Bitcoin Analyst Planb Says Bull Market Has Begun.

- Posted on March 4, 2024 12:18 AM

- Cryipto News

- 537 Views

Renowned Bitcoin analyst PlanB claims that Bitcoin maintaining the $62,000 level signifies the beginning of a bull market.

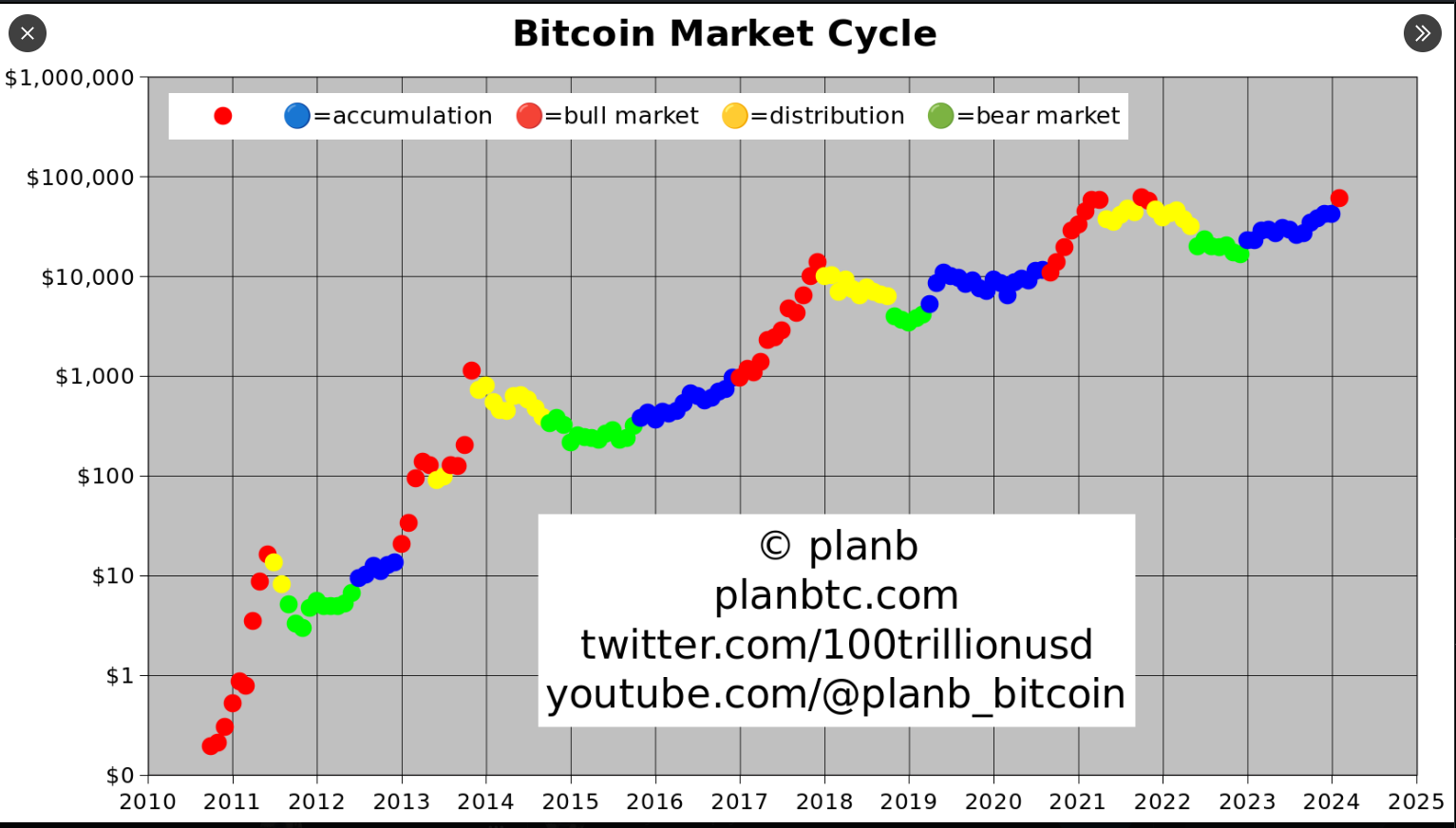

Famous crypto analyst and creator of the stock-to-flow (S2F) model, PlanB, states that the Bitcoin bull market has officially started as of March 1st.

In a post on X, referencing the S2F chart, PlanB mentioned that the period of Bitcoin accumulation and the easy opportunities for purchasing Bitcoin have come to an end.

"The bull market has begun. If history is any indicator, we will experience FOMO (Fear Of Missing Out) over the next 10 months," he said.

The famous analyst's prediction came two days after Bitcoin surpassed the $60,000 level, marking the cryptocurrency's first time reaching this level in over two years.

