Jpmorgan's Predictions For The Aftermath Of The Bitcoin Halving Event Have Garnered Significant Attention.

- Posted on April 20, 2024 2:16 AM

- Cryipto News

- 716 Views

Predictions by JPMorgan, one of the leading financial institutions in the USA, regarding the aftermath of the Bitcoin halving have attracted significant attention.

In their latest research report, JPMorgan analysts, led by Nikolaos Panigirtzoglou, have shared views that diverge from the general investor sentiment regarding the upcoming Bitcoin halving. They predict a decline in BTC prices following the halving event.

The JPMorgan report suggests that the halving event, which will cut mining rewards in half, has already been priced in, and therefore, an increase in Bitcoin prices post-halving is not expected. On the contrary, it is suggested that BTC prices could fall due to various factors.

The analysts point out that based on the open interest in futures markets, Bitcoin still remains in overbought conditions. It is emphasized that BTC is priced above the post-halving projected mining costs.

Panigirtzoglou and his team also believe that venture capital interest in crypto projects might wane after the halving.

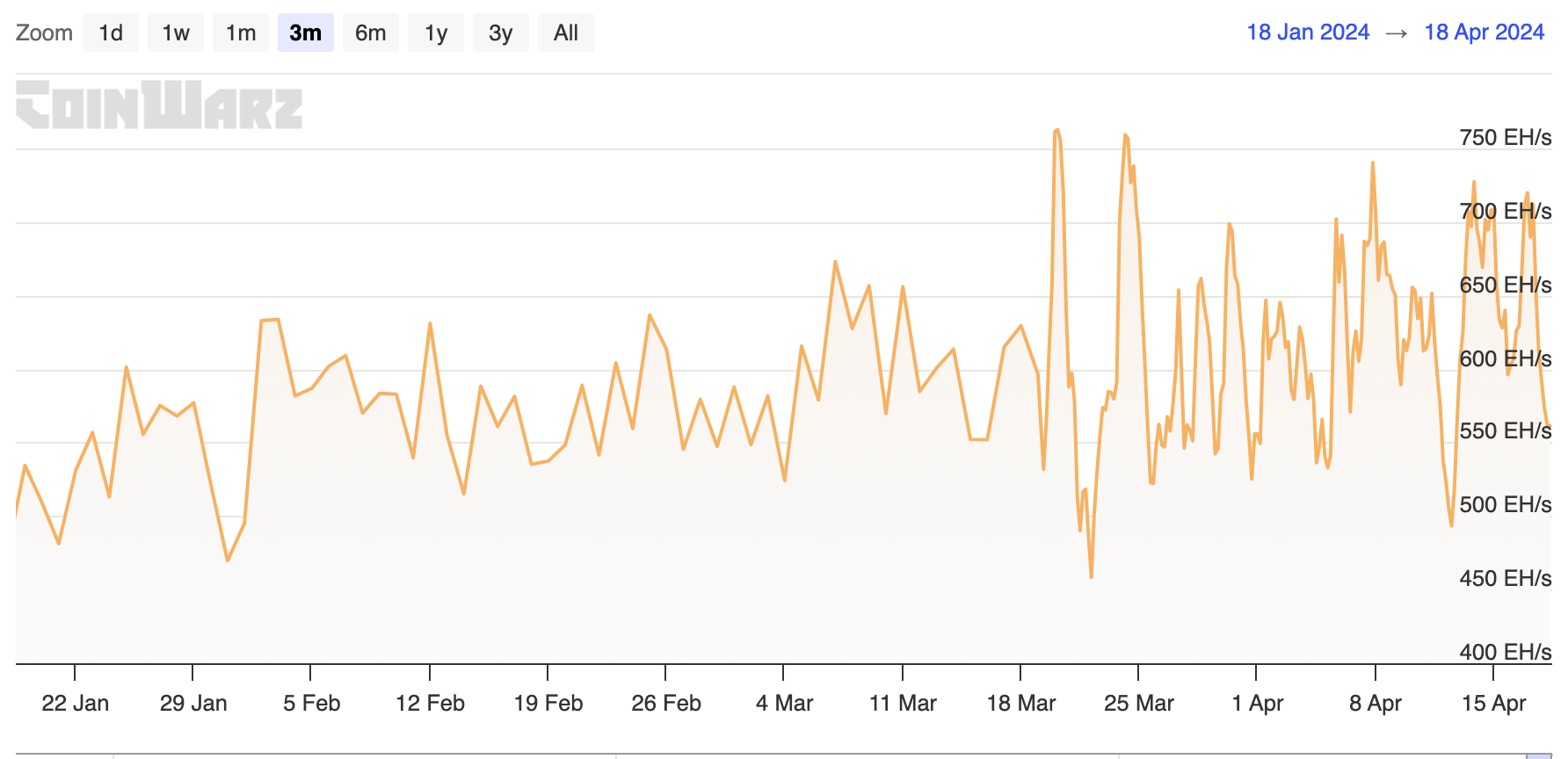

Additionally, the report forecasts that the reduction in mining rewards due to the halving could negatively affect both the hash rate and the processing power of the Bitcoin network.

Following the Bitcoin halving, it is anticipated that miners may withdraw from the network, leading to a decrease in hash rate and further consolidation within the mining industry. Especially, unprofitable miners may halt their operations or relocate to regions with cheaper energy costs, such as Latin America or Africa.

During this transition period, some mining companies may have the opportunity to repurpose their old equipment. However, while alternative mining activities with old mining machines may be feasible, the limited profitability of mining other cryptocurrencies compared to Bitcoin, due to generally lower market value and liquidity, is expected to constrain the profits from such alternative mining activities. This situation could lead to strategic changes and restructuring in the mining sector, as companies seek ways to reduce costs and ensure the sustainability of their operations.

You can follow the latest developments and news in the cryptocurrency markets in real-time on Kriptospot.com.