Blackrock To Purchase $10 Million Worth Of Bitcoin For A New Etf Product.

- Posted on January 4, 2024 1:26 AM

- Cryipto News

- 707 Views

BlackRock is said to plan purchasing approximately $10 million worth of Bitcoin to launch a new spot Bitcoin ETF product.

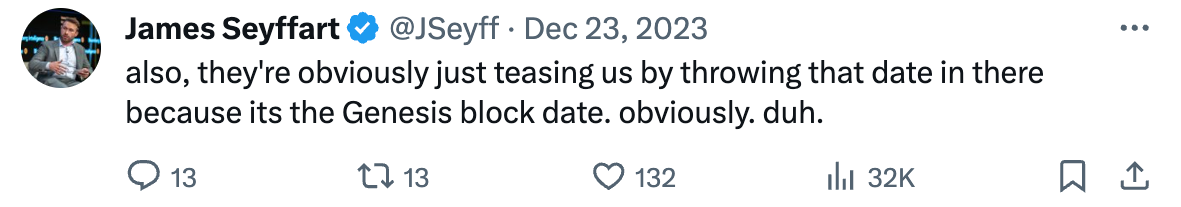

World's largest asset manager BlackRock is reportedly planning to purchase approximately $10 million worth of Bitcoin (BTC) on January 3, 2024. ETF analyst James Seyffart announced BlackRock's BTC purchase through a social media post.

Putting this in thread: https://t.co/Yhdh8b58rz

— James Seyffart (@JSeyff) December 22, 2023

Seyffart noted that the document indicating the Bitcoin purchase is not yet final, but the acquisition might align with the "January approval prediction." Additionally, he emphasized that this capital influx does not necessarily signify the launch of an ETF.

Seyffart responded to a user's question about whether a $10 million asset purchase is sufficient, stating that this amount is quite standard and subject to change. Bloomberg analyst Eric Balchunas, in a tweet at the end of last month, noted that BlackRock's $10 million purchase would be a significant increase compared to the $100,000 initial fund in October.

BlackRock expecting to seed $IBIT w/ $10 million on Jan 3rd.. notable the date and that it is a pretty big bump up from the $100k they seeded in Oct. https://t.co/cV22QYz3Do

— Eric Balchunas (@EricBalchunas) December 22, 2023

Balchunas also mentioned that Bitwise has filed an S-1 aiming to seed its spot Bitcoin ETF with $200 million.

While it was initially anticipated that the purchase for BlackRock's initial fund would take place on January 3rd, according to various sources, it is claimed that this date has been postponed to January 5th. However, it is important to note that neither of these dates is 100% confirmed.

The SEC set the last modification date for the Bitcoin ETF on December 29, 2023, and BlackRock, VanEck, and Valkyrie submitted last-minute changes. Analysts predict that the SEC's decision on ETFs will be announced on January 10, 2024.

You can follow real-time developments and the latest news in the cryptocurrency markets on Kriptospot.com.