Does Mt. Gox Play A Role In Bitcoin Falling Below $60,000?

- Posted on July 4, 2024 6:26 AM

- Cryipto News

- 653 Views

Since the beginning of June, Bitcoin has been on a downward trend and is struggling to gain upward momentum despite positive ETF inflows.

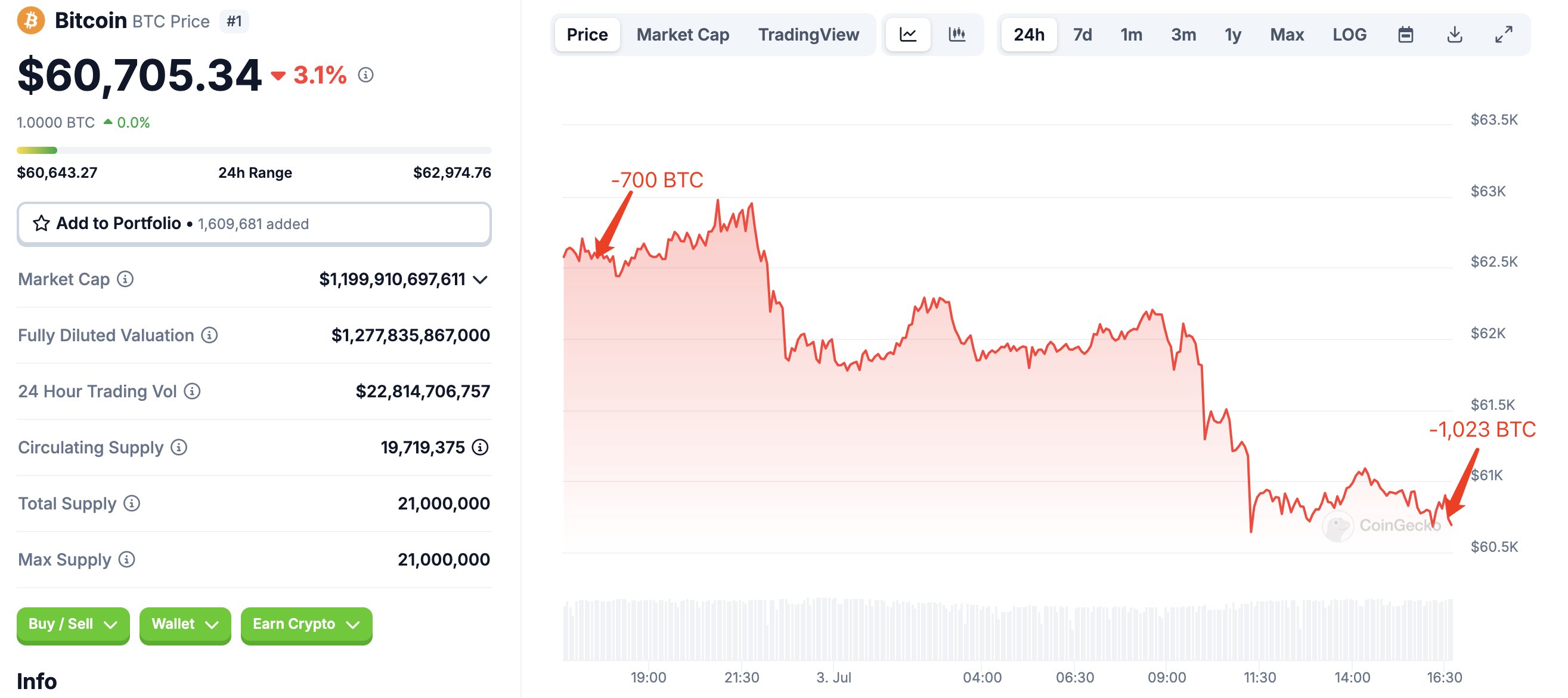

On July 3rd, Bitcoin fell below the psychological level of $60,000. One of the reasons for this decline is attributed to the Mt. Gox exchange starting to repay $9 billion worth of BTC.

