Blackrock Is Gearing Up To Take Steps To Lead The Bitcoin Etf Race.

- Posted on April 20, 2024 2:01 AM

- Cryipto News

- 853 Views

BlackRock's IBIT ETF is steadily progressing towards surpassing Grayscale's GBTC, aiming to become the largest ETF in terms of Bitcoin assets.

BlackRock's spot Bitcoin exchange-traded fund (ETF), iShares Bitcoin Trust (IBIT), is gradually approaching Grayscale's Bitcoin Trust ETF (GBTC) in terms of market share.

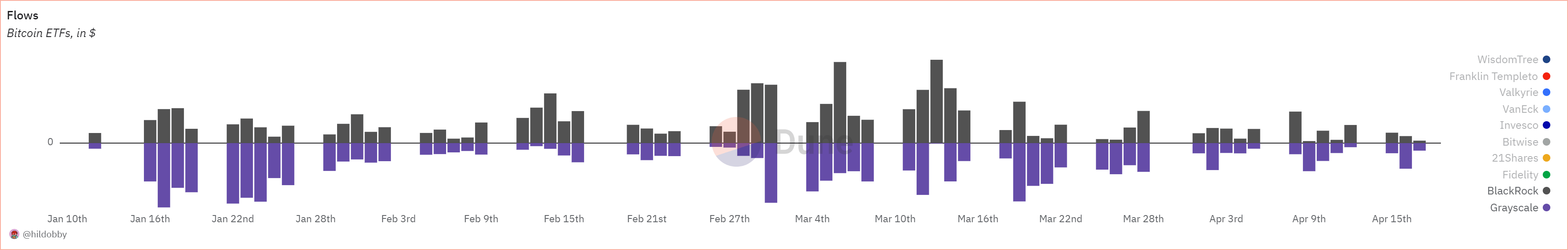

According to Dune data, IBIT recorded the second lowest daily inflow on April 17 with $24.9 million. This represents a significant increase compared to its calmest day on April 9 with $20.4 million inflow.

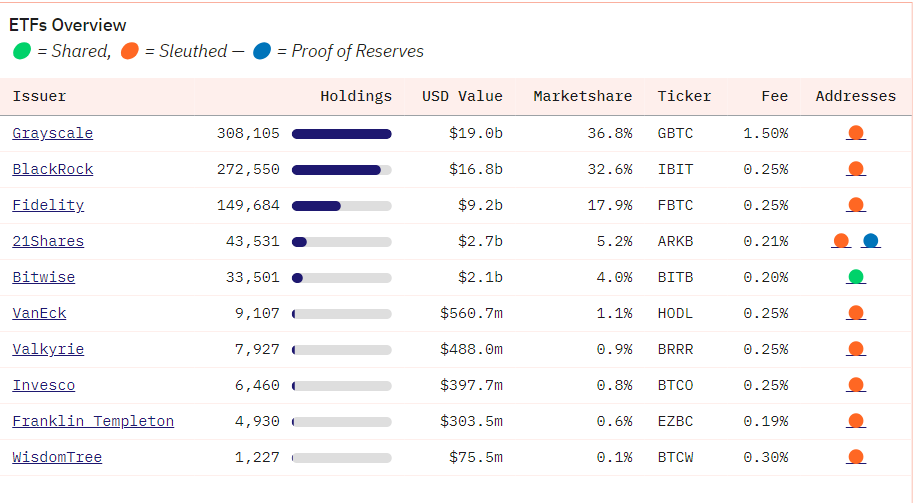

Despite the second lowest daily inflows, IBIT's current market share stands at 32.6%. This quietly approaches Grayscale's GBTC market share of 36.8%, which is the largest spot Bitcoin ETF.

BlackRock's ETF currently holds $16.8 billion worth of Bitcoin, which is $2.2 billion less than what GBTC holds.

It seems plausible that IBIT could surpass GBTC for the first place, especially considering that GBTC's Bitcoin holdings have dropped by 50% ahead of the Bitcoin halving — from 619,220 BTC on the first day of trading on January 11 to the current 308,105 BTC.

Looking at BlackRock's Bitcoin accumulation, there has been a slowdown since IBIT hit a record with $866 million in net inflows on March 13. Nevertheless, BlackRock's Bitcoin ETF assets have shown an increase of over 10,200%, starting from 2,621 BTC initially to the current 272,550 BTC.

On the other hand, Grayscale's Bitcoin sales have been declining since March 19, when it saw a significant outflow of $607 million, the fourth highest since the inception of GBTC. According to Dune data, outflows from GBTC were recorded at $79 million on April 17.

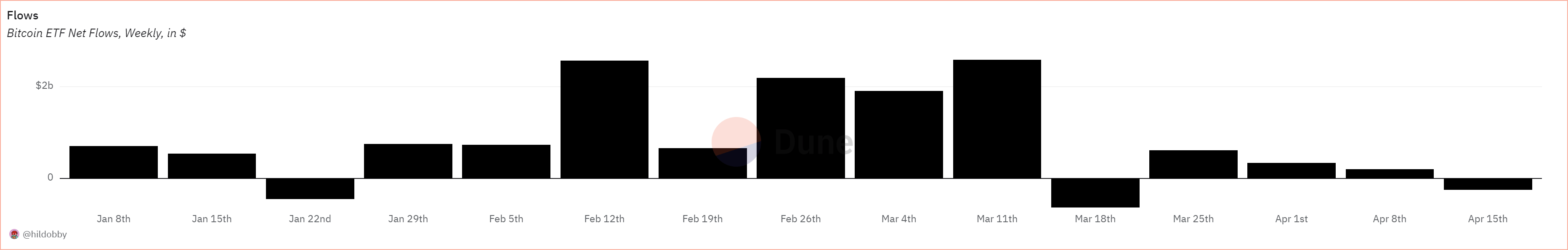

There has been a slowdown in cumulative ETF inflows since March. While last week saw a net inflow of $199 million into ETFs, this figure has dropped to $2.58 billion for the week starting March 11th.

As ETF inflows have slowed, Bitcoin prices have also been under pressure. According to CoinMarketCap data, Bitcoin's price fell by 10.7% to $62,971 over the past week and dropped below $60,000 on April 17, just days before the halving event.

Since Grayscale's GBTC fund began spot trading, it has experienced significant selling pressure, contributing to the pressure on Bitcoin. The high outflows from GBTC can be associated with the highest transaction fee among all Bitcoin ETF issuers in the USA, at 1.5%. In contrast, Grayscale's IBIT fund charges a 0.25% fee, while Franklin Templeton's ETF only demands a 0.19% fee.

Stay updated with the latest developments and news in the cryptocurrency markets at Kriptospot.com.