The Three Main Reasons Behind This Week's Decline In Sol

- Posted on January 20, 2024 10:33 PM

- Cryipto News

- 814 Views

SOL experienced a correction alongside a broad sell-off in the cryptocurrency market.

On January 18th, Solana's native token SOL experienced a 9% decline, reaching $91.40 amid a widespread sell-off in the cryptocurrency market. SOL had encountered resistance around the $100 level in the preceding 15 days. However, the overall crypto market capitalization surpassing $1.6 trillion by 2024 suggests that this decline may not be a significant cause for concern. Despite its recent setback, SOL had recorded an 84% increase in December.

Listings of SPL tokens and conducted airdrops within the Solana ecosystem fueled the Fear of Missing Out (FOMO), contributing to the rise in the SOL rally. Particularly, the increased demand for Solana Saga Phone was observed as some projects offered exclusive deals for Solana's phone. Nevertheless, the excessive optimism generated by airdrops led to prolonged launches and short-term support for DApps, contributing to the correction experienced by SOL.

Lastly, despite influencers mentioning launches expected in the Solana ecosystem on December 12, some tokens failed to garner the anticipated attention and did not achieve the expected valuation and volume, disappointing analysts and influencers alike.

gentle reminder to farm all these protocols

— Iced (@IcedKnife) December 12, 2023

Drift

Kamino

Tensor

Wormhole

Jupiter (second wave)

marginfi

parcl

Mayan

meteora

Cega

zeta

Phantom

Birdeye

Backpack

Cube

One significant reason behind the optimistic outlook for SOL is the growth in deposits within the decentralized finance (DeFi) sector.

The Total Value Locked (TVL) for SOL reached its peak at 15.4 million on December 19, 2023, marking a 60% increase from the previous month. However, it has remained relatively stable at around 14 million since that period. In addition to this growth trend in TVL, significant achievements were made by Kamino, Orca, and other Solana DeFi applications, each surpassing 150 million dollars.

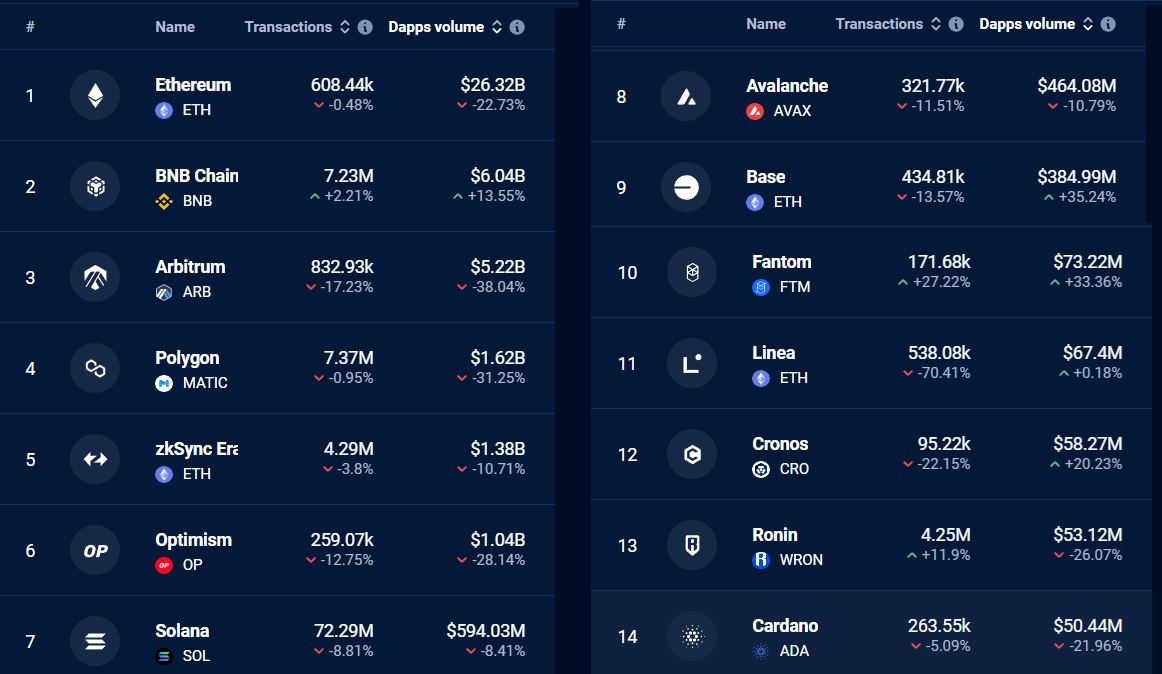

Furthermore, there has been notable growth in transaction volume and activity within the Solana network. Nevertheless, it still trails behind rival networks such as BNB Chain and Polygon.

In the last seven days, Solana experienced a 8.5% decrease in active DApp users. During this period, Solana's total DApp volume reached 594 million dollars, which, when compared to BNB Chain's 6 billion dollars and Polygon's 1.6 billion dollars in DApp volume, indicates a relatively weaker performance.

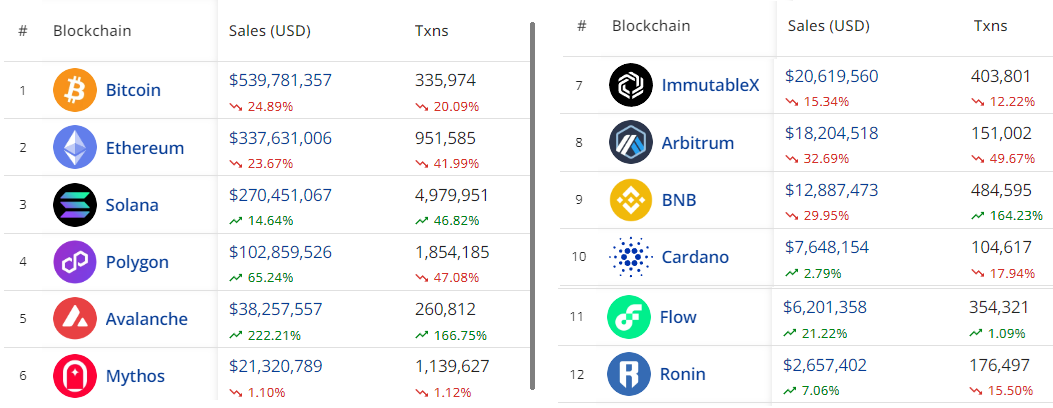

Despite the decline in active users, Solana's network robustness has gained trust due to its significant transaction verification capacity. The project, however, has faced criticism. Token launches, NFT collections, and bandwidth-intensive DApps have presented significant opportunities for Solana. According to CryptoSlam data, Solana ranks as the third-largest network in terms of NFT volume.

Solana's NFT volume reached 270.5 million dollars, an impressive performance that is only 20% behind Ethereum. Among the most traded NFT collections on the Solana network are Mad Lads, Saga Monkes, Froganas, and Tensorians.

When examining Solana's network activities, there doesn't seem to be a significant risk of a price correction for SOL. However, expectations regarding airdrops and SPL token performance could create negative pressure on SOL.

Despite its market value of 40.6 billion dollars, which is half of its peak in November 2021, SOL's potential for an upward trajectory remains if projects on the network continue to maintain stability and attract interest. Considering the challenges faced by rival networks, Solana's future performance will be crucial.

For real-time updates on developments in the cryptocurrency markets and the latest news, you can follow Kriptospot.com.