Bitcoin Exchange Traded Funds (Etfs) Cannot Be Stopped.

- Posted on February 13, 2024 9:40 PM

- Cryipto News

- 700 Views

In the last two trading days, entries into spot Bitcoin ETFs have exceeded miners' production by tenfold.

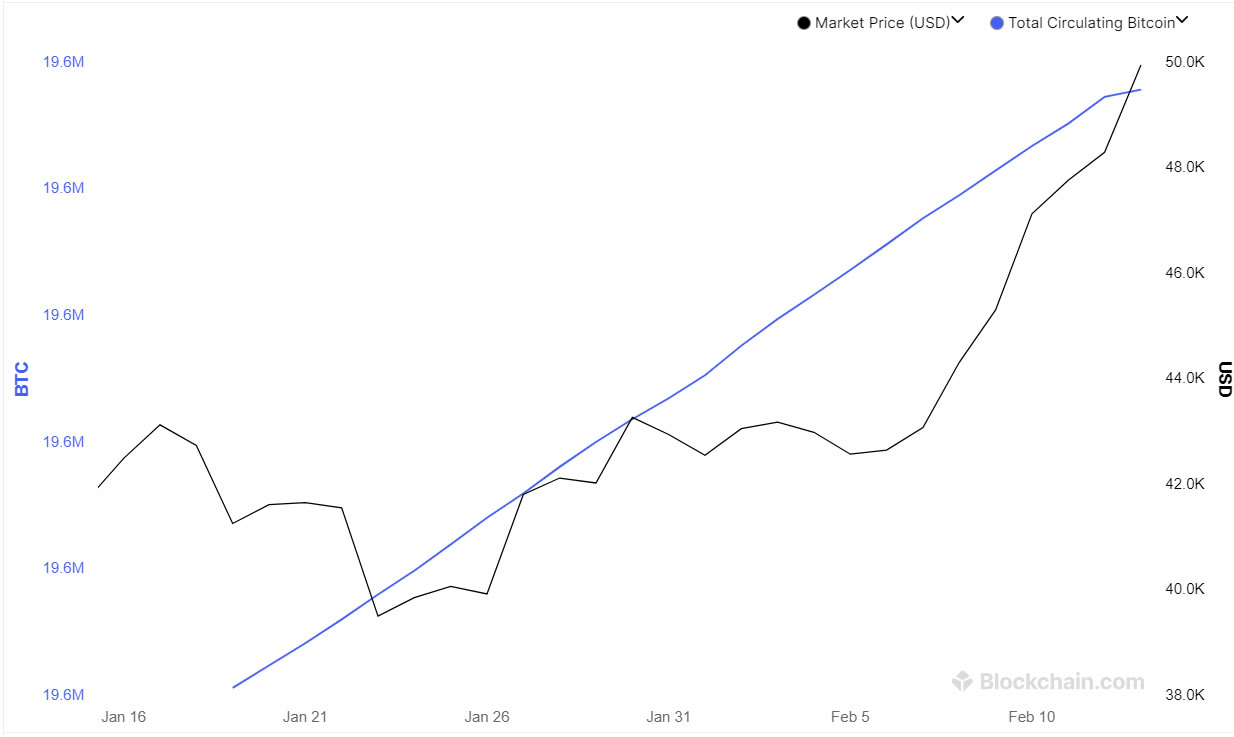

On Monday, spot Bitcoin exchange-traded funds (ETFs) collected ten times more Bitcoin than miners could produce. According to initial data, as of February 12, spot Bitcoin ETFs saw a net inflow of at least $493.4 million worth of 10,280 BTC.

The majority of these inflows came from BlackRock IBIT, which accounted for a $374.7 million entry. Additionally, there was a $151.9 million inflow into the Fidelity FBTC fund and a $40 million inflow into the Ark 21Shares ARKB fund. Although balanced out by outflows from Grayscale GBTC ($95 million) and Invesco BTCO ($20.8 million), the net inflow nearly reached half a billion dollars.

On the same day, according to Blockchain.com, Bitcoin miners produced approximately $51 million worth of 1,059 BTC. This figure represents only 10% of the BTC collected by spot ETFs.

A similar trend was observed on February 9th. Compared to approximately $45 million worth of 980 BTC added through mining, there was an influx of approximately 12,700 BTC or $541.5 million worth of assets into ETFs.

BlackRock led the way with a $250.7 million inflow, while Fidelity remained in second place with $188.4 million. Ark 21Shares also saw a significant inflow of $136.5 million. Outflows from the Grayscale fund, on the other hand, dropped to a weekly low of $51.8 million.

On February 12th, Bitcoin advocate Anthony Pompliano commented on CNBC's Squawk Box program, stating, "Wall Street loves Bitcoin":

“There is demand for Bitcoin that is 12.5 times what is produced daily." Pompliano noted that approximately 80% of the total supply has not moved in the last six months. He added that only around $200 billion worth of Bitcoin is available for trading, suggesting that these ETFs "consume 5% of the entire tradable Bitcoin supply within 30 days."

Wall Street LOVES bitcoin.

— Pomp 🌪 (@APompliano) February 12, 2024

They are buying up 12.5x more bitcoin per day than the network can produce.

The march to a new all-time high is underway if this continues.

I explain this on my segment with @SquawkCNBC this morning. pic.twitter.com/0zRc3RQ4hY