The Report Indicates That The Sec May Need More Time For Etf Approvals.

- Posted on January 4, 2024 12:29 AM

- Cryptocurrency Exchanges News

- 748 Views

Bloomberg ETF analyst Eric Balchunas mentioned that the likelihood of the SEC executing the "rug pull of the decade" is low but acknowledged its existence.

According to Bloomberg ETF analyst Eric Balchunas, the probability of the Bitcoin exchange-traded fund (ETF) being rejected is low, but the reason is not the Securities and Exchange Commission's (SEC) final rejection decision; rather, it is their need for more time. Balchunas stated that he and James Seyffart currently believe there is a 90% chance of approval by January 10, but if approval is not granted in the next two weeks, he thinks it will be due to the need for more time. He emphasized that the 10% probability applies to both scenarios, and he does not anticipate facing a final rejection decision.

New Research note from me today. We still believe 90% chance by Jan 10 for spot #Bitcoin ETF approvals. But if it comes earlier we are entering a window where a wave of approval orders for all the current applicants *COULD* occur pic.twitter.com/u6dBva1ytD

— James Seyffart (@JSeyff) November 8, 2023

However, according to Balchunas, the time and effort invested by the SEC and Bitcoin ETF issuers suggest that a last-minute rejection of the Bitcoin ETF is unlikely. Balchunas stated that this would be the "largest rug pull of the last ten years," emphasizing that everyone has put in significant effort, and a final rejection decision would be highly unfavorable. K33 Research analyst Vetle Lunde expressed a similar opinion, assessing the probability of rejection as only 5%. Balchunas also believes that if the SEC makes a definitive rejection decision, fund issuers could follow in the footsteps of Grayscale and file separate lawsuits against regulators. As the public comment period continues, only two comments have been recorded requesting the complete rejection of ETFs.

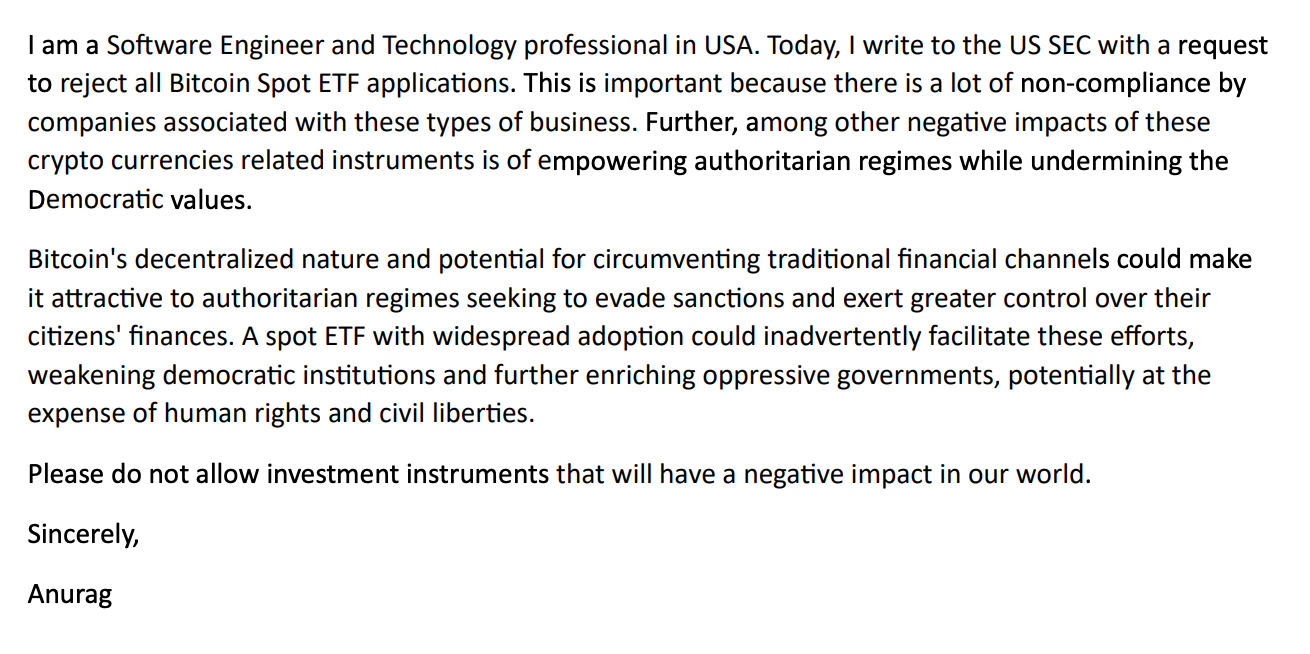

In the latest letter, it was claimed that Bitcoin's decentralized structure and its ability to bypass traditional financial channels could make it attractive for authoritarian regimes seeking to evade sanctions and exert more pressure on their citizens.

You can follow real-time developments and the latest news in the cryptocurrency markets with Kriptospot.com.