Solana (Sol) Has Surged To $150 Amid The Meme Coin Rally And Claims By Pantera Capital.

- Posted on March 8, 2024 9:39 PM

- Cryptocurrency Exchanges News

- 603 Views

A series of new developments have propelled Solana to a rapid ascent to $150. Can the uptrend in SOL continue?

Solana's native token saw a 19.5% increase between March 5 and March 7, reaching $150 for the first time since January 2022. The surge gained momentum following Bloomberg's claim that Pantera Capital plans to purchase $250 million worth of SOL tokens from the bankrupt estate of FTX. Investors are now debating whether Solana can breach the $200 mark.

The memecoin rally has benefited Solana exchanges. Despite Pantera Capital's bid, FTX's holding of $5.9 billion in SOL tokens represents about 10% of the total supply. Experts believe the rally is likely fueled by the frenzy around Solana-based memecoins. For instance, a collection inspired by celebrities, including poorly drawn tokens like Jeo Boden, Juses crust, and Spooderman, dominated the ecosystem in terms of volume and performance.

This trend encourages investors to speculate on newly launched tokens within the Solana network and motivates developers to provide liquidity for their projects. In short, momentary trends are boosting demand for SOL tokens and positively impacting the decentralized exchange (DEX) ecosystem. The Solana network is becoming more attractive, especially to newcomers who are less concerned about decentralization and may be looking for lower fees on competing blockchains.

Moreover, other SPL tokens with functional utility, such as Jupiter (JUP) and Raydium (RAY), saw an approximate 30% increase between March 5 and March 7. In addition to the DEX sector, Jito (JTO) increased by 15.5%, and Helium Mobile (MOBILE) by 14.5% during the same period. Additionally, there is anticipation around airdrops from Wormhole, Kamino, Parcl, and MarginFi, which continuously create demand for SOL tokens.

SOL's momentum is largely dependent on the activities of the Solana network. Scenarios where SOL's upward momentum could decrease after the airdrop and memecoin hype or be cut by the liquidation of FTX bankruptcy assets are conceivable. However, if volumes continue to increase, the weight of these criticisms may diminish. In essence, as new protocols and use cases emerge, SOL's performance will not only depend on the performance of specific tokens developed on the network but also on overall network activities.

