Why Did Ether Price Rise?

- Posted on June 21, 2024 2:47 AM

- Cryipto News

- 593 Views

The key factors driving the rise in Ether's price include the decision by the U.S. Securities and Exchange Commission (SEC) to end its long-standing investigation into Ethereum, and the decrease in Ethereum reserves on cryptocurrency exchanges.

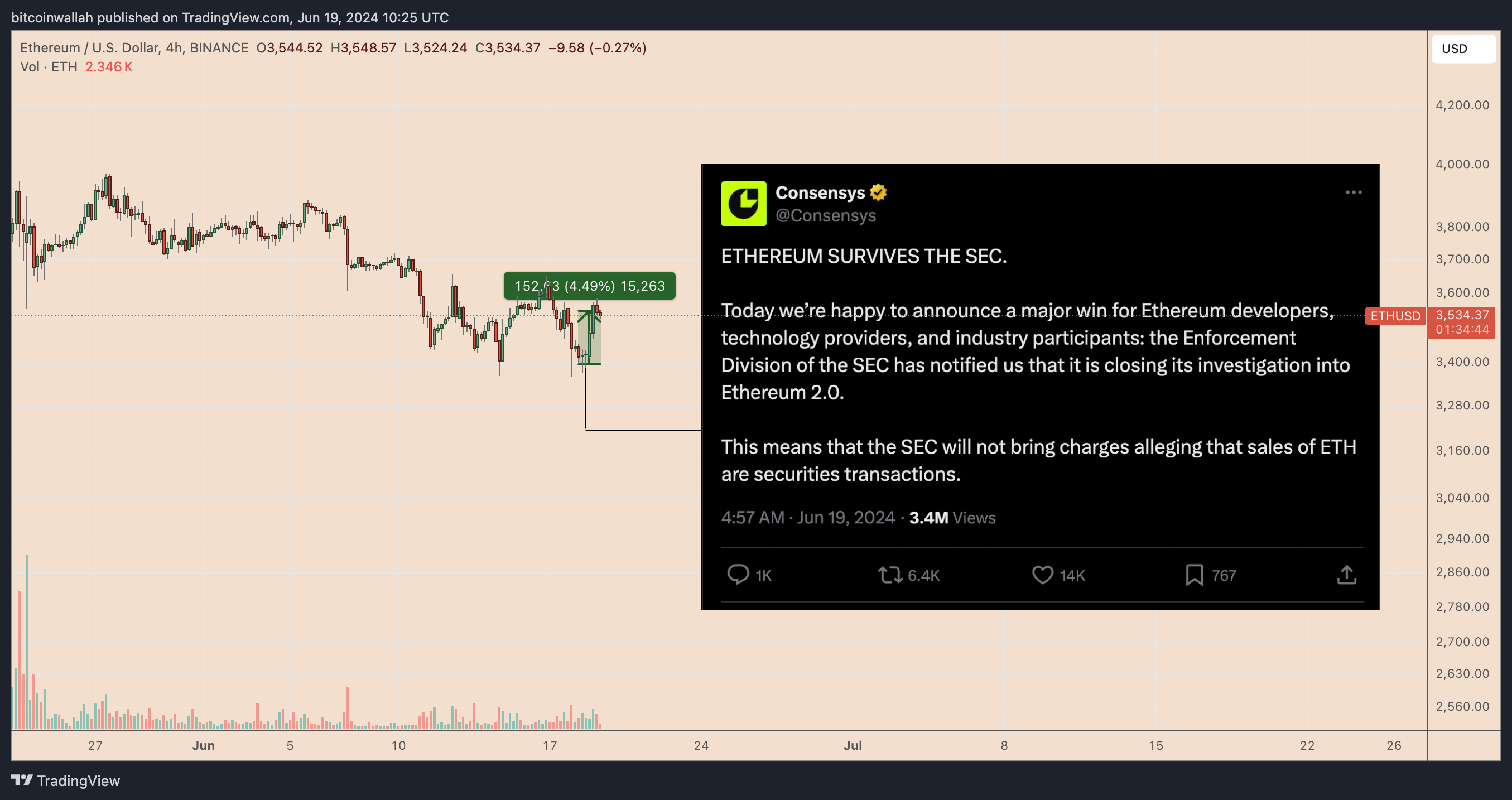

Ethereum's native token Ether (ETH) surged approximately 4.5% to $3,550 in the last 24 hours. The primary catalyst behind this significant rise was the decision by the Securities and Exchange Commission (SEC) to conclude its investigation into Ethereum.