As of 1:33 PM Turkish time on July 3rd, Bitcoin had lost 4.2% of its value in the last 24 hours, dropping to $59,600. According to CoinMarketCap, the world's first cryptocurrency experienced a 1.8% decrease on the weekly chart.

Bitcoin price has been on a downtrend since June, with BTC experiencing approximately an 18% drop in value during the second quarter of 2024. Investors were anticipating a breakout above $70,000, but the loss of support at $60,000 suggests that the price correction may continue.

Has Mt. Gox Started Repaying Creditors?

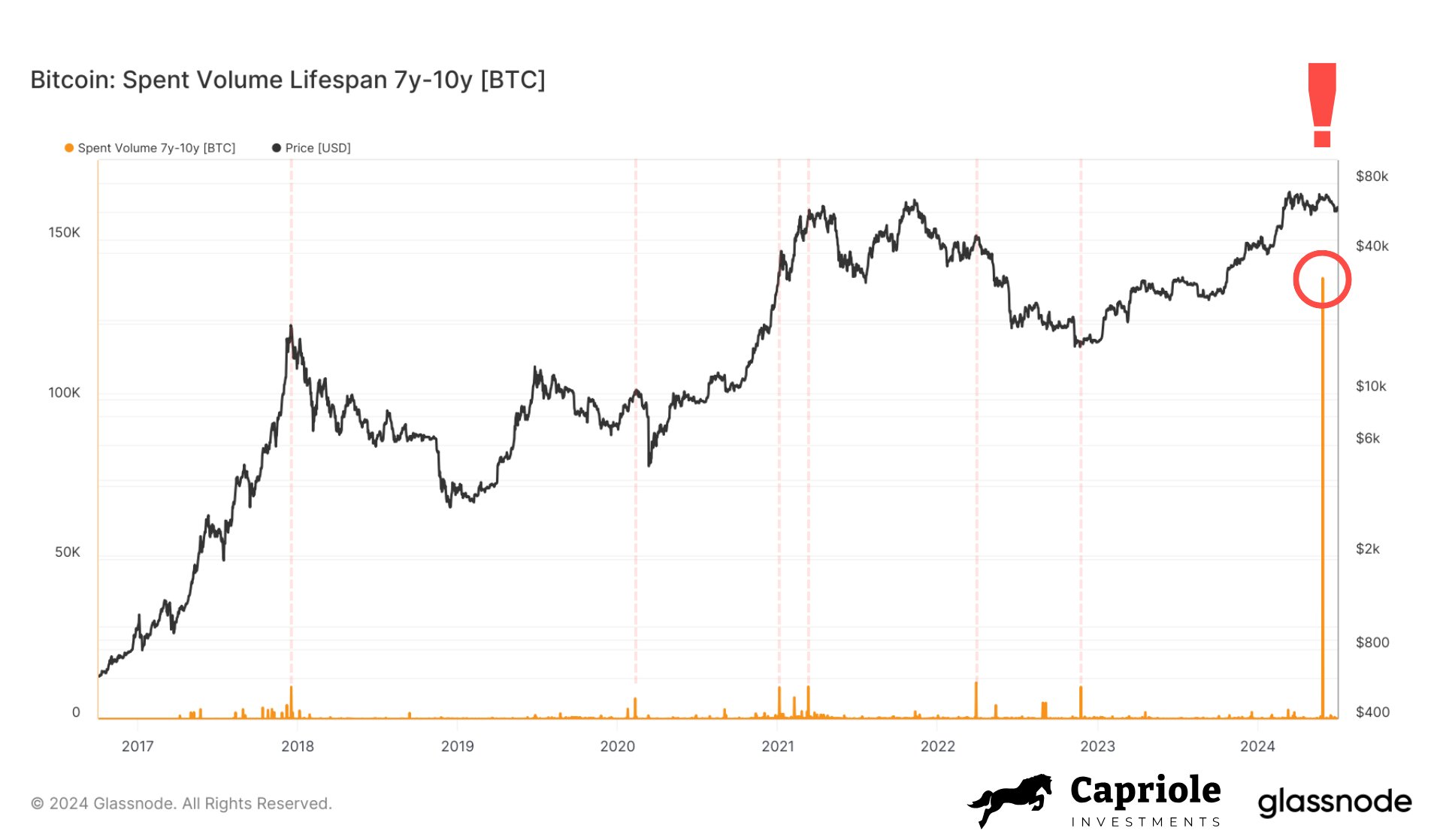

Bitcoin falling below $60,000 could be linked to the start of Mt. Gox creditor repayments expected at the beginning of July. Charles Edwards, founder of the digital asset hedge fund Capriole Investments, noted significant movement of Bitcoin in a transfer volume chart covering the past seven to ten years. Edwards mentioned in a post on July 2, “All historical data in this chart has become irrelevant due to the large amounts of Bitcoin moving on-chain. But by whom? Mt. Gox. It appears that repayments have started.”

