Ftx Prepares To Sell Another $744 Million Worth Of Assets

- Posted on November 6, 2023 4:16 PM

- Cryptocurrency Exchanges News

- 538 Views

After the court approved the gradual sale of approximately $3.4 billion worth of crypto assets a few months ago, another request to sell assets worth $744 million has now been made.

The bankrupt cryptocurrency exchange FTX has requested Delaware Court to allow crypto asset managers like Grayscale and Bitwise to sell approximately $744 million worth of assets.

FTX debtors requested in a court application dated November 3rd that trust funds be sold to enable the company to make payments to creditors.

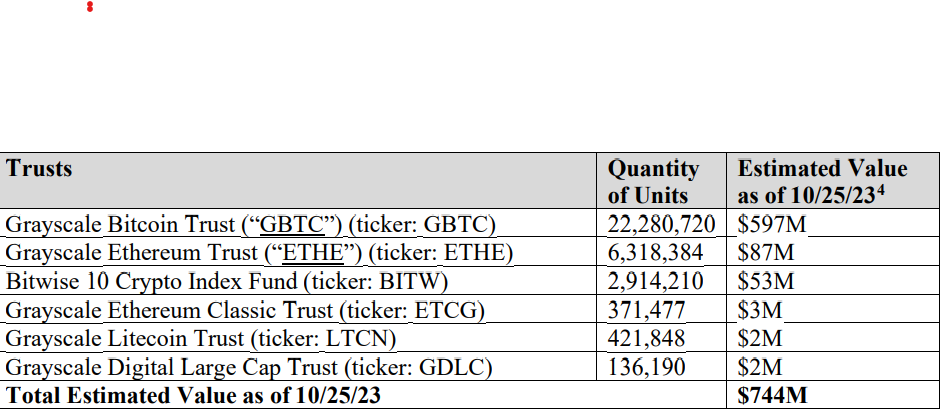

Bitwise has $53 million worth of assets in its trust fund, and Grayscale has $691 million worth of crypto assets spread across five different funds. These crypto funds provide an opportunity for many investors to invest in crypto assets without owning them directly.

In the court filing, the following statements were made:

"The Debtors believe that effectively reducing price volatility risk is best accomplished by preserving the value of the Trust Funds, thus maximizing the return to the Creditors and encouraging Debtors to equitably distribute the Funds in the reorganization plan." FTX debtors have requested the sale of the trust funds and their sale procedures to be approved by an investment advisor. Additionally, they suggested the creation of a pricing committee as part of the sales procedure.

The recent request by FTX debtors for the sale of trust funds comes after the court approved the sale of approximately $3.4 billion worth of crypto assets. The court ordered these assets to be sold in batches of $50 million and $100 million to avoid causing disruption in the market.

The FTX bankruptcy process continues following the conviction of the former FTX CEO, Sam Bankman-Fried, in a New York criminal case. The former CEO was found guilty on seven counts, including two counts of wire fraud, two counts of wire fraud conspiracy, one count of securities fraud, one count of commodities fraud conspiracy, and one count of money laundering conspiracy. A judgment is expected from the judge on March 28, 2024.