ConsenSys, a prominent Ethereum developer, announced on June 19 that "the SEC's Enforcement Division has informed us that it has closed its investigation into Ethereum 2.0." They emphasized that this decision is a "major win" for Ethereum developers, technology providers, and industry participants.

SEC's decision came after approving 19b-4 applications from VanEck, BlackRock, Fidelity, and other Wall Street firms, allowing spot Ether ETFs to be listed and traded on their exchanges.

Bloomberg analyst Eric Balchunas predicts that Ether ETFs will begin trading from July 2 onwards. K33 Research forecasts that these investment products will attract inflows worth $4 billion in the first five months after their launch, indicating strong potential demand for ETH tokens.

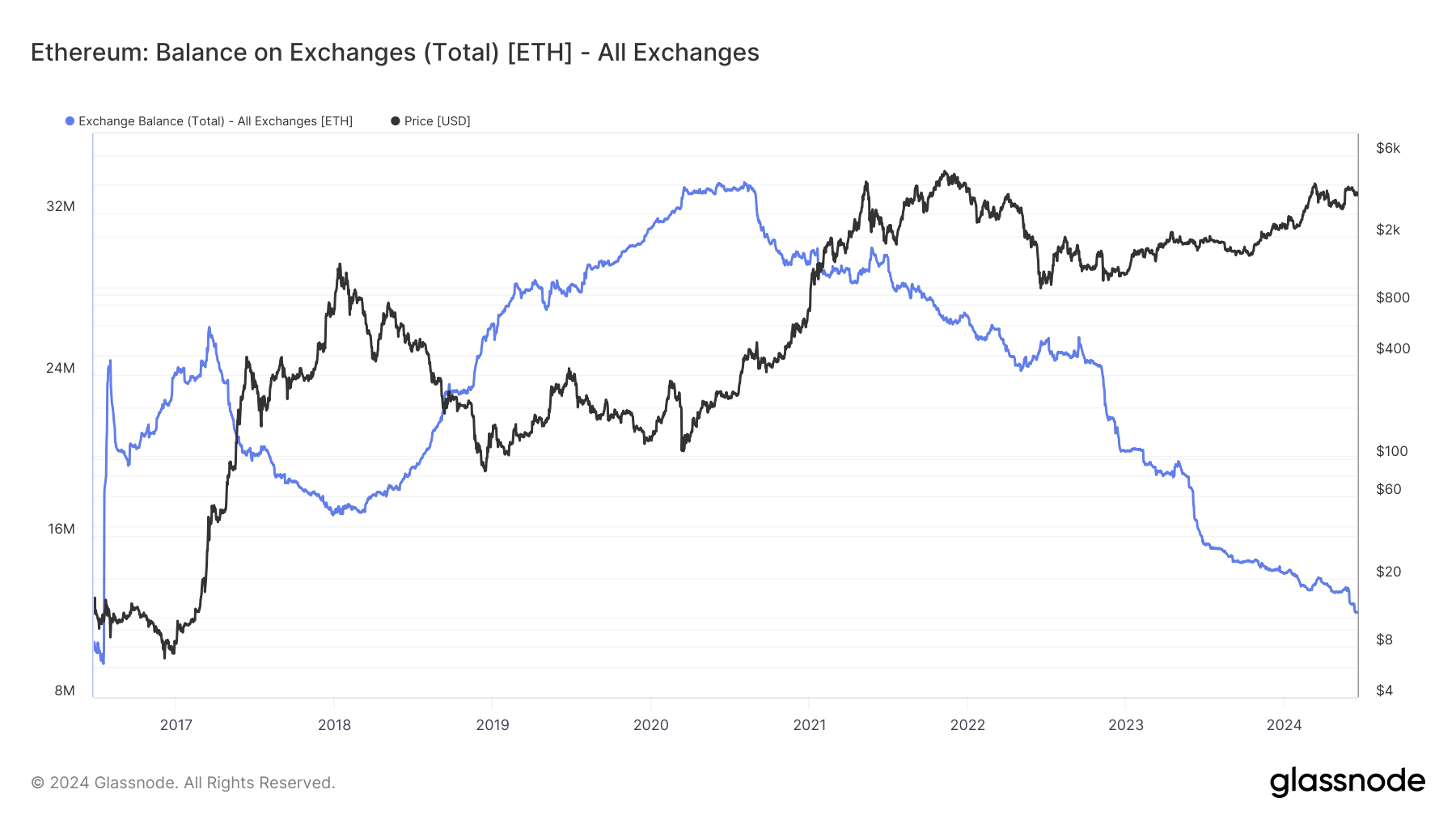

According to Glassnode data, the total amount of Ether held on all crypto exchanges dropped to 12.20 million ETH on June 18, marking the lowest level since July 2016.

