The Strong Performance Of Bitcoin Exchange-Traded Funds (Etfs) Adds Further Stability To Bitcoin.

- Posted on May 23, 2024 1:52 AM

- Cryipto News

- 676 Views

The Bitcoin ecosystem is attracting attention with consecutive high daily closes, significant Bitcoin withdrawals from crypto exchanges, and entries into the spot Bitcoin ETF market.

Expectations of a Bitcoin rally are intensifying with potentially increased inflows and favorable trading conditions, alongside growing interest in Bitcoin exchange-traded funds (ETFs).

Researchers at Bitfinex, analyzing weekly market conditions, suggest that Bitcoin has established a bottom price around $60,000.

The latest Bitfinex Alpha report highlights three main developments supporting this optimism: higher daily closures, significant Bitcoin withdrawals from crypto exchanges, and entries into the spot Bitcoin ETF market.

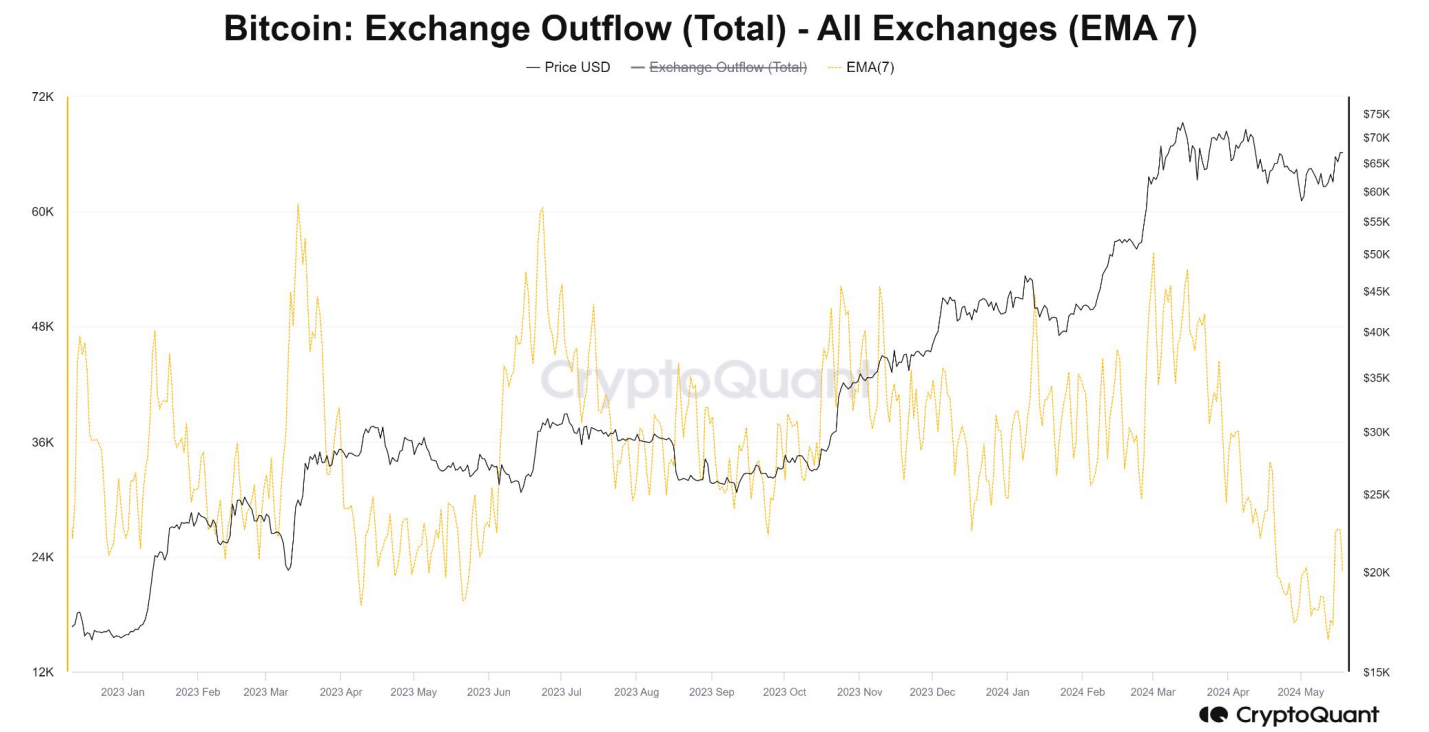

According to the report, the withdrawal of 55,000 BTC from exchanges on May 15 did not affect Bitcoin's low volatility levels. Typically, large withdrawals from exchanges are considered a negative sign for the market, yet Bitcoin continued to trade above the $61,000 level despite a significant $3.85 billion BTC outflow last week.