The defunct Mt. Gox exchange owes over $9.4 billion worth of Bitcoin to approximately 127,000 creditors. Gox creditors have been waiting for over a decade to recover their funds. This situation suggests that some investors might be inclined to withdraw their long-held profits.

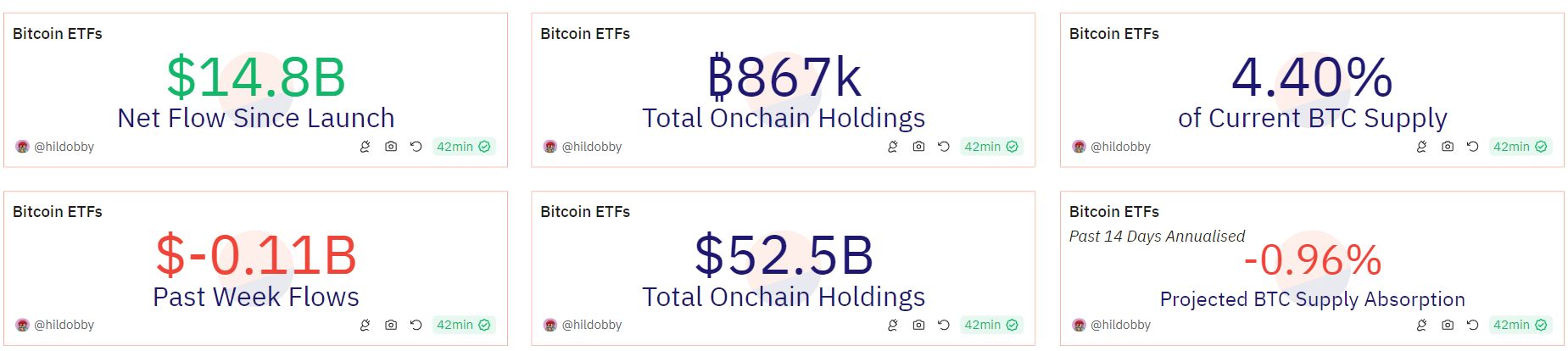

However, the pressure from the $9 billion worth of Bitcoin to be released into the market as a result of Mt. Gox's repayment process could potentially be absorbed by U.S.-based spot Bitcoin exchange-traded funds (ETFs). According to Dune, ETFs have purchased over $52.5 billion worth of Bitcoin since their launch in January.

The drop of Bitcoin below $60,000 may have been influenced by a large whale.

An unknown whale sold $180 million worth of Bitcoin in just three minutes. This large-scale and rapid sale may have had a significant impact on the price.

Zaheer shared a chart supporting this large sale in a July 3 X post.

According to Lookonchain, another unknown whale contributing to the price drop transferred 1,723 BTC, worth over $168 million, to Binance in the past 24 hours.

The transfer of Bitcoin by a whale to the world’s largest cryptocurrency exchange indicates an intention to sell their assets and realize a profit.

You can stay updated with the latest developments and news in the cryptocurrency markets at Kriptospot.com.