The increase in Ether withdrawals from crypto exchanges has paralleled Ethereum's price rise, indicating reduced selling pressure and a growing trend of holding ETH in private wallets or decentralized protocols.

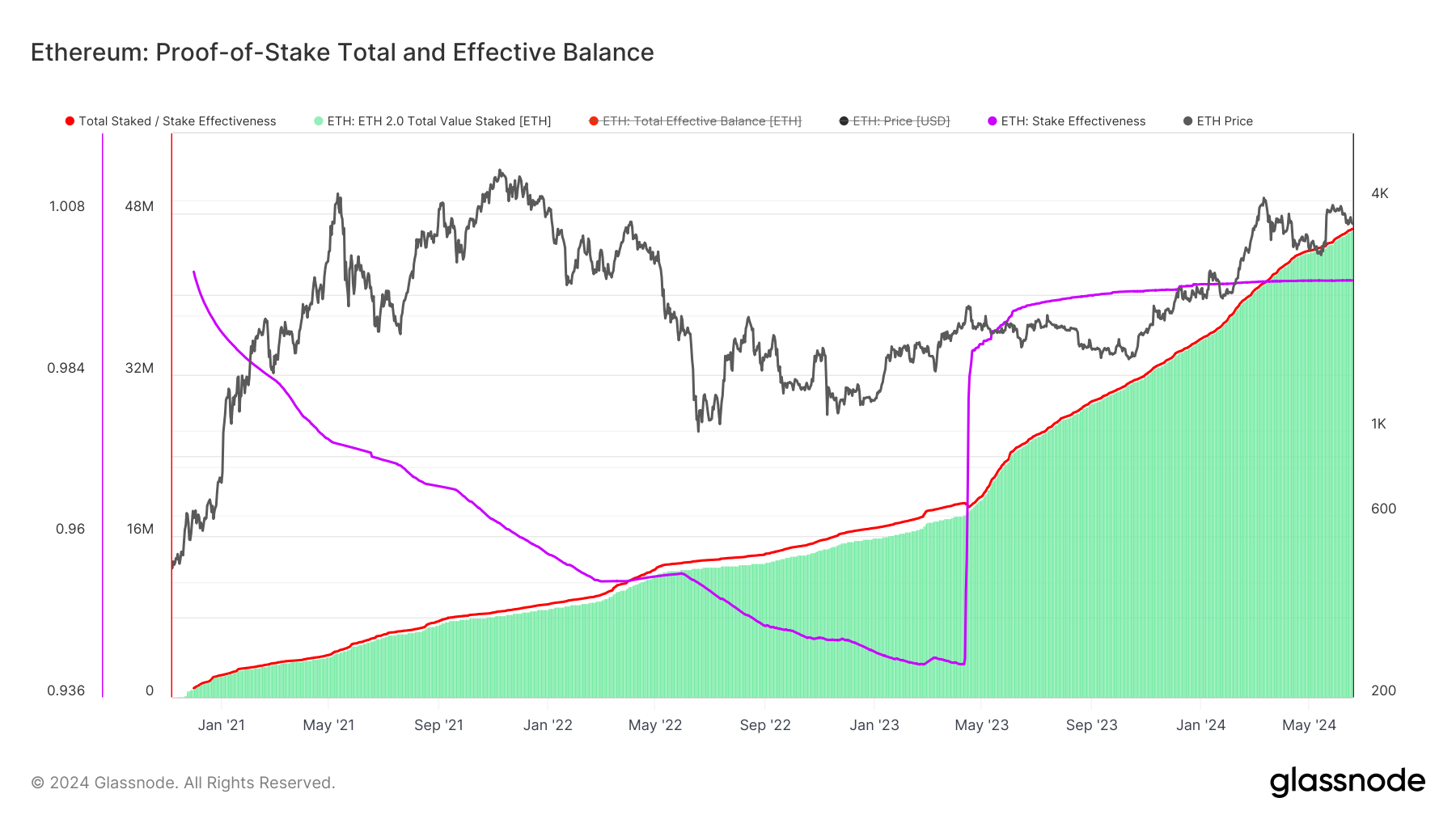

For instance, official Ethereum staking addresses have steadily increased their holdings since December 2020, currently holding 46.418 million ETH as of June 19th.

In March 2023, despite the Shanghai upgrade, Ethereum continues to grow. This upgrade eliminated the requirement for ETH stakers to lock their tokens indefinitely.

Most investors, although currently having the option, have not withdrawn their staked ETH. This preference indicates that stability and rewards from staking are favored over selling. This suggests a potential upward trend in Ether's price in the coming weeks.

