Spot Bitcoin Exchange Traded Funds (Etfs) Received A $418 Million Investment.

- Posted on March 28, 2024 3:14 AM

- Cryipto News

- 714 Views

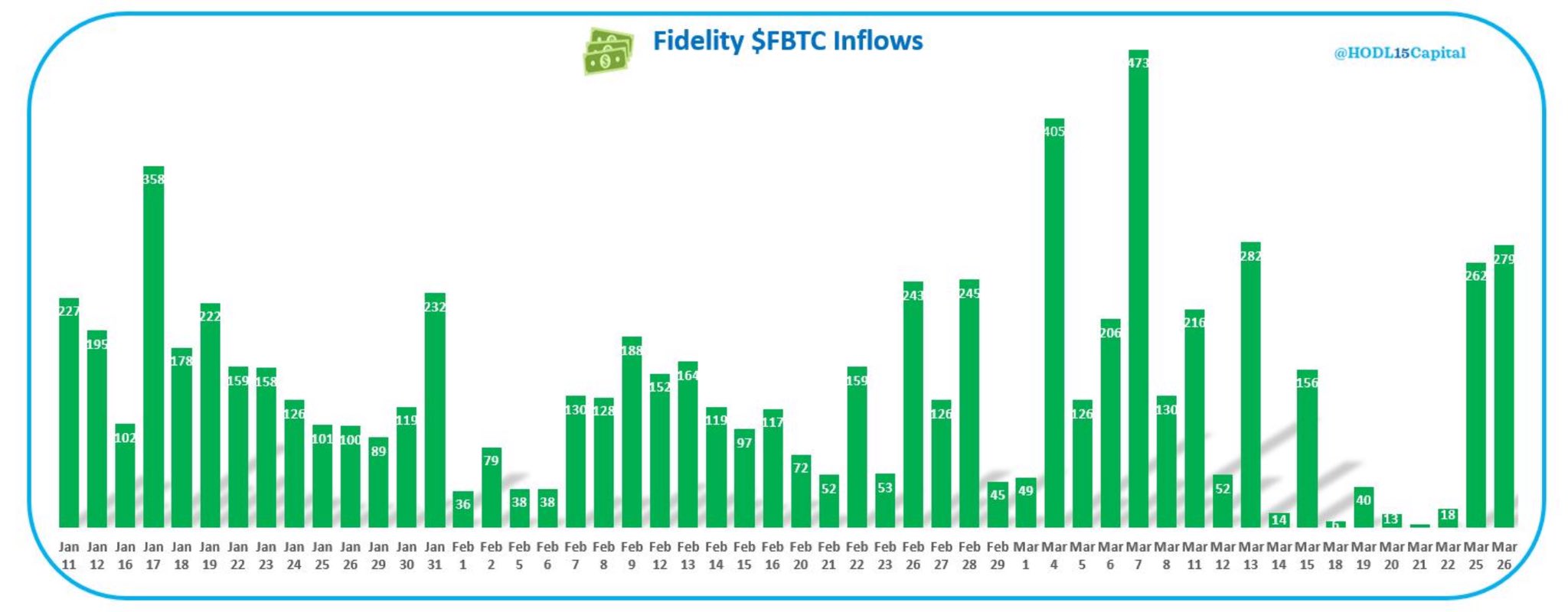

Fidelity's Bitcoin exchange-traded fund (ETF) recorded its highest daily gain in the past two weeks, securing the top spot with a $279 million inflow in a single day.

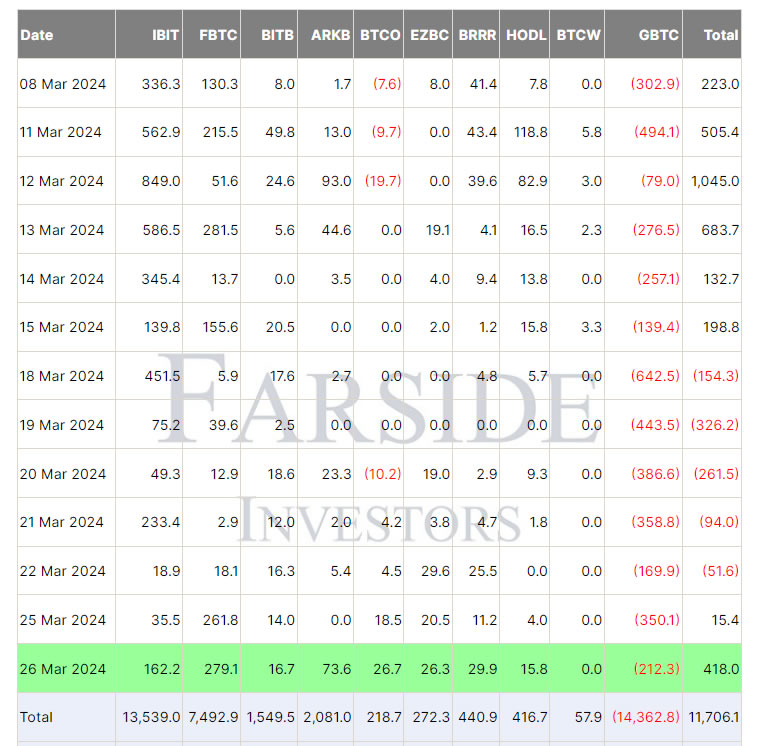

In the United States, spot Bitcoin exchange-traded funds (ETFs) have begun to see new investments flowing in after five consecutive days of net capital outflows. According to data from Farside Investors, funds managed by Blackrock and Fidelity, along with 10 recently approved spot Bitcoin ETFs, recorded a total net inflow of $418 million on March 26th.

