Five Experts Share Their Views On The Future Of Bitcoin: Will The Upward Trend Continue?

- Posted on March 30, 2024 1:18 AM

- Cryipto News

- 519 Views

In addition to macroeconomic factors, the overall demand for Bitcoin may play a much more decisive role in driving the price of Bitcoin higher this year.

A number of industry analysts predict that the Bitcoin halving event in April will only represent a portion of the substantial gains the cryptocurrency is expected to achieve this year.

Investment researcher Lyn Alden, in an interview with Cointelegraph, stated that the upcoming Bitcoin halving next month would reduce the daily BTC production from the current average of 900 BTC to approximately 450 BTC.

However, Alden noted that the amount of the supply cut is relatively insignificant when compared to the daily cash flows to and from cryptocurrency exchanges and Bitcoin exchange-traded funds (ETFs).

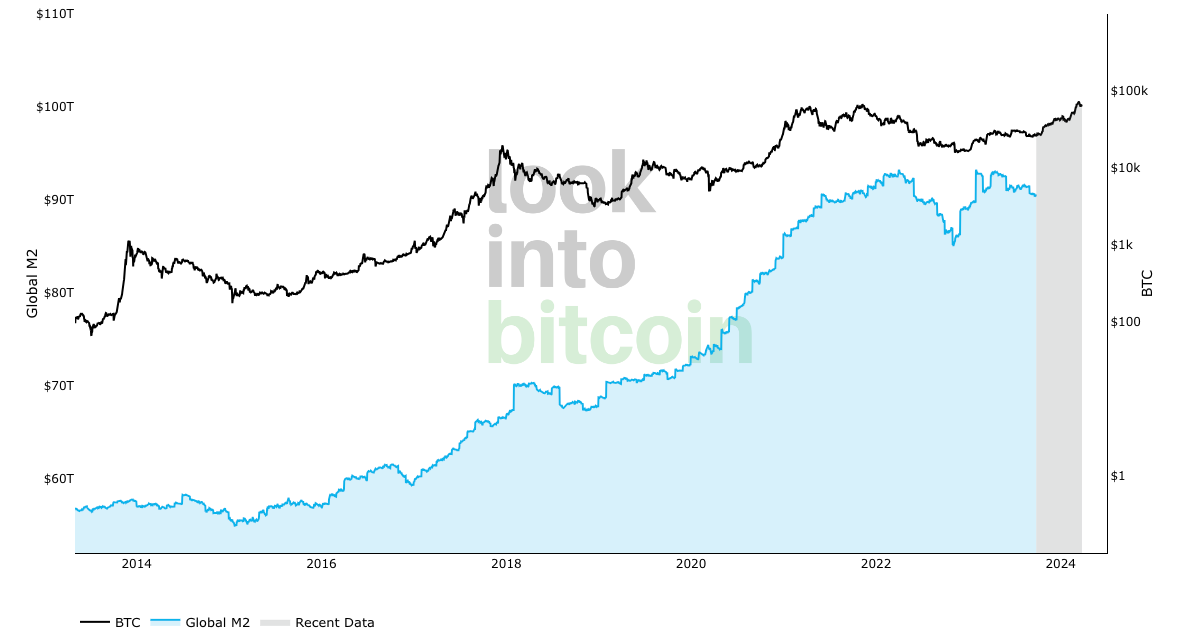

"Actually, inflows or outflows could easily surpass this figure by tenfold," Alden said, indicating that the overall demand for Bitcoin is "a more significant factor than tightening supply." He also pointed to a graph comparing the BTC price with the global money supply (M2), emphasizing that historically, the demand for Bitcoin has been more closely related to global liquidity measures such as the global supply of money.

Lyn Alden acknowledges the significance of the Bitcoin halving but emphasizes that it is just one of many factors determining the onset and timing of a bull market. Alden continues by stating, "While the halving is important, the combination of factors such as global liquidity measures, HODL waves, and other catalysts have a greater impact." He adds, "Due to the increase in global liquidity over the next two years and the fact that many coins have ended up in strong hands during the bear market, even a relatively small increase in demand could significantly drive up the price."

