Shares Of Bitcoin-Centric Companies Have Risen Again.

- Posted on January 2, 2024 10:24 PM

- Cryipto News

- 737 Views

MicroStrategy and Coinbase gained 6% and 9% respectively before the opening of the New York Stock Exchange.

Shares of Bitcoin-focused companies MicroStrategy and cryptocurrency exchange Coinbase increased before the market opening due to Bitcoin surpassing $45,000 and the imminent decision on the Bitcoin ETF on January 10.

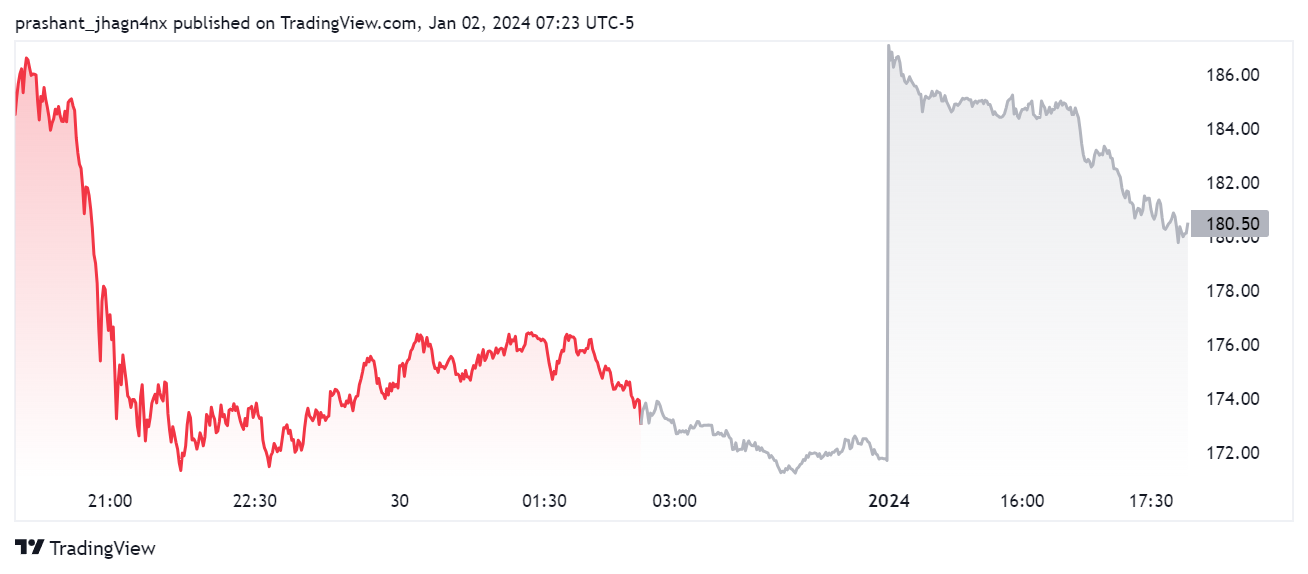

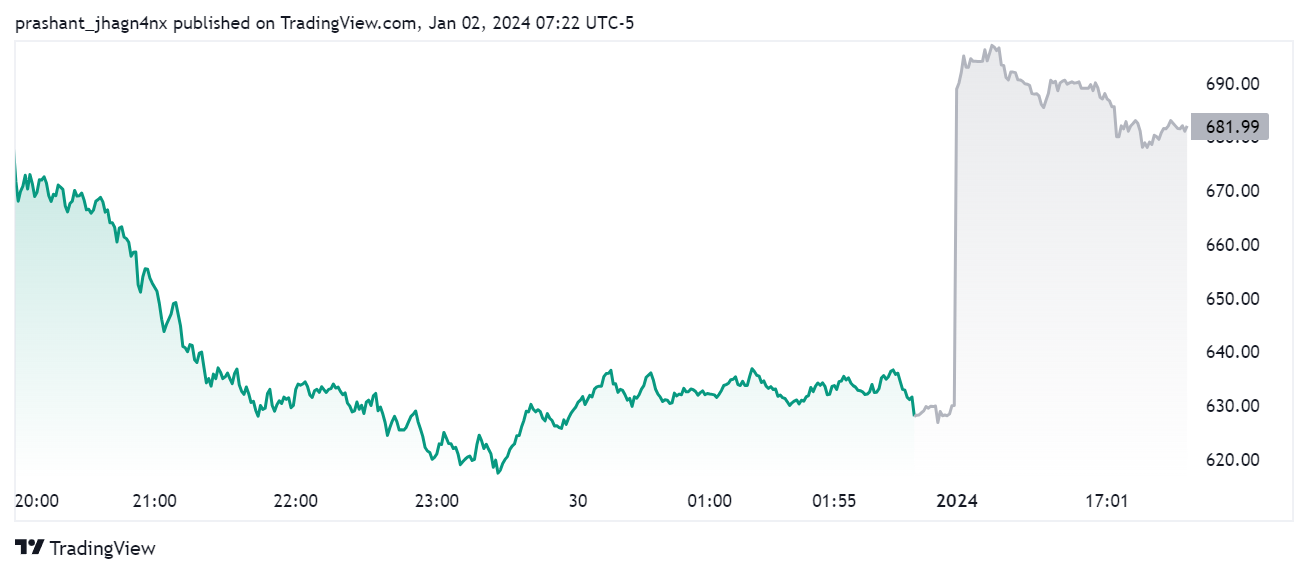

On January 2, before the market opening, Coinbase and MicroStrategy shares recorded increases of 6% and 9%, respectively. Coinbase shares rose by 6.4% to $184.99, while MicroStrategy shares increased by 9.14% to $689.11.

The pre-market trading session takes place in the hours before the market opens at 9:30 New York time each trading day, providing investors with the opportunity for stock trading.

Coinbase's share price, after a quiet year in 2022, increased by 36% last month, gaining approximately 420% in value year-to-date. However, the share price of America's first publicly traded crypto exchange is still 46% below the all-time high of $343 set at its 2021 launch.

Similarly, MicroStrategy's shares increased by 25% last month and by 372% last year, but they are currently 8% below their highest level of $750.

PayPal or Block Inc., like other publicly traded companies focused on crypto, experienced a decline in pre-market trading despite the upward movement in the crypto market. However, this situation may change when the markets open in the United States.

The recent changes in the stock prices of crypto-focused companies contrast with the year-end gains.

The recent increase in the stock prices of the two major Bitcoin-focused companies is associated with the approaching approval of the spot Bitcoin ETF.

While MicroStrategy continues to be the largest holder of Bitcoin, Coinbase has been entrusted with custody operations by several corporate giants applying for a spot BTC ETF.

You can follow real-time developments and the latest news in the cryptocurrency markets with Kriptospot.com.