Fidelity's investment fund experienced its highest daily investment flow since March 13th on March 26th, reaching an inflow of $279.1 million on this date and resulting in the investment giant purchasing an additional 4,000 BTC. This marks the second consecutive day that the fund has received inflows exceeding $260 million.

On the other hand, BlackRock's fund attracted an investment of $162.2 million, a figure lower compared to the daily average of over $300 million in investment inflows recorded at the beginning of the month. The Ark 21Shares Bitcoin ETF fund experienced its best day since March 12, receiving an investment of $73.6 million, while the funds of Invesco Galaxy, Franklin Templeton, and Valkyrie also drew in more than $26 million in investments.

Meanwhile, Grayscale's Bitcoin Trust (GBTC) continued to suffer investment losses, recording a daily outflow of $212 million; although this amount is significant compared to the net investments received by its competitors, it was not enough to overcome the net inflows they received.

Since its transformation from a trust to an ETF on January 11, Grayscale has lost approximately 277,393 BTC, valued at around $19.5 billion at current prices.

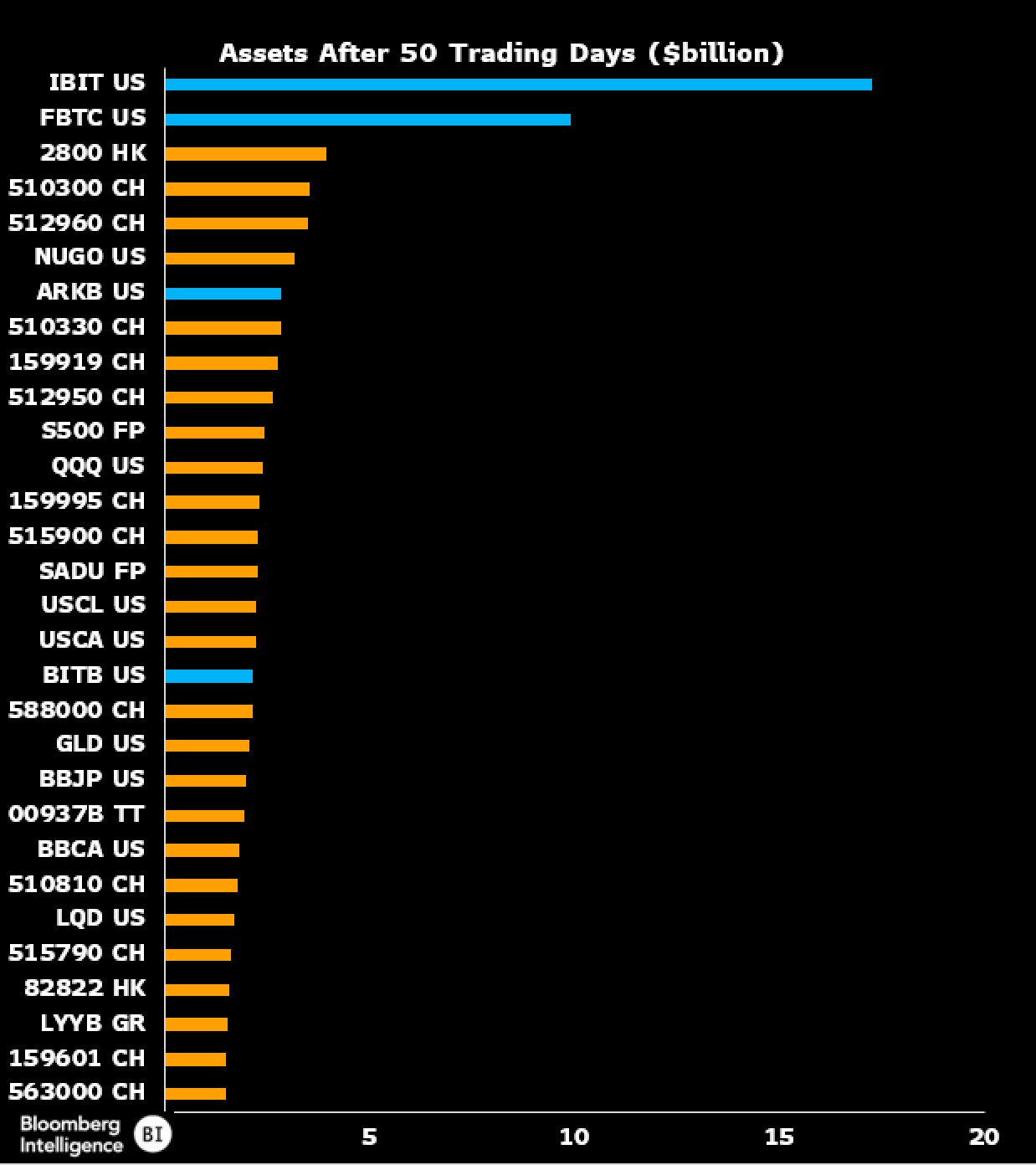

Eric Balchunas, senior ETF analyst at Bloomberg, pointed out the presence of Bitcoin ETFs in a chart including the top 30 asset funds over the first 50 days since their transactions began, in a note sent to X on March 26.

He emphasized that the four Bitcoin ETFs, including BlackRock's IBIT and Fidelity's FBTC listed in the global funds list, are "in a league of their own."

Balchunas mentioned that even the Bitwise Bitcoin ETF (BITB), ranked as the 18th largest Bitcoin ETF by assets under management, is bigger than the world's largest SPDR Gold Shares (GLD) fund.

On March 26th, crypto asset management company Hashdex announced that it had converted its futures-based fund into a spot product traded under the DEFI code, positioning itself as the eleventh spot Bitcoin ETF issuer in the United States.

You can follow the latest developments and news in the cryptocurrency markets in real-time on Kriptospot.com.