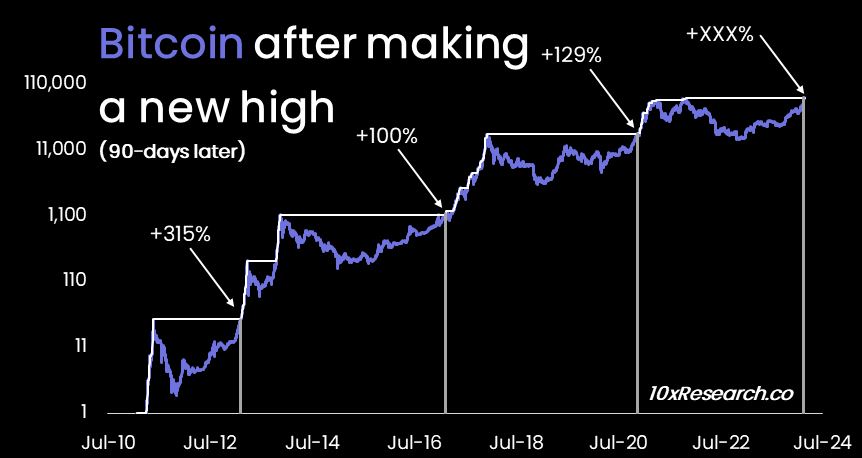

Markus Thielen, CEO and chief analyst of 10x Research, believes that the current upward trend is "undoubtedly on par" with the bull market of 2020 and 2021. Using quantitative analysis methods, Thielen notes that Bitcoin's price started to rise after surpassing its recent highs on March 13, 2024.

According to 10x Research, Bitcoin's price is forecasted to reach $77,000 in early April and $99,000 by May 2024. Thielen observes that whenever Bitcoin has experienced a new price surge in the past, the price has been able to increase by up to 189% within 180 days, and historically, Bitcoin has peaked nine to 11 months after major breakthroughs.

Thielen predicts that between December and February 2025, or within nine to 11 months following the breakthrough on March 13, Bitcoin could reach a staggering $146,000.

The analyst stated, "Corrections and pullbacks can happen at any time, but traders can use the breakout level of $68,300 as the new support level, and we can suggest that Bitcoin could significantly rise above this level over the next few weeks and months." He added, "While there is a possibility of Bitcoin reaching $146,000 this summer, we are maintaining our price target of $125,000 for now."

According to Peters, the launch of spot Bitcoin exchange-traded funds (ETFs) in the United States on January 11, 2024, is behind such a breakthrough.

Peters emphasized, "Demand for Bitcoin is rapidly outpacing new supply, which is something we haven't seen in previous cycles." Peters noted that before the launch of ETFs, demand mostly came from the retail side, but the ongoing cycle will be "more institutional."

Furthermore, the analyst pointed out that Bitcoin miners who have actively abandoned BTC since August 2023 have already sold into the current rally in preparation for the upcoming block reward halving. Peters also added that due to the high demand from spot ETFs, all sales are considered "good bids," but it is important to note that ETFs are not the only participants in the rally so far, as other entities such as MicroStrategy and Bitcoin whales continue to accumulate.

Meanwhile, Li Xing, the financial market strategist at Exness, believes that macroeconomic developments will also play a role in directing Bitcoin's price this year.

The analyst stated, "Additionally, geopolitical risks and uncertainties surrounding the US elections could continue to increase demand, signaling the beginning of a sustained bull run in the future."

Bitcoin halvings are designed to resist inflation and maintain its value, occurring approximately every four years. Past halvings have been observed to lead to rallies in Bitcoin's price; for example, after the halving in 2016, the Bitcoin price reached its all-time high.

You can stay updated with the latest developments and news in the cryptocurrency markets on Kriptospot.com.