Bulls Are Moving Towards The $69,000 Target...

- Posted on February 14, 2024 8:23 PM

- Cryipto News

- 607 Views

As Bitcoin reaches its highest levels since the end of 2021, it continues its momentum unabated before the opening of Wall Street.

The bulls, enjoying the Valentine's Day surprise, reached the highest level in two years.

Bitcoin surged past the $51,000 level, staging a strong comeback from the previous day's low of $48,400.

During the Asian session, Bitcoin not only recovered its 4% loss but also continued to climb towards higher levels in the long term, reaching $52,000 at the time of writing.

While the BTC/USD pair gained one thousand dollars in value within a single hourly candle, the total cryptocurrency market value approached the 2 trillion dollar mark as Bitcoin surpassed the 1 trillion dollar market cap.

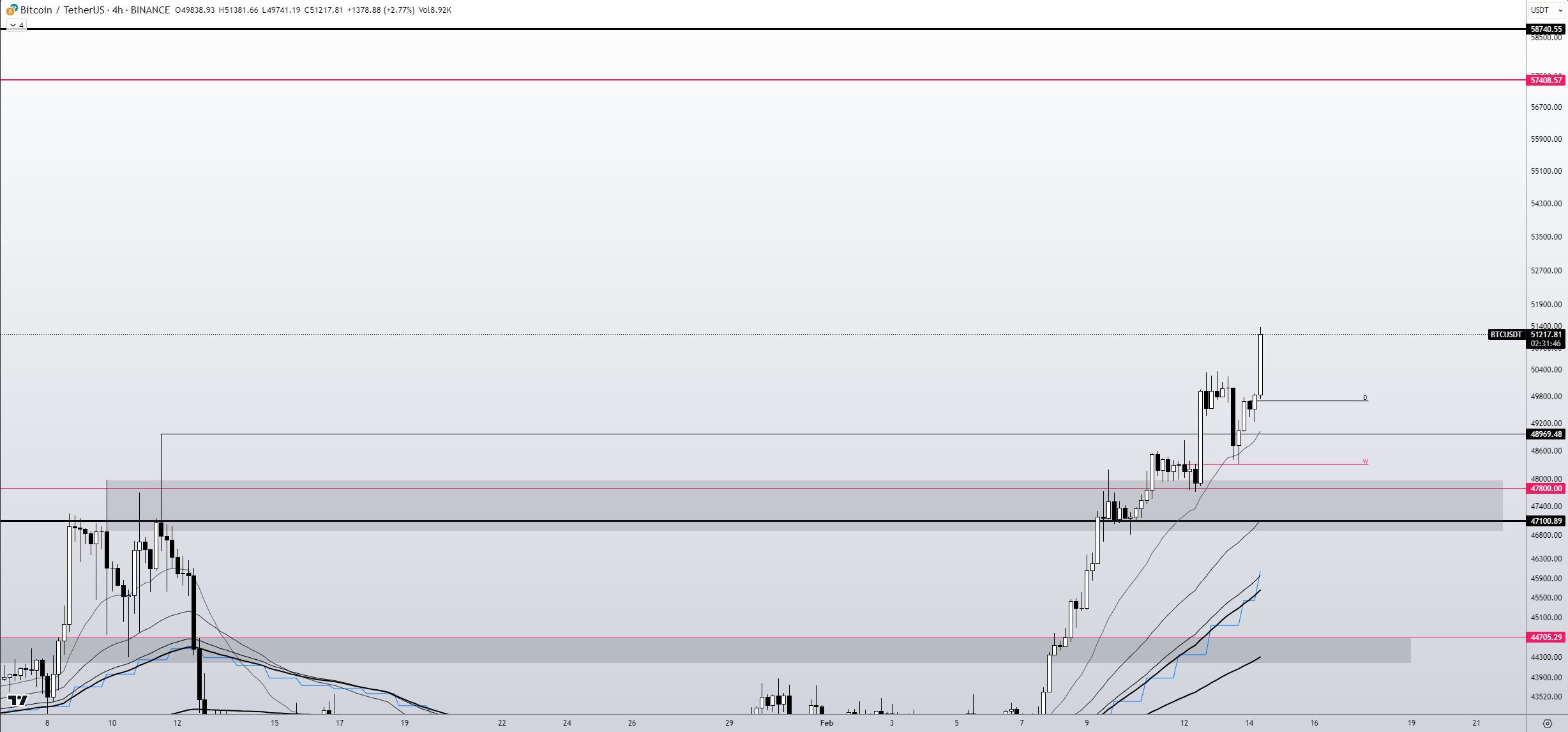

Popular trader Skew analyzed the low timeframe setup, indicating a continuing resistance/support flip on the 4-hour chart.

He also mentioned that the key trend lines to watch are the exponential moving averages (EMAs) and the Relative Strength Index (RSI).

In his recent Twitter post, Skew commented, "I believe this trend is quite clear as long as the market maintains its current upward momentum."

"The 4-hour EMAs, along with RSI for momentum confirmation, provide concise and meaningful trend confirmations, particularly at key points such as daily and weekly openings," he added.

Skew also noted on Binance that spot buyer interest is outpacing institutional entries in the United States through spot Bitcoin exchange-traded funds (ETFs).

Bitcoin ETF Flow

— BitMEX Research (@BitMEXResearch) February 14, 2024

All data out for 13th Feb. Very strong day, with $631m positive net flow over all providers. Huge day for Blackrock at +$493m pic.twitter.com/F1abDO6OUZ

BTC price performance "as expected" Popular trader and analyst Rekt Capital, who has a longer-term perspective, claimed that Bitcoin is progressing in line with classic bull markets.

Rekt Capital, in a statement this week, noted that the timing of the all-time high levels in BTC price is "just right."

Referring to 2020, Rekt Capital pointed out the impact of halving rewards, stating that the BTC/USD pair typically starts rallying two months before.

The next halving is expected to take place in mid-April.

#BTC

— Rekt Capital (@rektcapital) February 13, 2024

Right on schedule$BTC #Crypto #Bitcoin https://t.co/fj3vJ62bIb pic.twitter.com/Tue8nMMDUe

You can follow real-time developments and the latest news in the cryptocurrency markets on Kriptospot.com.