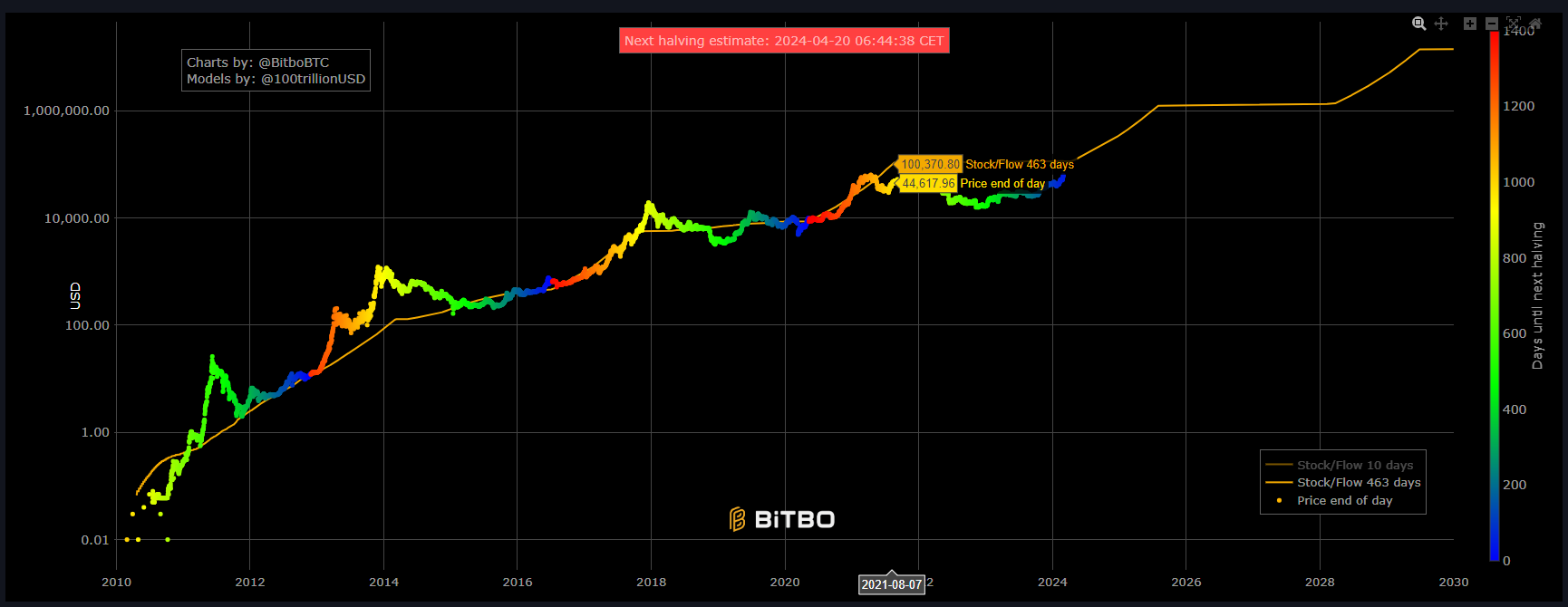

While the S2F model gained popularity during the 2021 bull market, it's not a perfect predictor of Bitcoin's price. The chart indicated that Bitcoin should have surpassed $100,000 in early August 2021, when it was trading around $44,000. Ethereum co-founder Vitalik Buterin also criticized the S2F model for giving investors a "false sense of certainty."

PlanB's predictions are in line with the expectations of other market experts. Vetle Lunde, a senior analyst at K33 Research, notes that Bitcoin typically consolidates after halving but then begins a rally in the following months. Lunde adds, "While there's usually a period of stagnation after halving, each halving has proven to be a strong entry point for the market. We see that 150-400 days after halving, the combined effect of reduced miner selling pressure positively impacts BTC."

The recent approval of spot Bitcoin exchange-traded funds (ETFs) also contributes to increased investor interest in Bitcoin and subsequent price increases.

Following the conversion of Grayscale Bitcoin Trust to an ETF, Bitcoin experienced a 3% correction after $598.9 million worth of BTC was sold on February 29th. Despite these sales, Bitcoin's price recorded an increase of over 22% in the past week according to CoinMarketCap's data.

Excluding Grayscale, nine new spot Bitcoin funds recorded over $2 billion in total daily trading volume for the second consecutive day on February 28th. According to a report by CryptoQuant, an on-chain data analysis firm, these new ETFs represent 75% of new Bitcoin investments since their launch on January 11th.

A research report published by Bitfinex analysts suggests that ETFs have created passive demand for Bitcoin for the first time in its history, independent of price. This could lead to Bitcoin reaching all-time highs by the end of 2024.

The report states, "Our analysis predicts that Bitcoin will reach a price target of between $100,000 and $120,000 by the fourth quarter of 2024, and we anticipate a cycle peak in terms of total cryptocurrency market value in 2025."

Stay updated with the latest developments and news in the cryptocurrency markets with Kriptospot.com.