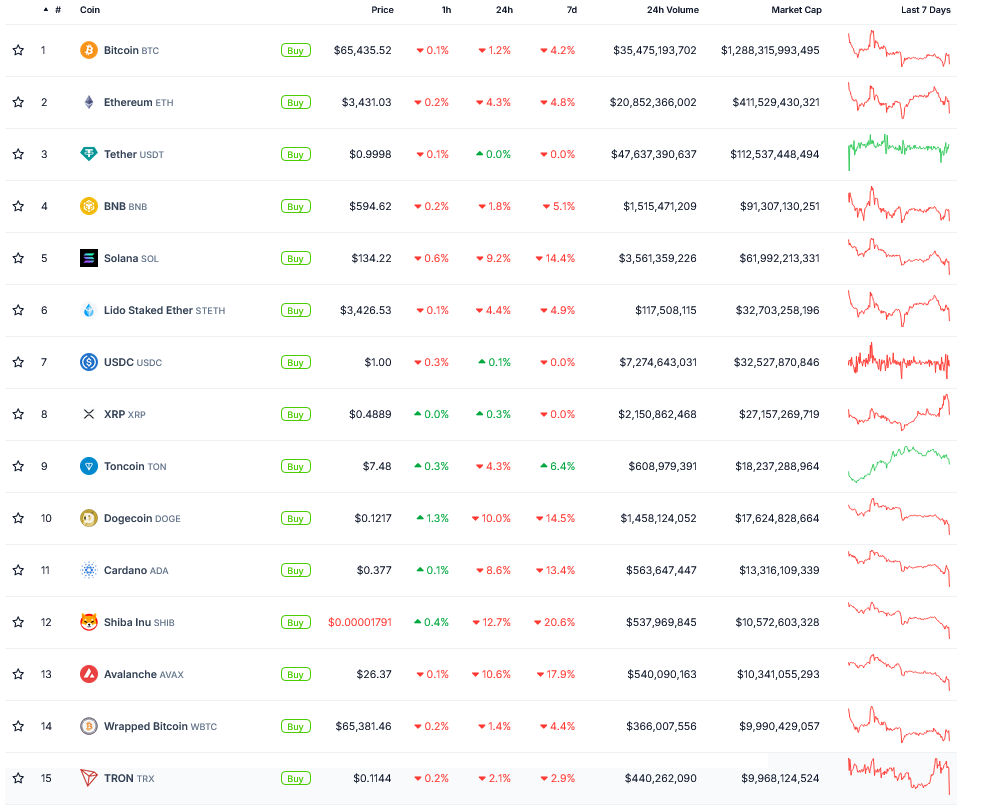

In the last 24 hours, the total market capitalization of cryptocurrencies dropped by 3.5% to $2.46 trillion. According to CoinGecko data, Shiba Inu (SHIB) and Avalanche (AVAX) were among the top 20 altcoins most affected by market value on June 17. SHIB fell by 12.7%, while AVAX declined by 10.6%.

Uniswap (UNI) and Dogecoin (DOGE) experienced double-digit losses. Solana (SOL) decreased by 9.4%, while Ripple (XRP) was the only cryptocurrency to show a modest increase of 0.1%, ending in the green.

Bitcoin (BTC) decreased by 1.3%, and Ether (ETH) fell by 4.4%. BTC's price dropped to 2,150,578 TL, while ETH fell to 116,198 TL.

Henrik Anderrson, Chief Investment Officer at Apollo Crypto, stated that he couldn't pinpoint the exact reason for the market downturn but suggested that the recent waning interest in spot Bitcoin exchange-traded funds (ETFs) may have contributed to it.

"Anderrson noted that while there isn't a clear catalyst, negative flows in BTC ETFs appear to have weakened altcoins, triggering liquidations among leveraged traders in Bitcoin, Ethereum, and Dogecoin," he explained.

According to Farside Investors' data, spot Bitcoin ETFs experienced withdrawals in five out of the last six trading days.

Digital asset firm 10xResearch attributed the recent decline in altcoins to the decrease in spot Bitcoin ETF flows last week. 10xResearch commented, "It was surprising that Bitcoin couldn't rally despite weak inflation data, but the downturn in Ethereum and altcoins could have been anticipated."

While Bitcoin declined, BTC mining shares are on the rise.

A sector analyst mentioned that Bitcoin mining shares have shown strong performance in recent weeks, recovering losses since the halving event in April.

Mitchell Askew, Chief Analyst at Blockware Solutions, mentioned, "Mining shares initially underperformed due to concerns about post-halving profitability."

However, those fears have since been alleviated, and mining shares have stabilized.

Askew highlighted that Valkyrie Bitcoin Miners exchange-traded fund WGMI has increased by approximately 54% since the halving event, indicating a return of market confidence in the mining sector.

You can stay updated on developments and the latest news in cryptocurrency markets at Kriptospot.com.