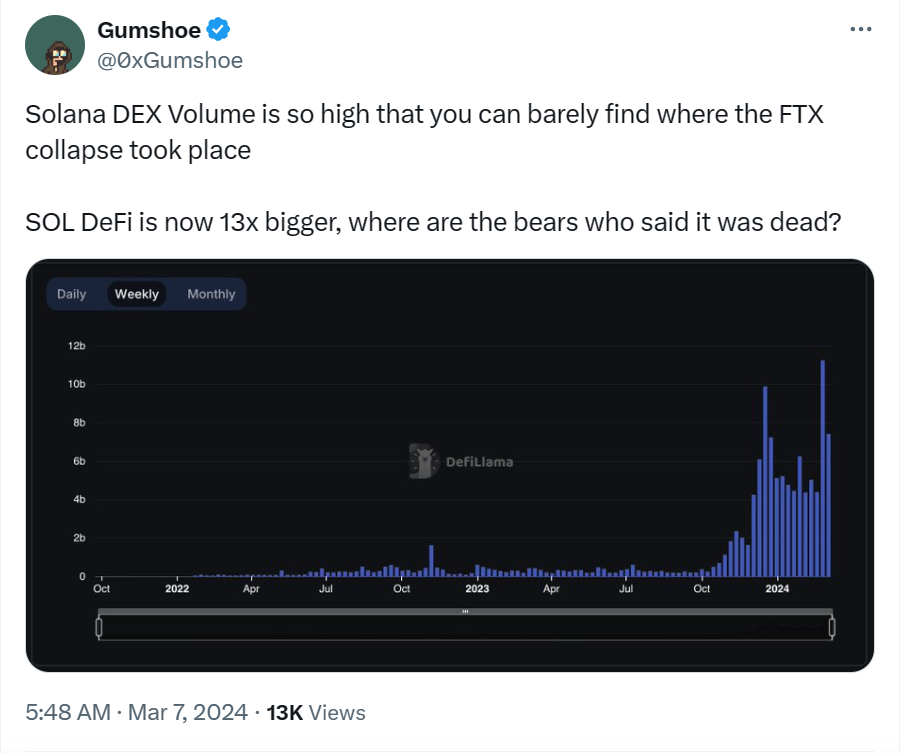

Cryptocurrency researcher Gumshoe highlighted that the activity on Solana's decentralized exchanges (DEX) has surpassed the peaks since the collapse of FTX and Alameda Research in November 2022. This suggests that, rather than token performance, a more crucial indicator might be whether the Solana ecosystem is expanding in terms of deposits and trading volume. Therefore, while the demand for SOL may be supported by factors such as meme coins, liquid staking, and airdrops, it also indicates that it is shaped by a broader ecosystem dynamics.

As of March 6th, the total value locked (TVL) on Solana, a metric measuring deposits into smart contracts, reached its highest level in the past 16 months. This signifies a 33% increase compared to the previous month. In comparison, the TVL of rival BNB Chain saw only a 2.5% increase in the same period, while Arbitrum experienced an 18% decrease in ETH terms. The increase in deposits in Solana's decentralized applications (DApps) is attributed particularly to platforms like Jito, MarginFi, Kamino, BlazeStake, Jupiter, and Drift. This indicates a healthy growth trend in the Solana ecosystem and suggests continued investor interest in new protocols and use cases developed on this platform.

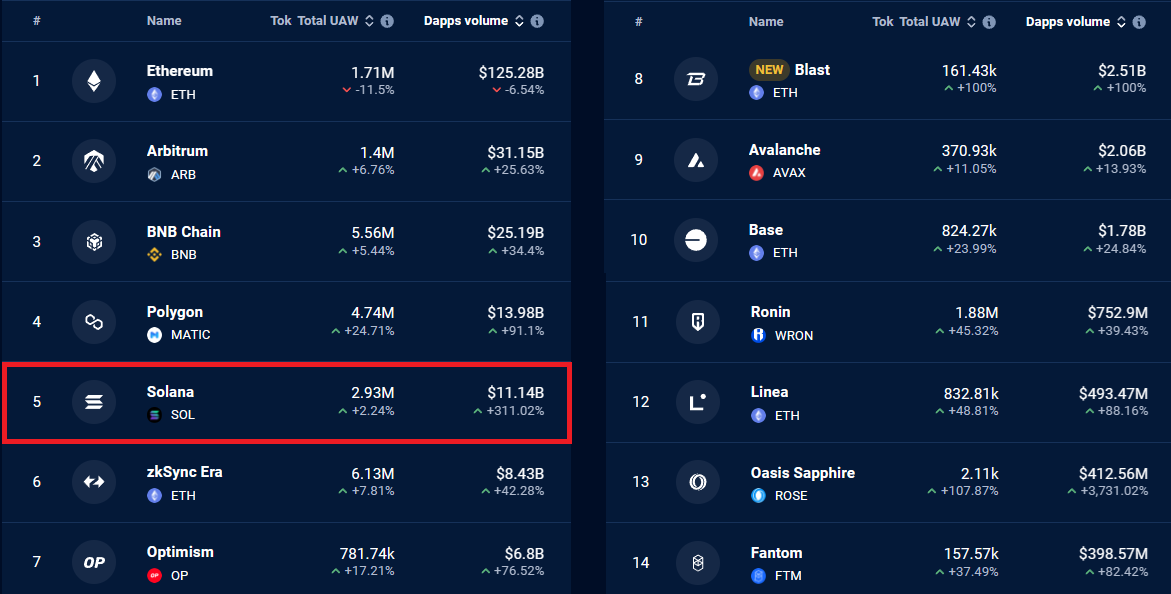

In the past month, the volume within Solana's decentralized applications (DApps) has seen a significant increase of 311%, in stark contrast to a 7% decline in the Ethereum network. This highlights Solana's growth outpacing that of other leading competitors.

However, when looking at the absolute numbers, with Arbitrum's monthly volume at $31.1 billion and BNB Chain's at $25.2 billion, it's evident that Solana still faces a significant gap. Therefore, whether SOL can reclaim the $200 level seems to depend on the demand for the Solana network.

For the latest developments and news in the cryptocurrency markets, you can follow real-time updates at Kriptospot.com.