Binance Reached A New Record In Transaction Volume Within March.

- Posted on April 8, 2024 1:12 AM

- Cryptocurrency Exchanges News

- 851 Views

Binance's spot transaction volumes reached the highest level of the year in March, driven by Bitcoin and Ethereum reaching record levels.

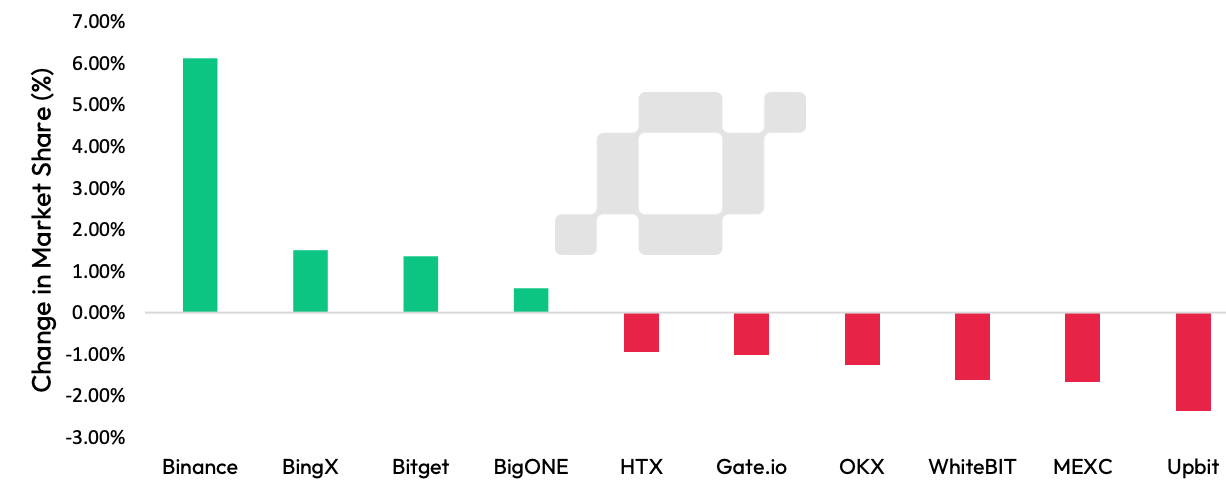

According to a new report by CCData, Binance's spot trading volume reached its highest level since May 2021, following seven consecutive months of growth. The cryptocurrency analysis platform CCData's report dated April 5 states that Binance's spot trading volume surged to $1.12 trillion in March, marking a 121% increase. The report also notes that the exchange's combined market share rose by 1.04% in March to reach 44.1%.

According to CCData's analysis, Binance has recovered after settling its case with the United States Department of Justice and paying a $4.3 billion settlement fine. This has been observed with an 89.7% increase in derivative trading volumes, reaching $2.91 trillion, the highest level since May 2021.

CCData analysts also noted that Binance has seen its biggest gains in the spot markets, increasing its market dominance by 2.3% compared to February. Additionally, the exchange has captured its largest share of spot trading volumes on CEX platforms, accounting for 38.0% since the beginning of the year.

In January of this year, the analysis firm Kaiko reported an increase in Binance's trading volume, with its market share rising to 50% just two months after settling with the US Department of Justice.

Despite regulatory pressures, the exchange claimed to have seen an increase of over 40 million users in 2023. Binance emphasized that this represented approximately a 30% growth compared to the previous year and attributed the expansion to its "core services."

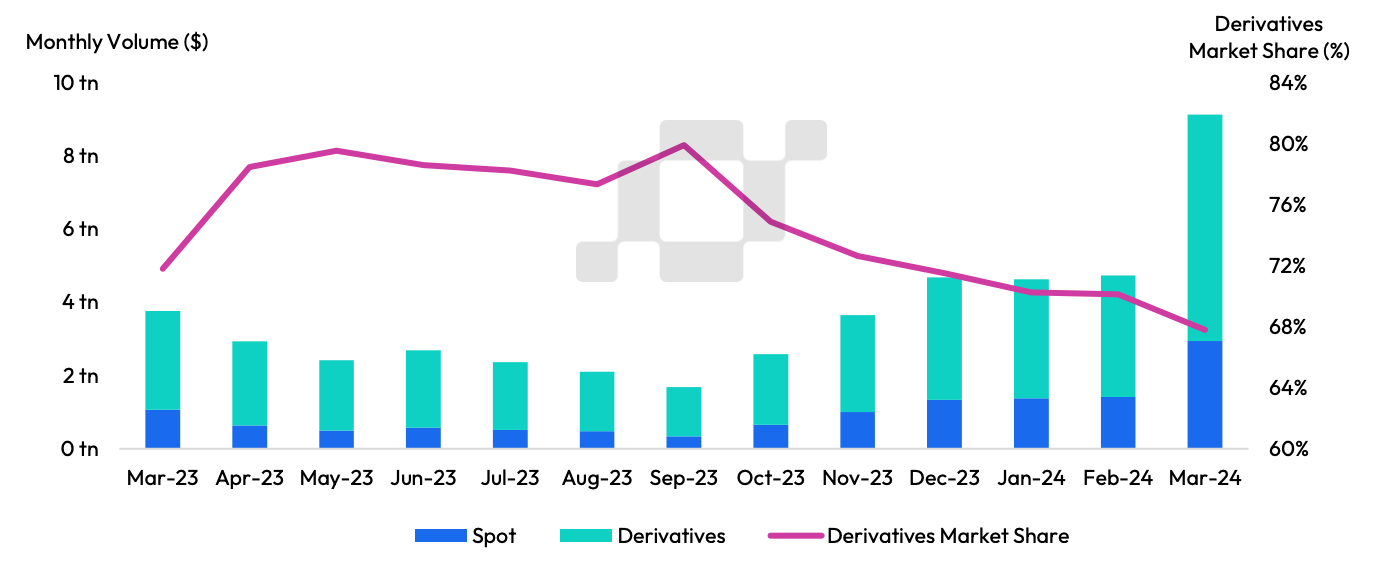

According to CCData's data, the combined spot and derivative trading volume on centralized exchanges (CEX) reached an all-time high of $9.12 trillion in March, rising by 92.9% as traders flooded into the markets.

The trading volume of crypto derivatives on centralized exchanges (CEX) surged by 86.5% to reach $6.18 trillion, equivalent to three times the total market capitalization of all cryptocurrencies.

"This increase came as investors and traders speculated on price movements following Bitcoin's approach to its all-time high in March." The increase in both spot and derivative trading activities coincided with the success of spot Bitcoin ETFs and heightened excitement surrounding the expected halving of BTC supply in April.

This development underscored investors' continued trust in centralized exchanges despite recent failures such as FTX.

You can stay updated on developments and the latest news in the cryptocurrency markets by following Kriptospot.com.