Jpmorgan Predicts That Bitcoin Etfs Could Become A Billion-Dollar Industry In The Near Future.

- Posted on March 16, 2024 9:25 PM

- Cryipto News

- 541 Views

According to JPMorgan analysts' assessment, when adjusted for volatility, the allocation to Bitcoin in investors' portfolios exceeds that of gold by 3.7 times.

According to a JP Morgan analysis, when volatility is considered, the weight of Bitcoin in investors' portfolios significantly surpasses that of gold.

JP Morgan's senior executive, Nikolaos Panigirtzoglou, stated that after adjustments, Bitcoin occupies 3.7 times more space in investors' portfolios compared to gold.

The analyst highlighted that since the approval of spot Bitcoin exchange-traded funds (ETFs) in January, there has been an influx of capital exceeding $10 billion, suggesting that the potential market size for Bitcoin ETFs could reach $62 billion.

Another report by JPM Securities predicts that the spot Bitcoin ETF market could expand up to $220 billion in the next two to three years:

"We anticipate an additional capital inflow of up to $220 billion for ETFs in the next three years. Considering the capital multiplier, this could have a significant impact on the price of Bitcoin." The market has observed positive impacts of Bitcoin ETFs, with the largest cryptocurrency experiencing an over 45% increase in market value in February. Net inflows to spot Bitcoin ETFs, which were $1.5 billion in January, rose to $6.1 billion in February.

The highest daily inflows into spot Bitcoin ETFs surpassed $1 billion on March 12, and analysts believe this figure could increase further if exits from the Grayscale Bitcoin Trust ETF cease.

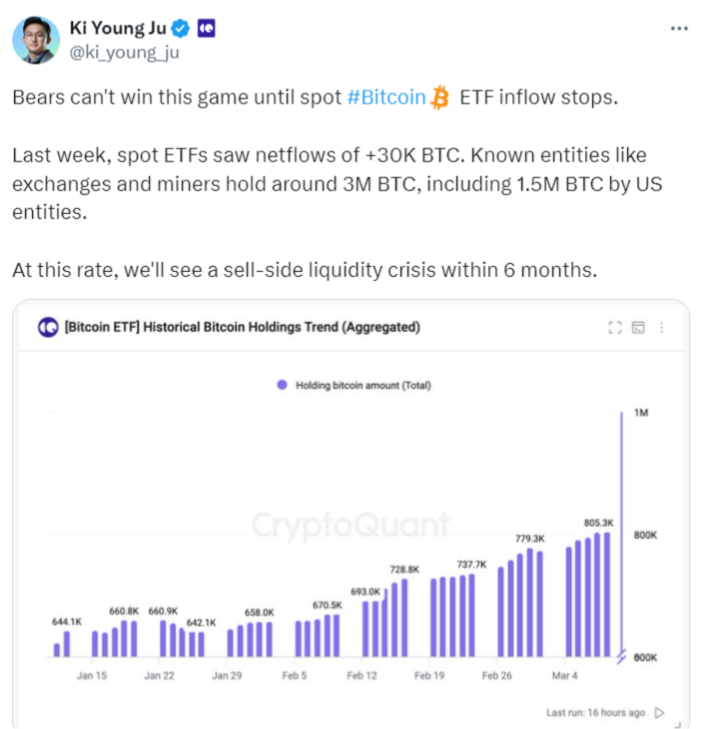

Ki Young Ju, CEO of the crypto analysis firm CryptoQuant, predicts that with just over a month until Bitcoin's halving process, the daily supply of Bitcoin will halve, potentially leading to a supply crisis in the next six months by further increasing demand.

Following a prolonged crypto winter, the approval of spot Bitcoin ETFs acted as a catalyst for significant price movements that propelled BTC to surpass its all-time high of $69,000 during the last bull cycle. This development opened the doors to institutional adoption, led by the world's largest asset manager, BlackRock.

You can stay up-to-date with developments and the latest news in the cryptocurrency markets on Kriptospot.com.