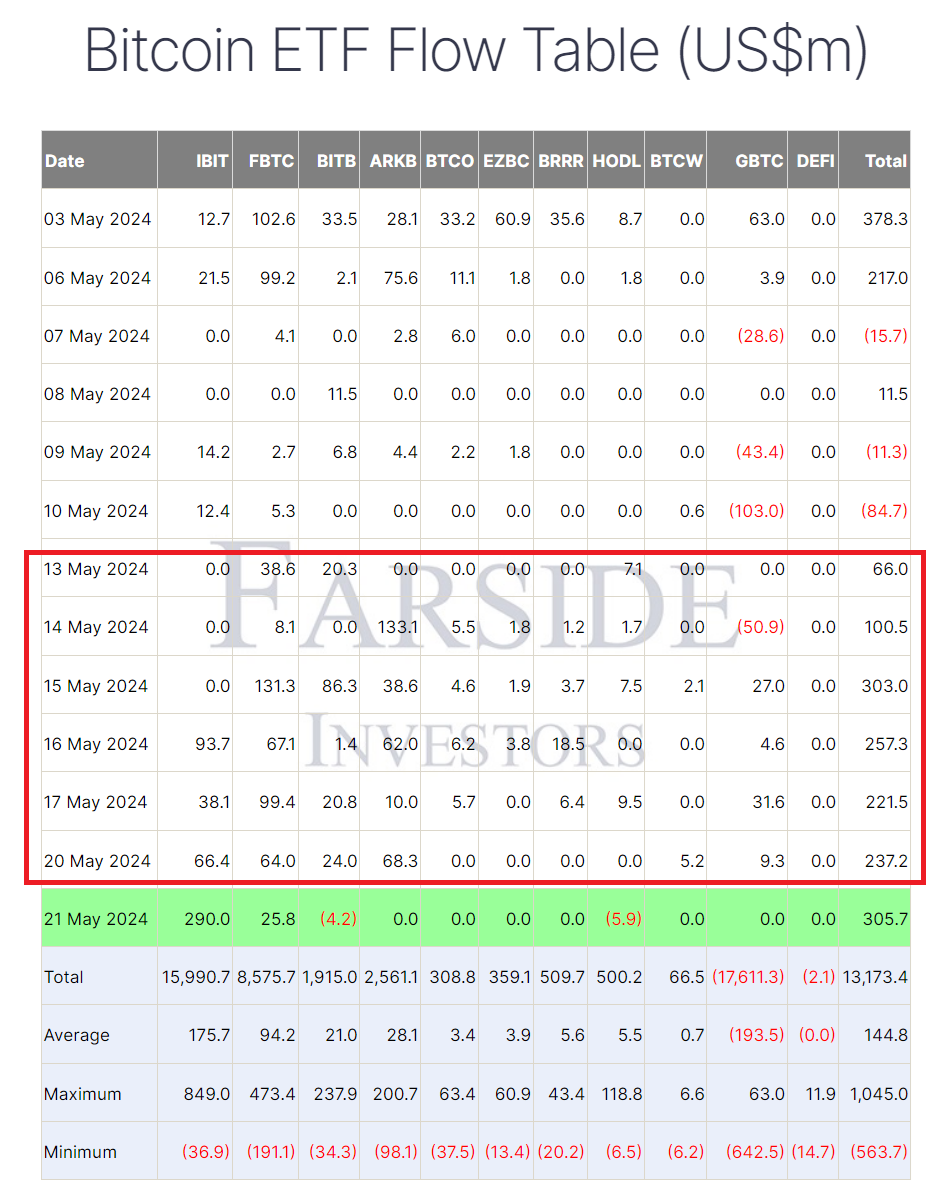

Additionally, the spot Bitcoin ETF market in the United States has recorded net positive inflows for seven consecutive days. The Grayscale Bitcoin Trust (GBTC) has been responsible for the majority of outflows, with losses exceeding $17.6 billion to date.

However, over the past seven days, GBTC has seen net positive inflows on six of those days. According to the Bitfinex report, "Currently, ETF buyers are considering other options besides GBTC, which has a similar cost basis of around $62,000."

Traders who prefer to diversify their portfolios with lower costs and tax advantages often invest in ETFs.

BlackRock's iShares Bitcoin Trust (IBIT) has attracted approximately $16 billion in investments and currently leads the leaderboard, surpassing the other nine approved Bitcoin ETFs.

JPMorgan Chase has announced investments in Bitcoin ETFs offered by companies such as Grayscale, ProShares, Bitwise, BlackRock, and Fidelity.

In a filing with the U.S. Securities and Exchange Commission (SEC) on May 10, JPMorgan Chase reported owning approximately $760,000 worth of shares in ProShares Bitcoin Strategy ETF (BITO), IBIT, Fidelity's Wise Origin Bitcoin Fund (FBTC), GBTC, and Bitwise Bitcoin ETF.

The SEC also emphasized the importance of not assuming that the information provided by the financial firm is "accurate and complete."

Stay updated with the latest developments and news in the cryptocurrency markets with Kriptospot.com.