ETH price bounced back from critical support

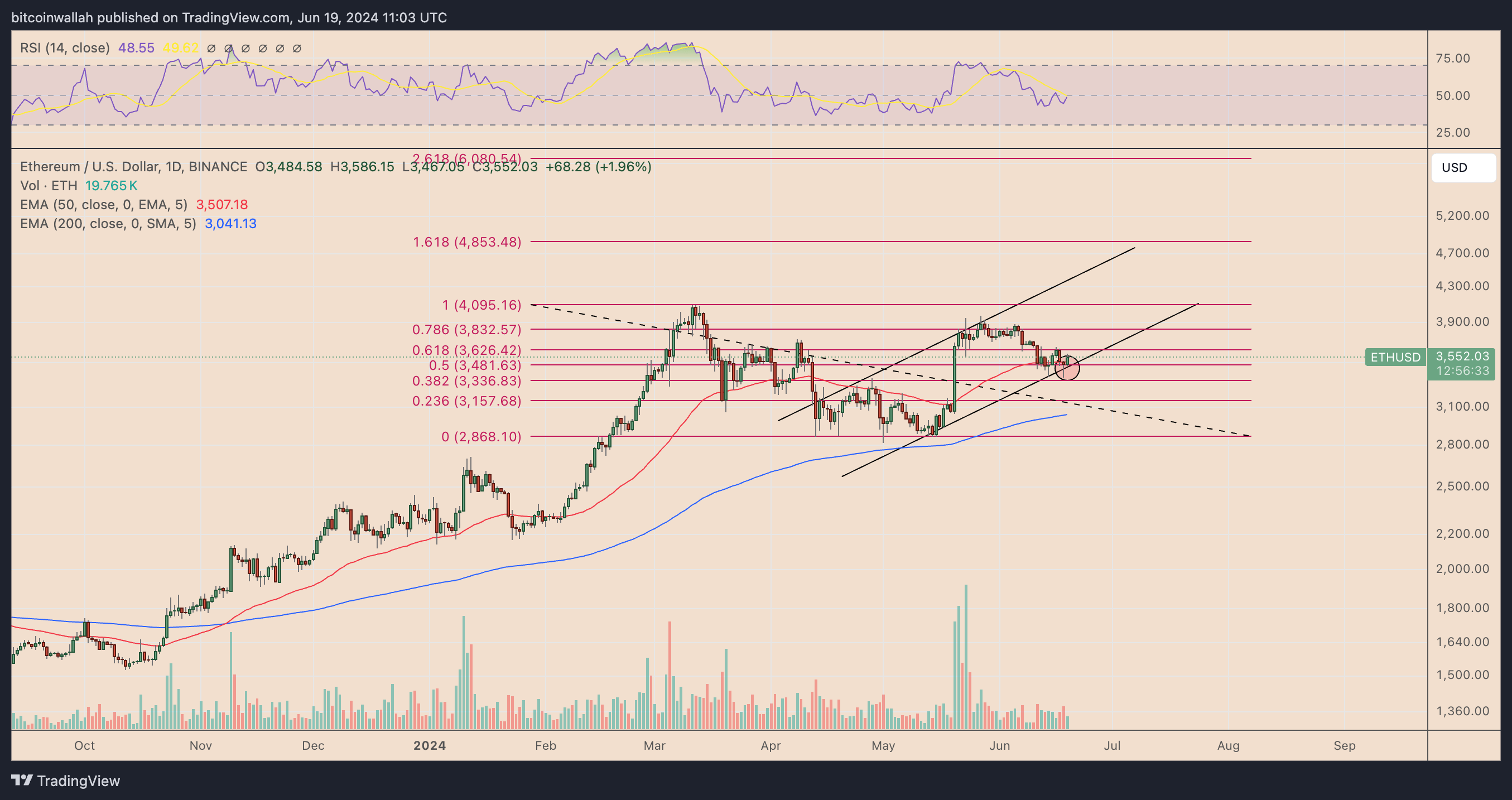

Today, ETH price increased after testing a technical support level around $3,500. This level includes the 50-day exponential moving average (50-day EMA), the 0.5 Fibonacci retracement level, and the lower trend line of the dominant uptrend channel.

The upward target for Ethereum in July aligns with the upper trend line of its rising channel and is supported by the approximately $4,853 level, corresponding to the 1.618 Fibonacci extension. This projection is based on past price movements resulting in recoveries following similar patterns from the lower trend line.

Conversely, a significant break below the lower trend line of the rising channel could increase the likelihood of a decline towards the 200-day exponential moving average (EMA) level around $3,040 for Ethereum in July.

You can follow real-time developments and the latest news in the cryptocurrency markets on Kriptospot.com.